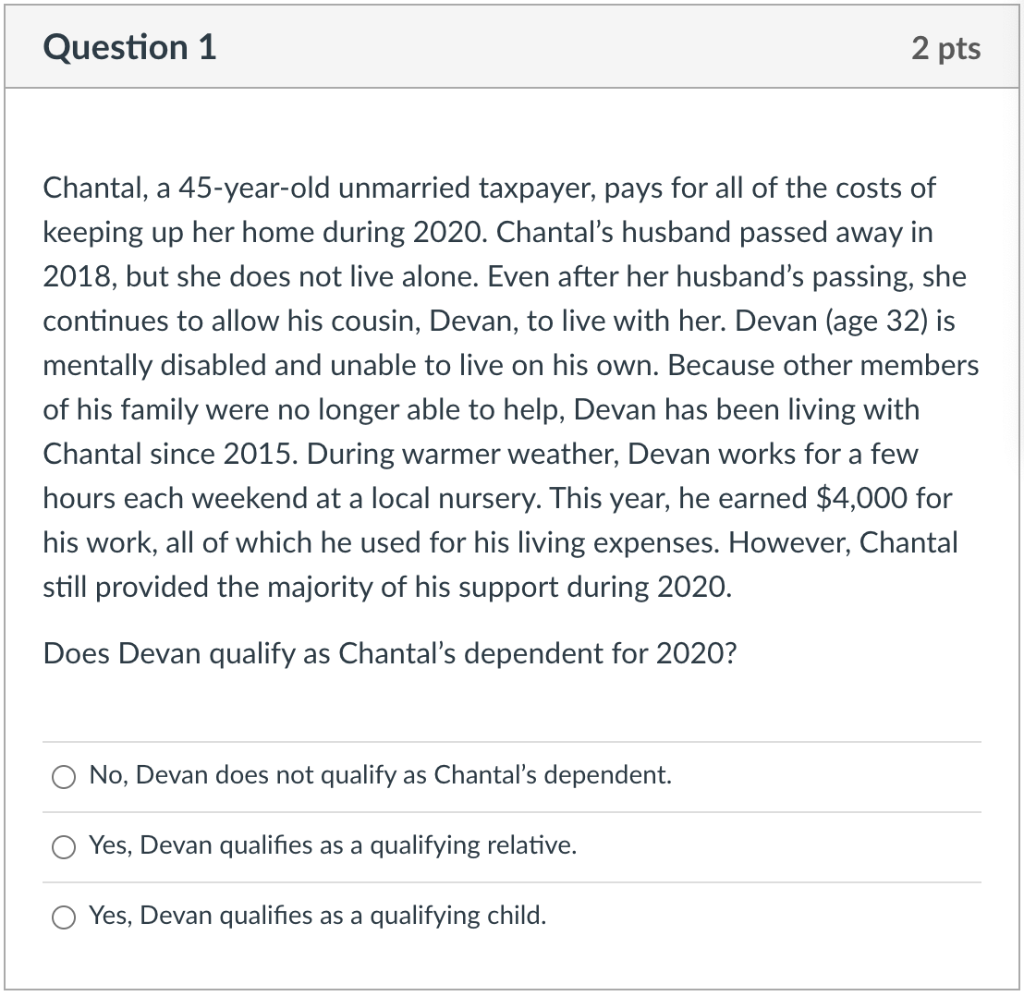

Question 1 2 pts Chantal, a 45-year-old unmarried taxpayer, pays for all of the costs of keeping up her home during 2020. Chantal's husband passed away in 2018, but she does not live alone. Even after her husband's passing, she continues to allow his cousin, Devan, to live with her. Devan (age 32) is mentally disabled and unable to live on his own. Because other members of his family were no longer able to help, Devan has been living with Chantal since 2015. During warmer weather, Devan works for a few hours each weekend at a local nursery. This year, he earned $4,000 for his work, all of which he used for his living expenses. However, Chantal still provided the majority of his support during 2020. Does Devan qualify as Chantal's dependent for 2020? No, Devan does not qualify as Chantal's dependent. Yes, Devan qualifies as a qualifying relative. Yes, Devan qualifies as a qualifying child. Question 2 2 pts Using the information from the question above, what is Chantal's filing status for 2020? Single Head of Household Surviving Spouse (Qualifying Widow) Question 1 2 pts Chantal, a 45-year-old unmarried taxpayer, pays for all of the costs of keeping up her home during 2020. Chantal's husband passed away in 2018, but she does not live alone. Even after her husband's passing, she continues to allow his cousin, Devan, to live with her. Devan (age 32) is mentally disabled and unable to live on his own. Because other members of his family were no longer able to help, Devan has been living with Chantal since 2015. During warmer weather, Devan works for a few hours each weekend at a local nursery. This year, he earned $4,000 for his work, all of which he used for his living expenses. However, Chantal still provided the majority of his support during 2020. Does Devan qualify as Chantal's dependent for 2020? No, Devan does not qualify as Chantal's dependent. Yes, Devan qualifies as a qualifying relative. Yes, Devan qualifies as a qualifying child. Question 2 2 pts Using the information from the question above, what is Chantal's filing status for 2020? Single Head of Household Surviving Spouse (Qualifying Widow)