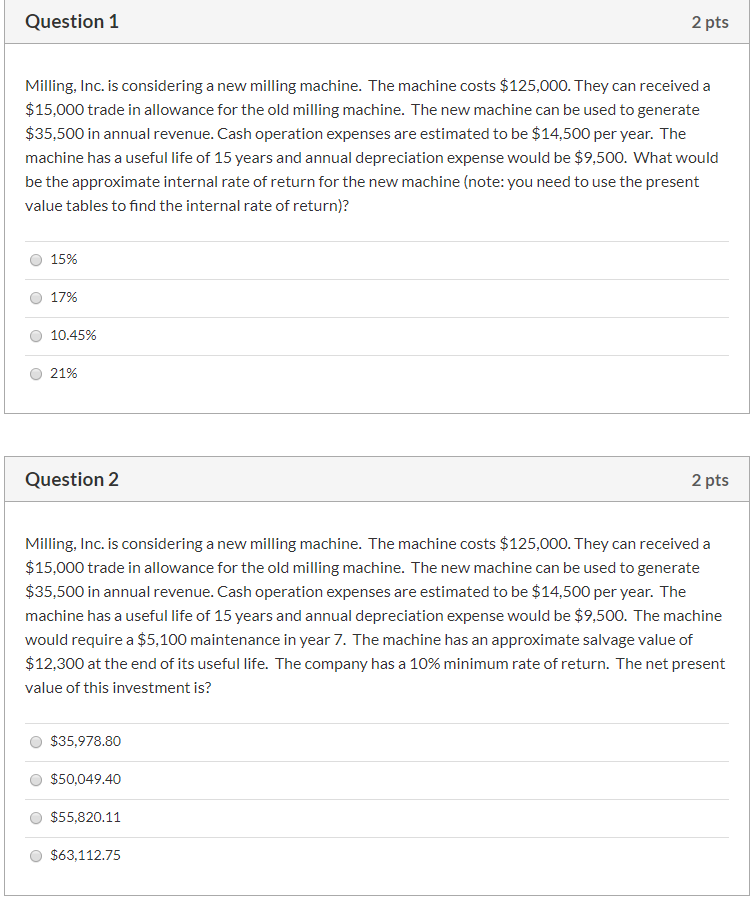

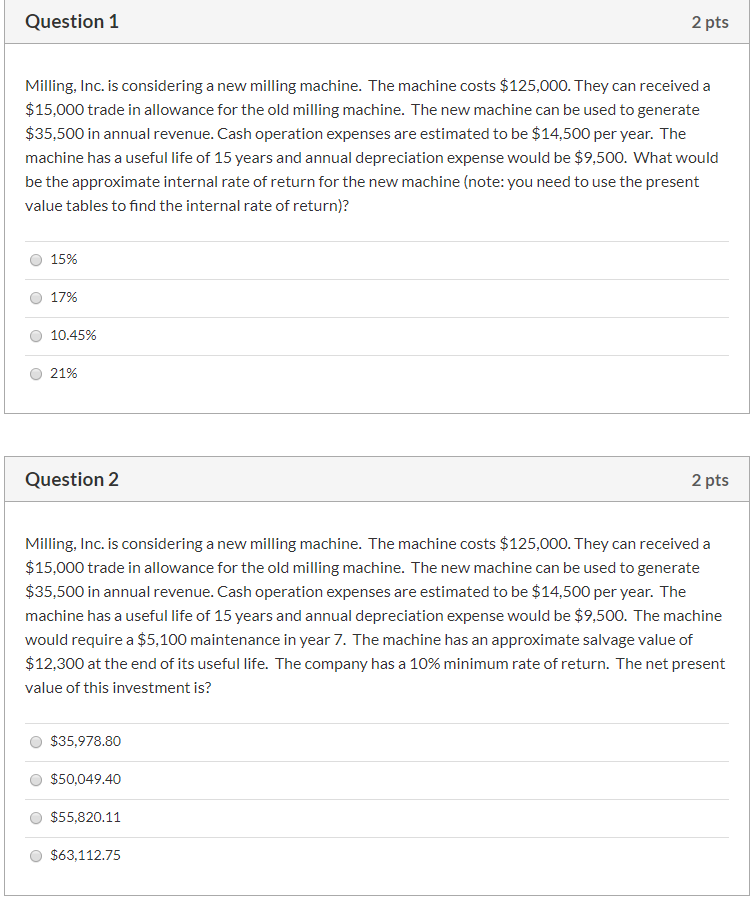

Question 1 2 pts Milling, Inc. is considering a new milling machine. The machine costs $125,000. They can received a $15,000 trade in allowance for the old milling machine. The new machine can be used to generate $35,500 in annual revenue. Cash operation expenses are estimated to be $14,500 per year. The machine has a useful life of 15 years and annual depreciation expense would be $9,500. What would be the approximate internal rate of return for the new machine (note: you need to use the present value tables to find the internal rate of return)? 15% 17% 10.45% 21% Question 2 2 pts Milling, Inc. is considering a new milling machine. The machine costs $125,000. They can received a $15.000 trade in allowance for the old milling machine. The new machine can be used to generate $35,500 in annual revenue. Cash operation expenses are estimated to be $14,500 per year. The machine has a useful life of 15 years and annual depreciation expense would be $9,500. The machine would require a $5,100 maintenance in year 7. The machine has an approximate salvage value of $12.300 at the end of its useful life. The company has a 10% minimum rate of return. The net present value of this investment is? $35,978.80 $50,049.40 $55,820.11 $63,112.75 Question 1 2 pts Milling, Inc. is considering a new milling machine. The machine costs $125,000. They can received a $15,000 trade in allowance for the old milling machine. The new machine can be used to generate $35,500 in annual revenue. Cash operation expenses are estimated to be $14,500 per year. The machine has a useful life of 15 years and annual depreciation expense would be $9,500. What would be the approximate internal rate of return for the new machine (note: you need to use the present value tables to find the internal rate of return)? 15% 17% 10.45% 21% Question 2 2 pts Milling, Inc. is considering a new milling machine. The machine costs $125,000. They can received a $15.000 trade in allowance for the old milling machine. The new machine can be used to generate $35,500 in annual revenue. Cash operation expenses are estimated to be $14,500 per year. The machine has a useful life of 15 years and annual depreciation expense would be $9,500. The machine would require a $5,100 maintenance in year 7. The machine has an approximate salvage value of $12.300 at the end of its useful life. The company has a 10% minimum rate of return. The net present value of this investment is? $35,978.80 $50,049.40 $55,820.11 $63,112.75