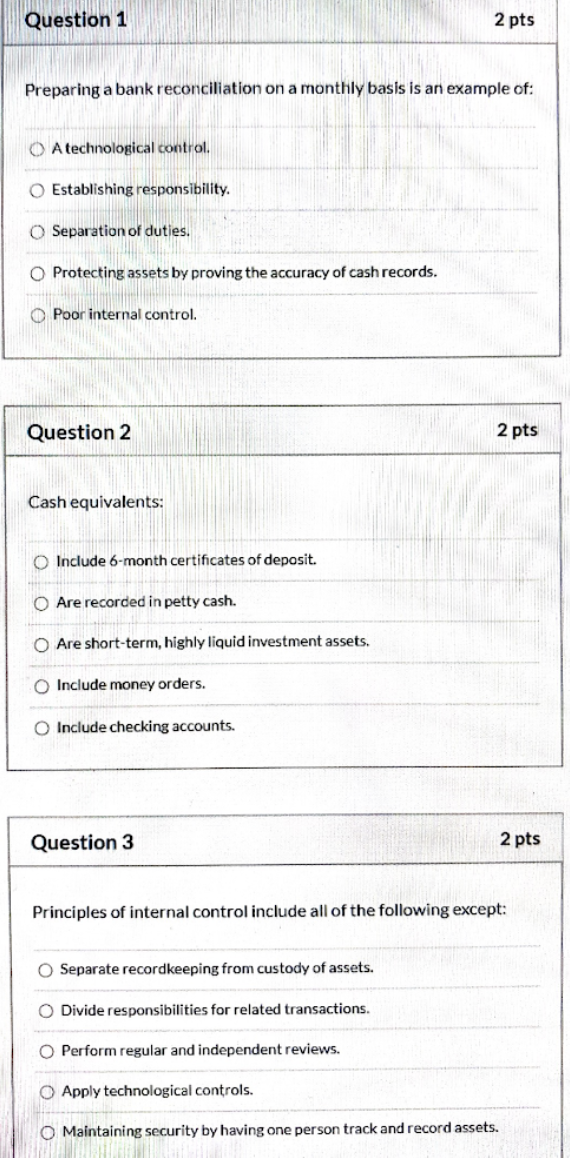

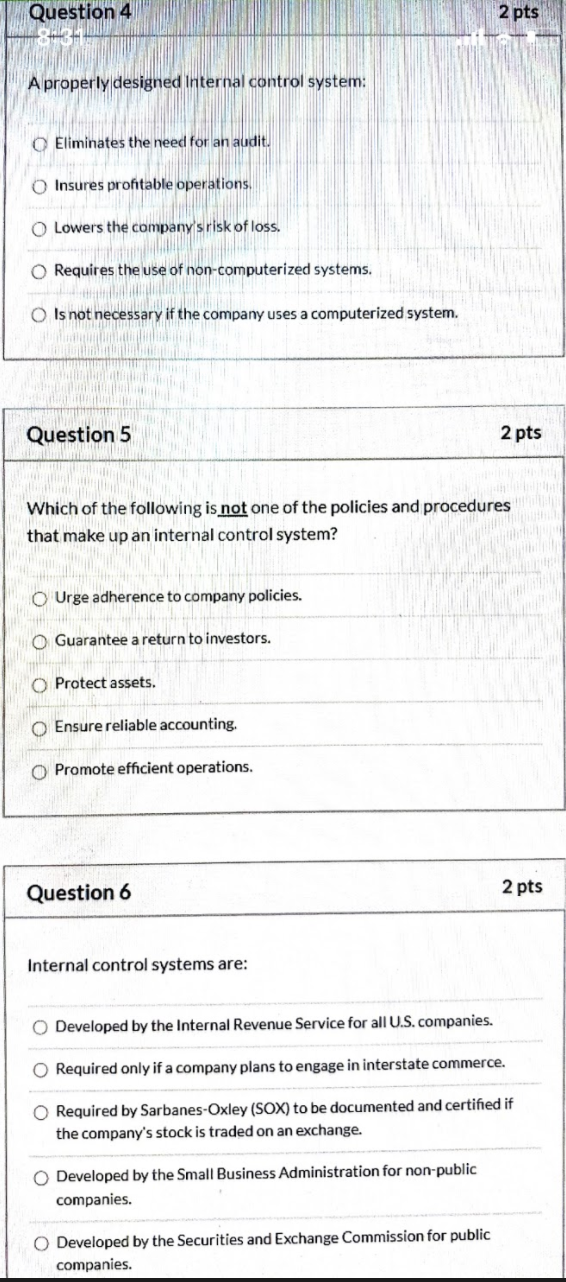

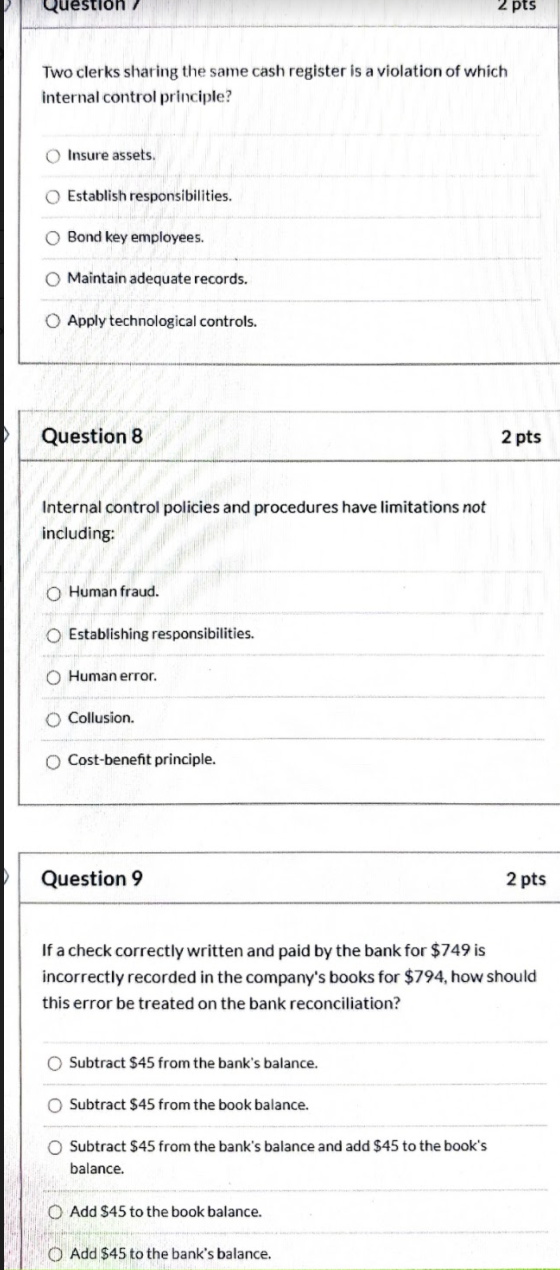

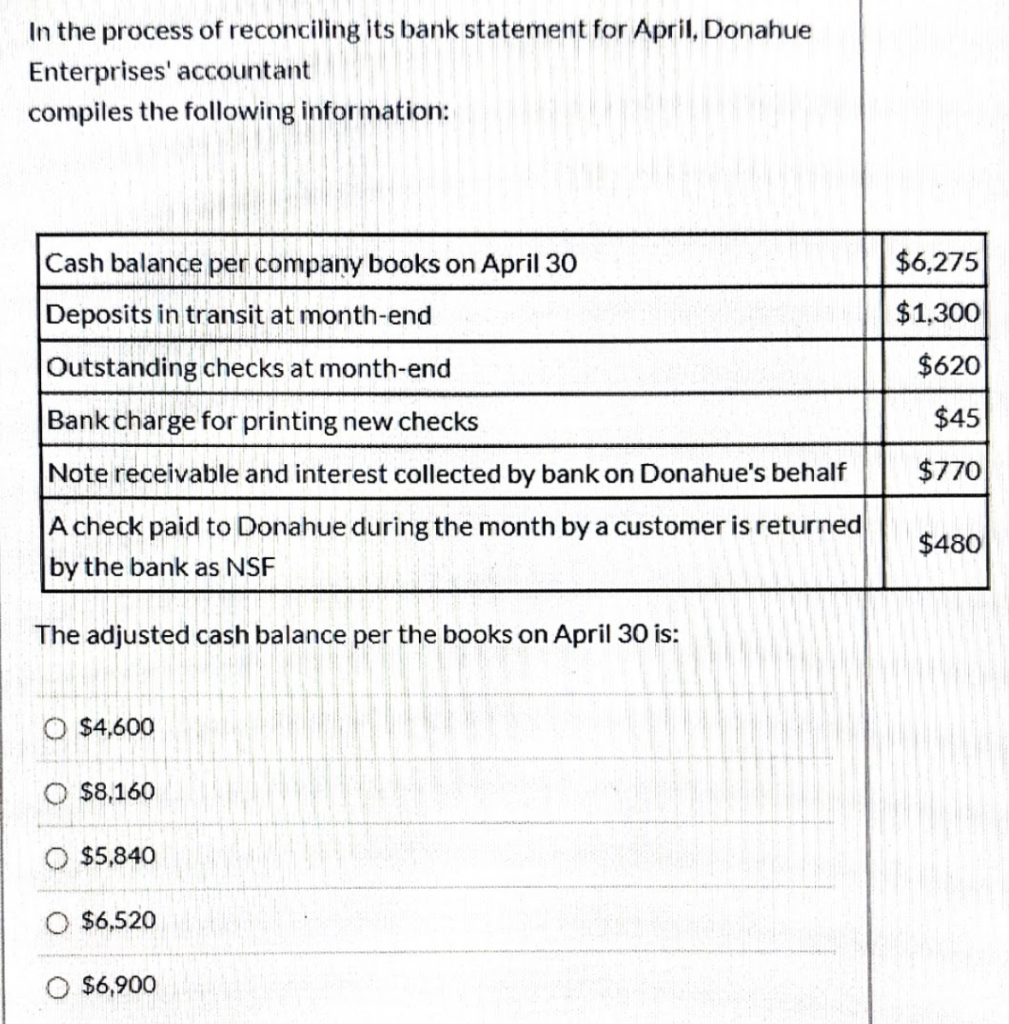

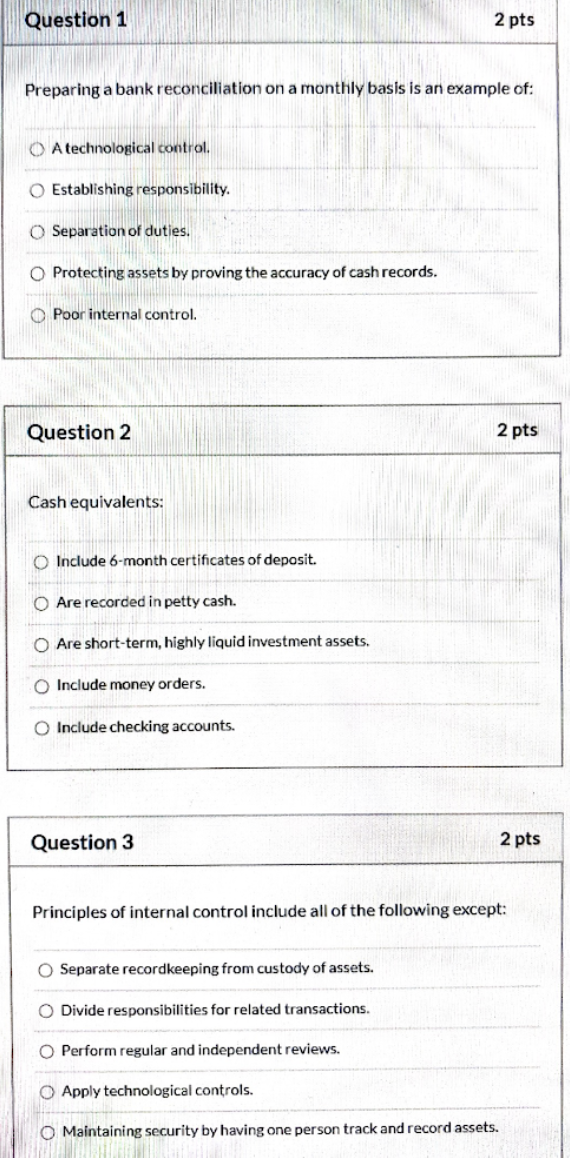

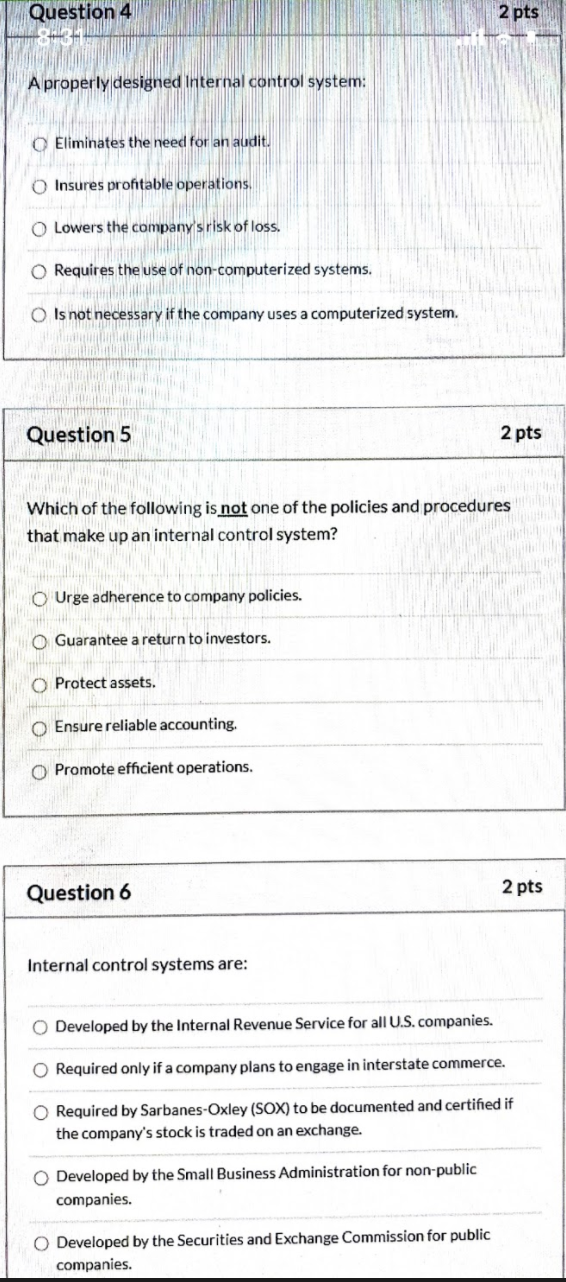

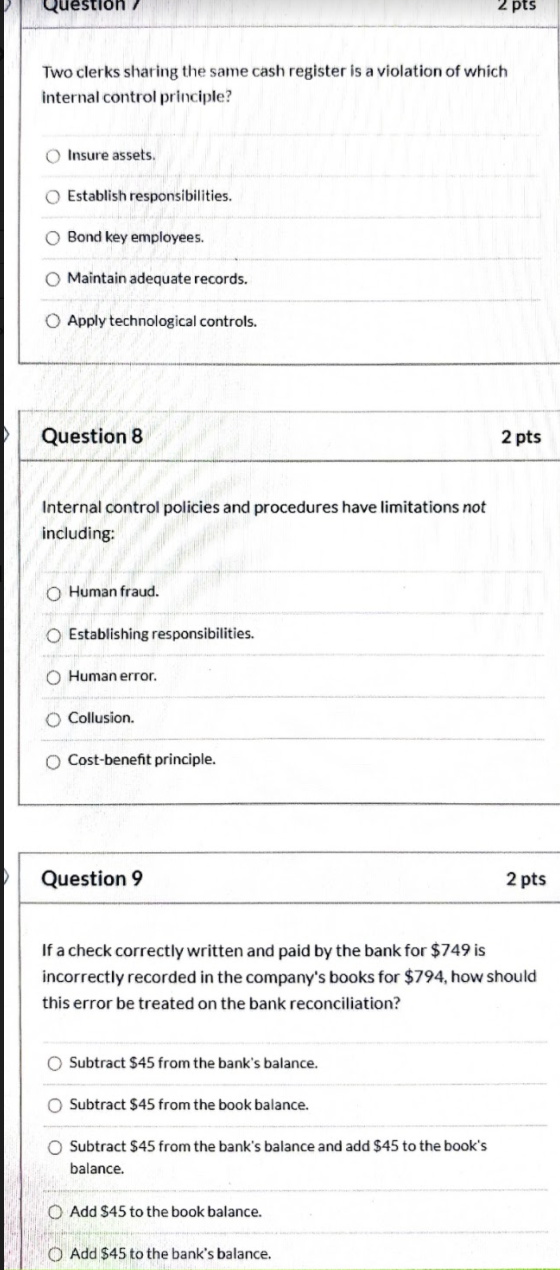

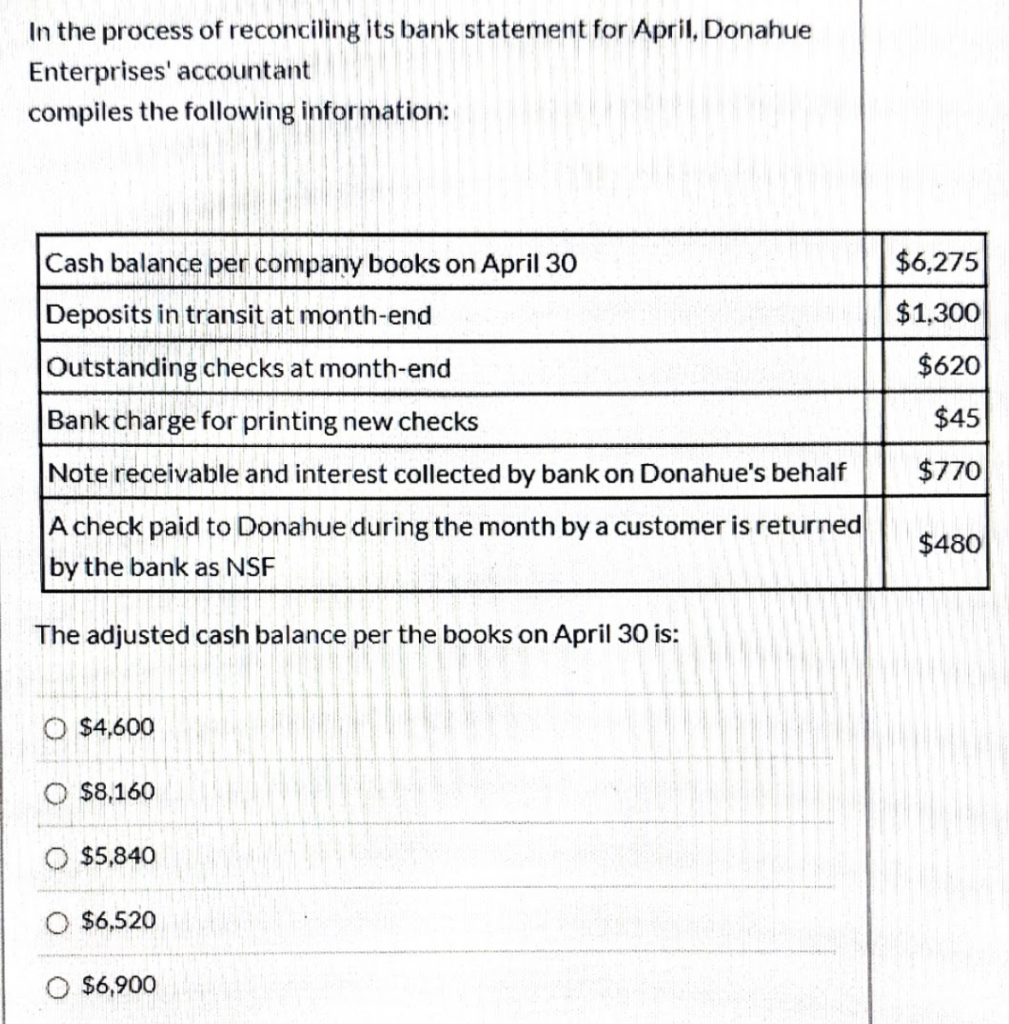

Question 1 2 pts Preparing a bank reconciliation on a monthly basis is an example of: O A technological control. O Establishing responsibility. O Separation of duties. O Protecting assets by proving the accuracy of cash records. Poor internal control. Question 2 2 pts Cash equivalents: Include 6-month certificates of deposit. Are recorded in petty cash. O Are short-term, highly liquid investment assets. Include money orders. O O O Include checking accounts. Question 3 2 pts Principles of internal control include all of the following except: Separate recordkeeping from custody of assets. Divide responsibilities for related transactions. Perform regular and independent reviews. Apply technological controls. O Maintaining security by having one person track and record assets. Question 4 2 pts A properly designed Internal control system: Eliminates the need for an audit. Insures profitable operations. Lowers the company's risk of loss. O Requires the use of non-computerized systems. O is not necessary if the company uses a computerized system. Question 5 2 pts Which of the following is not one of the policies and procedures that make up an internal control system? Urge adherence to company policies. Guarantee a return to investors. Protect assets. Ensure reliable accounting, O Promote efficient operations. Question 6 2 pts Internal control systems are: O Developed by the Internal Revenue Service for all U.S.companies. Required only if a company plans to engage in interstate commerce. o o Required by Sarbanes-Oxley (SOX) to be documented and certified if the company's stock is traded on an exchange. Developed by the Small Business Administration for non-public companies. O Developed by the Securities and Exchange Commission for public companies. Question 2 pts Two clerks sharing the same cash register is a violation of which internal control principle? Insure assets. Establish responsibilities. Bond key employees. Maintain adequate records. Apply technological controls. Question 8 2 pts Internal control policies and procedures have limitations not including: Human fraud. O Establishing responsibilities. O Human error. Collusion Cost-benefit principle. Question 9 2 pts If a check correctly written and paid by the bank for $749 is incorrectly recorded in the company's books for $794, how should this error be treated on the bank reconciliation? Subtract $45 from the bank's balance. Subtract $45 from the book balance. Subtract $45 from the bank's balance and add $45 to the book's balance. 0 Add $45 to the book balance. O Add $45 to the bank's balance. In the process of reconciling its bank statement for April, Donahue Enterprises' accountant compiles the following information: $6,275 $1,300 $620 Cash balance per company books on April 30 Deposits in transit at month-end Outstanding checks at month-end Bank charge for printing new checks Note receivable and interest collected by bank on Donahue's behalf A check paid to Donahue during the month by a customer is returned by the bank as NSF $45 $770 $480 The adjusted cash balance per the books on April 30 is: 0 $4,600 $8,160 $5,840 $6,520 $6,900