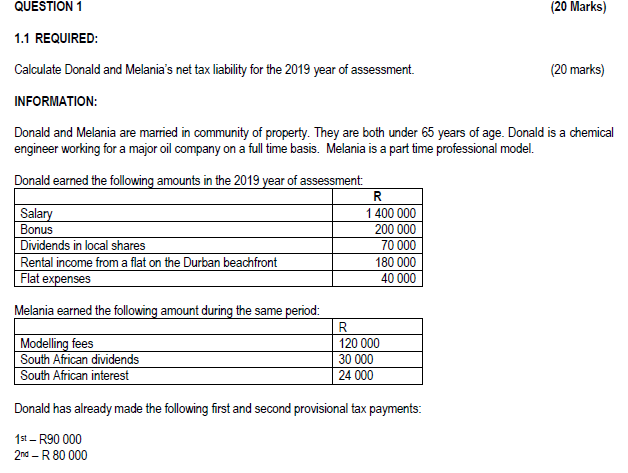

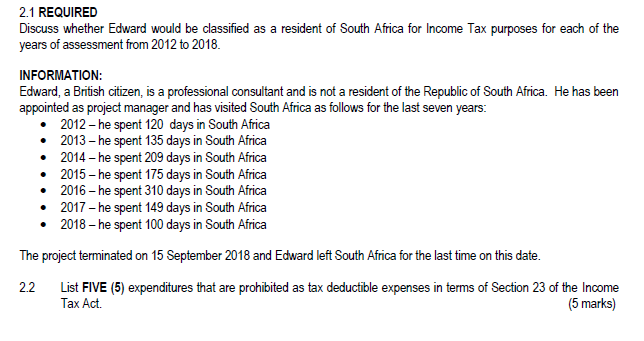

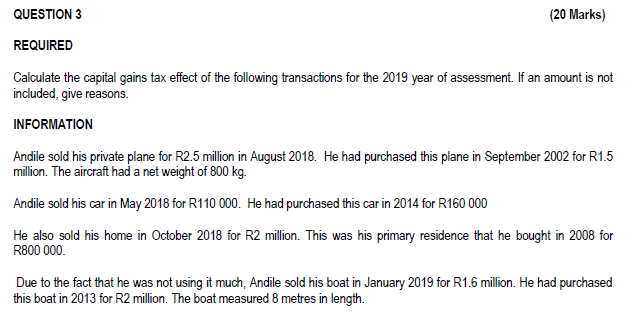

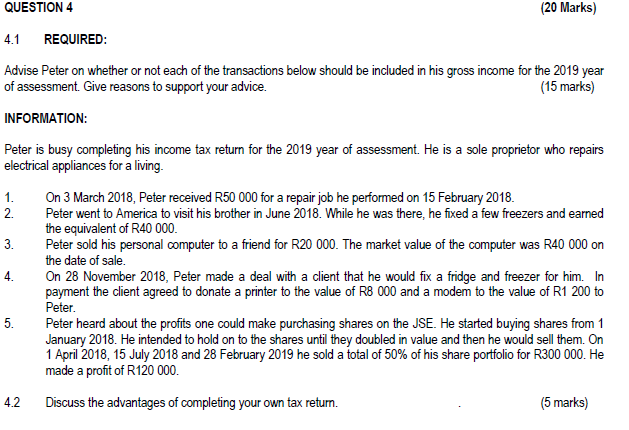

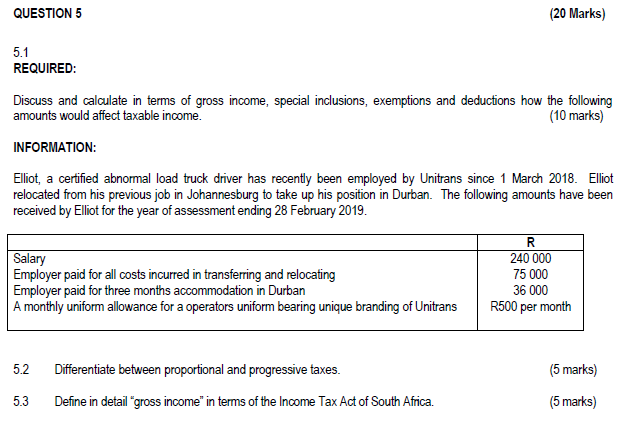

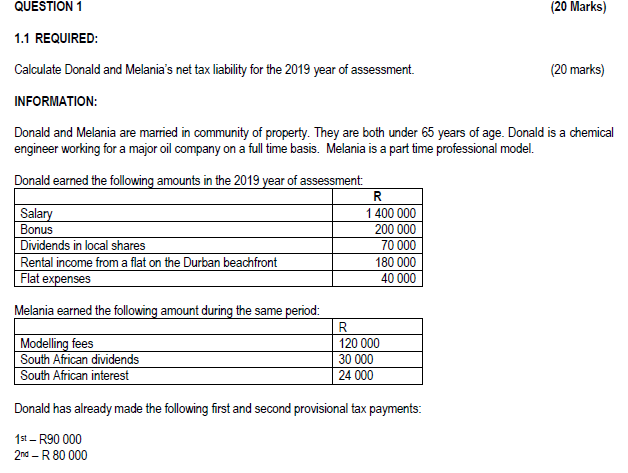

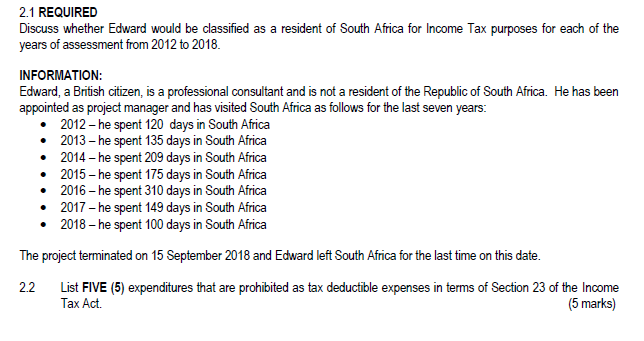

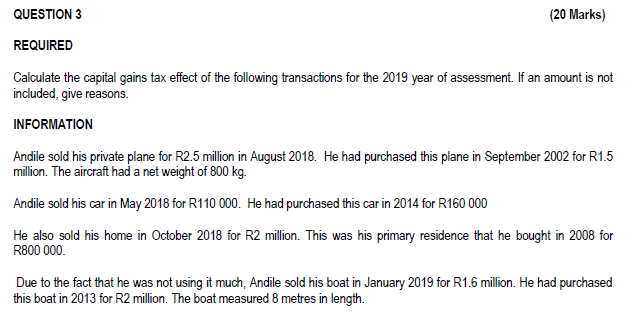

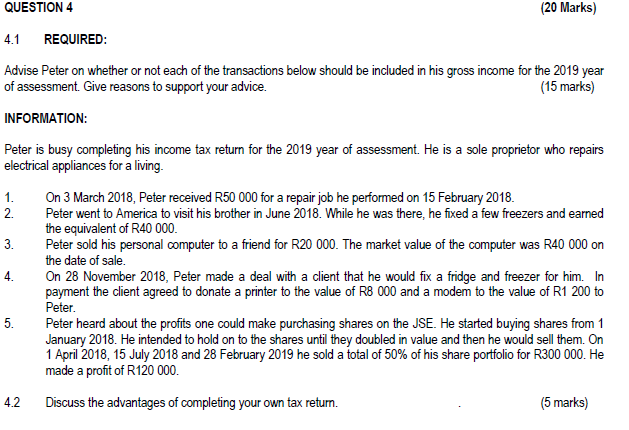

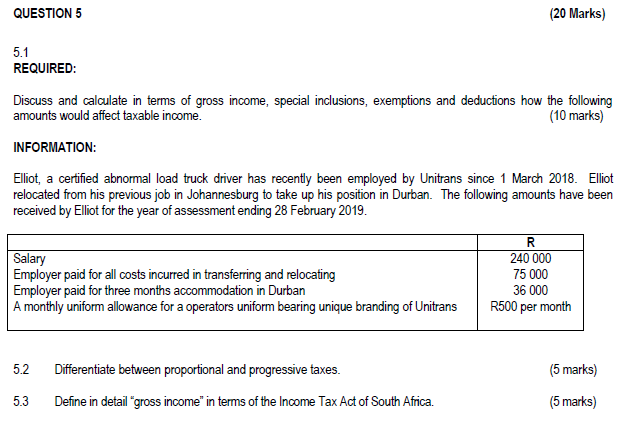

QUESTION 1 (20 Marks) 1.1 REQUIRED: Calculate Donald and Melania's net tax liability for the 2019 year of assessment. (20 marks) INFORMATION: Donald and Melania are married in community of property. They are both under 65 years of age. Donald is a chemical engineer working for a major oil company on a full time basis. Melania is a part time professional model. Donald earned the following amounts in the 2019 year of assessment R Salary 1 400 000 Bonus 200 000 Dividends in local shares 70 000 Rental income from a flat on the Durban beachfront 180 000 Flat expenses 40 000 Melania earned the following amount during the same period: R Modelling fees 120 000 South African dividends 30 000 South African interest 24 000 Donald has already made the following first and second provisional tax payments: 1st - R90 000 2nd - R 80 000 2.1 REQUIRED Discuss whether Edward would be classified as a resident of South Africa for Income Tax purposes for each of the years of assessment from 2012 to 2018. INFORMATION: Edward, a British citizen, is a professional consultant and is not a resident of the Republic of South Africa. He has been appointed as project manager and has visited South Africa as follows for the last seven years: 2012 - he spent 120 days in South Africa 2013 - he spent 135 days in South Africa 2014 he spent 209 days in South Africa 2015 - he spent 175 days in South Africa 2016 he spent 310 days in South Africa 2017 - he spent 149 days in South Africa 2018 he spent 100 days in South Africa The project terminated on 15 September 2018 and Edward left South Africa for the last time on this date. List FIVE (5) expenditures that are prohibited as tax deductible expenses in terms of Section 23 of the Income Tax Act. (5 marks) 22 QUESTION 3 (20 Marks) REQUIRED Calculate the capital gains tax effect of the following transactions for the 2019 year of assessment. If an amount is not included, give reasons. INFORMATION Andile sold his private plane for R2.5 million in August 2018. He had purchased this plane in September 2002 for R1.5 million. The aircraft had a net weight of 800 kg. Andile sold his car in May 2018 for R110 000. He had purchased this car in 2014 for R160 000 He also sold his home in October 2018 for R2 million. This was his primary residence that he bought in 2008 for R800 000 Due to the fact that he was not using it much, Andile sold his boat in January 2019 for R1.6 million. He had purchased this boat in 2013 for R2 million. The boat measured 8 metres in length. QUESTION 4 (20 Marks) 4.1 REQUIRED: Advise Peter on whether or not each of the transactions below should be included in his gross income for the 2019 year of assessment. Give reasons to support your advice. (15 marks) INFORMATION: Peter is busy completing his income tax return for the 2019 year of assessment. He is a sole proprietor who repairs electrical appliances for a living. 1. On 3 March 2018, Peter received R50 000 for a repair job he performed on 15 February 2018. 2. Peter went to America to visit his brother in June 2018. While he was there, he fixed a few freezers and earned the equivalent of R40 000 3. Peter sold his personal computer to a friend for R20 000. The market value of the computer was R40 000 on the date of sale. 4. On 28 November 2018, Peter made a deal with a client that he would fix a fridge and freezer for him. In payment the client agreed to donate a printer to the value of R8 000 and a modem to the value of R1 200 to Peter. 5. Peter heard about the profits one could make purchasing shares on the JSE. He started buying shares from 1 January 2018. He intended to hold on to the shares until they doubled in value and then he would sell them. On 1 April 2018, 15 July 2018 and 28 February 2019 he sold a total of 50% of his share portfolio for R300 000. He made a profit of R120 000 4.2 Discuss the advantages of completing your own tax return. (5 marks) QUESTION 5 (20 Marks) 5.1 REQUIRED: Discuss and calculate in terms of gross income, special inclusions, exemptions and deductions how the following amounts would affect taxable income. (10 marks) INFORMATION: Elliot, a certified abnormal load truck driver has recently been employed by Unitrans since 1 March 2018. Elliot relocated from his previous job in Johannesburg to take up his position in Durban. The following amounts have been received by Elliot for the year of assessment ending 28 February 2019. Salary Employer paid for all costs incurred in transferring and relocating Employer paid for three months accommodation in Durban A monthly uniform allowance for a operators uniform bearing unique branding of Unitrans R 240 000 75 000 36 000 R500 per month 5.2 (5 marks) Differentiate between proportional and progressive taxes. Define in detail gross income" in terms of the Income Tax Act of South Africa. 5.3 (5 marks) QUESTION 1 (20 Marks) 1.1 REQUIRED: Calculate Donald and Melania's net tax liability for the 2019 year of assessment. (20 marks) INFORMATION: Donald and Melania are married in community of property. They are both under 65 years of age. Donald is a chemical engineer working for a major oil company on a full time basis. Melania is a part time professional model. Donald earned the following amounts in the 2019 year of assessment R Salary 1 400 000 Bonus 200 000 Dividends in local shares 70 000 Rental income from a flat on the Durban beachfront 180 000 Flat expenses 40 000 Melania earned the following amount during the same period: R Modelling fees 120 000 South African dividends 30 000 South African interest 24 000 Donald has already made the following first and second provisional tax payments: 1st - R90 000 2nd - R 80 000 2.1 REQUIRED Discuss whether Edward would be classified as a resident of South Africa for Income Tax purposes for each of the years of assessment from 2012 to 2018. INFORMATION: Edward, a British citizen, is a professional consultant and is not a resident of the Republic of South Africa. He has been appointed as project manager and has visited South Africa as follows for the last seven years: 2012 - he spent 120 days in South Africa 2013 - he spent 135 days in South Africa 2014 he spent 209 days in South Africa 2015 - he spent 175 days in South Africa 2016 he spent 310 days in South Africa 2017 - he spent 149 days in South Africa 2018 he spent 100 days in South Africa The project terminated on 15 September 2018 and Edward left South Africa for the last time on this date. List FIVE (5) expenditures that are prohibited as tax deductible expenses in terms of Section 23 of the Income Tax Act. (5 marks) 22 QUESTION 3 (20 Marks) REQUIRED Calculate the capital gains tax effect of the following transactions for the 2019 year of assessment. If an amount is not included, give reasons. INFORMATION Andile sold his private plane for R2.5 million in August 2018. He had purchased this plane in September 2002 for R1.5 million. The aircraft had a net weight of 800 kg. Andile sold his car in May 2018 for R110 000. He had purchased this car in 2014 for R160 000 He also sold his home in October 2018 for R2 million. This was his primary residence that he bought in 2008 for R800 000 Due to the fact that he was not using it much, Andile sold his boat in January 2019 for R1.6 million. He had purchased this boat in 2013 for R2 million. The boat measured 8 metres in length. QUESTION 4 (20 Marks) 4.1 REQUIRED: Advise Peter on whether or not each of the transactions below should be included in his gross income for the 2019 year of assessment. Give reasons to support your advice. (15 marks) INFORMATION: Peter is busy completing his income tax return for the 2019 year of assessment. He is a sole proprietor who repairs electrical appliances for a living. 1. On 3 March 2018, Peter received R50 000 for a repair job he performed on 15 February 2018. 2. Peter went to America to visit his brother in June 2018. While he was there, he fixed a few freezers and earned the equivalent of R40 000 3. Peter sold his personal computer to a friend for R20 000. The market value of the computer was R40 000 on the date of sale. 4. On 28 November 2018, Peter made a deal with a client that he would fix a fridge and freezer for him. In payment the client agreed to donate a printer to the value of R8 000 and a modem to the value of R1 200 to Peter. 5. Peter heard about the profits one could make purchasing shares on the JSE. He started buying shares from 1 January 2018. He intended to hold on to the shares until they doubled in value and then he would sell them. On 1 April 2018, 15 July 2018 and 28 February 2019 he sold a total of 50% of his share portfolio for R300 000. He made a profit of R120 000 4.2 Discuss the advantages of completing your own tax return. (5 marks) QUESTION 5 (20 Marks) 5.1 REQUIRED: Discuss and calculate in terms of gross income, special inclusions, exemptions and deductions how the following amounts would affect taxable income. (10 marks) INFORMATION: Elliot, a certified abnormal load truck driver has recently been employed by Unitrans since 1 March 2018. Elliot relocated from his previous job in Johannesburg to take up his position in Durban. The following amounts have been received by Elliot for the year of assessment ending 28 February 2019. Salary Employer paid for all costs incurred in transferring and relocating Employer paid for three months accommodation in Durban A monthly uniform allowance for a operators uniform bearing unique branding of Unitrans R 240 000 75 000 36 000 R500 per month 5.2 (5 marks) Differentiate between proportional and progressive taxes. Define in detail gross income" in terms of the Income Tax Act of South Africa. 5.3