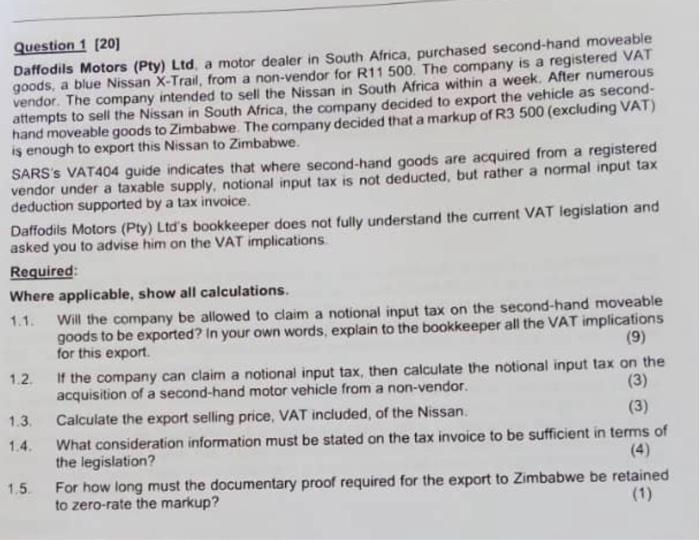

Question 1 (20) Daffodils Motors (Pty) Ltd, a motor dealer in South Africa, purchased second-hand moveable goods, a blue Nissan X-Trail, from a non-vendor for R11 500. The company is a registered VAT vendor. The company intended to sell the Nissan in South Africa within a week. After numerous attempts to sell the Nissan in South Africa, the company decided to export the vehicle as second- hand moveable goods to Zimbabwe The company decided that a markup of R3 500 (excluding VAT) is enough to export this Nissan to Zimbabwe SARS'S VAT404 guide indicates that where second-hand goods are acquired from a registered vendor under a taxable supply, notional input tax is not deducted, but rather a normal input tax deduction supported by a tax invoice Daffodils Motors (Pty) Ltd's bookkeeper does not fully understand the current VAT legislation and asked you to advise him on the VAT implications Required: Where applicable, show all calculations. 1.1 Will the company be allowed to claim a notional input tax on the second-hand moveable goods to be exported? in your own words, explain to the bookkeeper all the VAT implications for this export 12 If the company can claim a notional input tax, then calculate the notional input tax on the acquisition of a second-hand motor vehicle from a non-vendor. (3) 1.3 Calculate the export selling price, VAT included, of the Nissan What consideration information must be stated on the tax invoice to be sufficient in terms of the legislation? 1.5 For how long must the documentary proof required for the export to Zimbabwe be retained to zero-rate the markup? (9) (3) 1.4. Question 1 (20) Daffodils Motors (Pty) Ltd, a motor dealer in South Africa, purchased second-hand moveable goods, a blue Nissan X-Trail, from a non-vendor for R11 500. The company is a registered VAT vendor. The company intended to sell the Nissan in South Africa within a week. After numerous attempts to sell the Nissan in South Africa, the company decided to export the vehicle as second- hand moveable goods to Zimbabwe The company decided that a markup of R3 500 (excluding VAT) is enough to export this Nissan to Zimbabwe SARS'S VAT404 guide indicates that where second-hand goods are acquired from a registered vendor under a taxable supply, notional input tax is not deducted, but rather a normal input tax deduction supported by a tax invoice Daffodils Motors (Pty) Ltd's bookkeeper does not fully understand the current VAT legislation and asked you to advise him on the VAT implications Required: Where applicable, show all calculations. 1.1 Will the company be allowed to claim a notional input tax on the second-hand moveable goods to be exported? in your own words, explain to the bookkeeper all the VAT implications for this export 12 If the company can claim a notional input tax, then calculate the notional input tax on the acquisition of a second-hand motor vehicle from a non-vendor. (3) 1.3 Calculate the export selling price, VAT included, of the Nissan What consideration information must be stated on the tax invoice to be sufficient in terms of the legislation? 1.5 For how long must the documentary proof required for the export to Zimbabwe be retained to zero-rate the markup? (9) (3) 1.4