Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 2 pts Barry Cuda is considering the purchase of the following Builtrite bond: $1000 par, 3 5/8% coupon rate, 15 year maturity

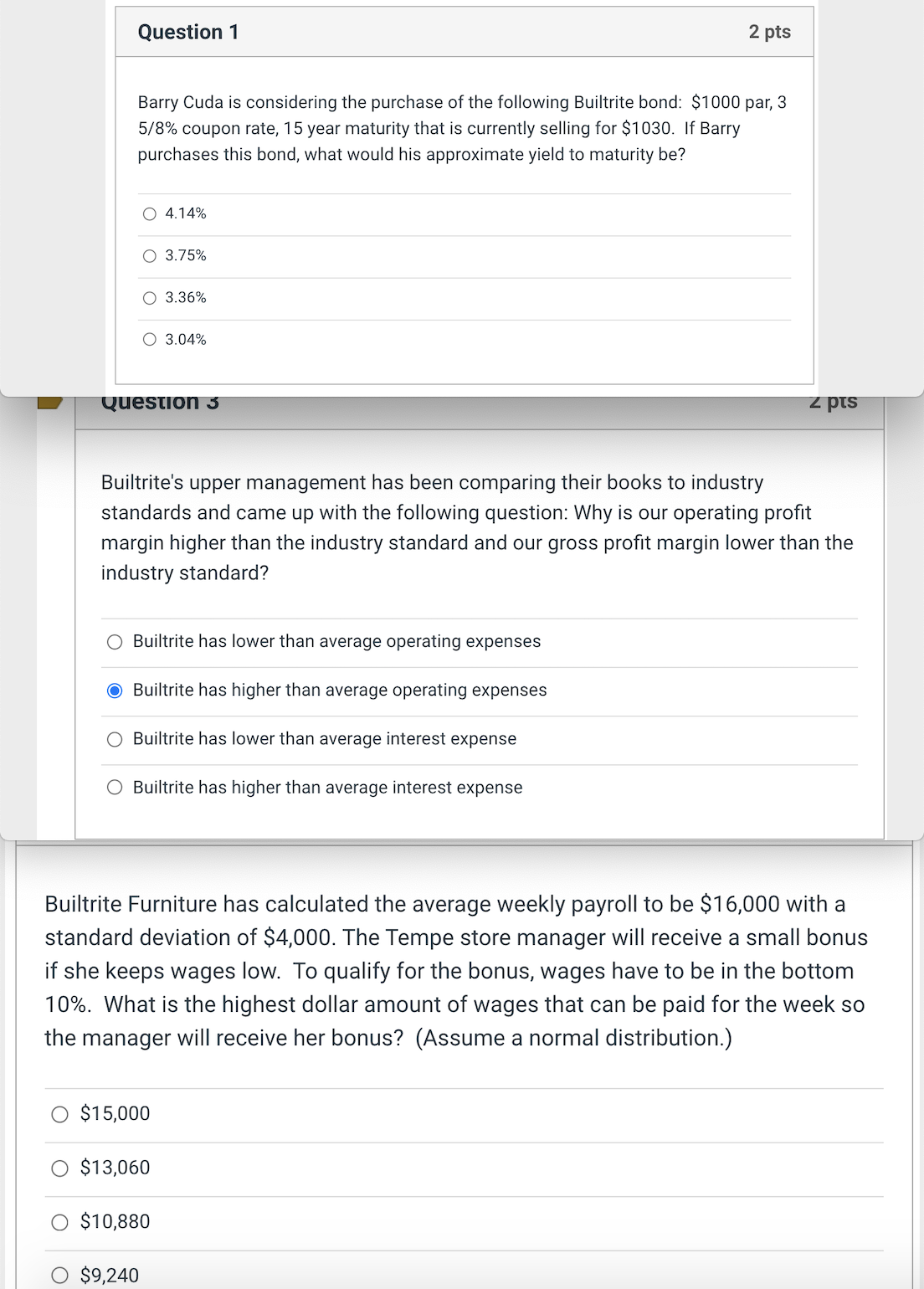

Question 1 2 pts Barry Cuda is considering the purchase of the following Builtrite bond: $1000 par, 3 5/8% coupon rate, 15 year maturity that is currently selling for $1030. If Barry purchases this bond, what would his approximate yield to maturity be? 4.14% 3.75% 3.36% 3.04% Question 3 Z pts Builtrite's upper management has been comparing their books to industry standards and came up with the following question: Why is our operating profit margin higher than the industry standard and our gross profit margin lower than the industry standard? Builtrite has lower than average operating expenses O Builtrite has higher than average operating expenses Builtrite has lower than average interest expense Builtrite has higher than average interest expense Builtrite Furniture has calculated the average weekly payroll to be $16,000 with a standard deviation of $4,000. The Tempe store manager will receive a small bonus if she keeps wages low. To qualify for the bonus, wages have to be in the bottom 10%. What is the highest dollar amount of wages that can be paid for the week so the manager will receive her bonus? (Assume a normal distribution.) $15,000 $13,060 $10,880 $9,240

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started