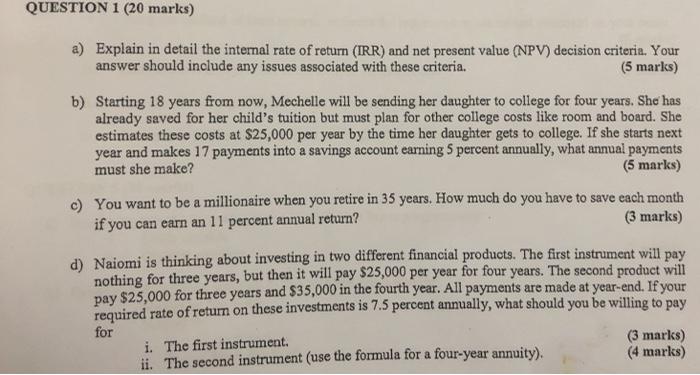

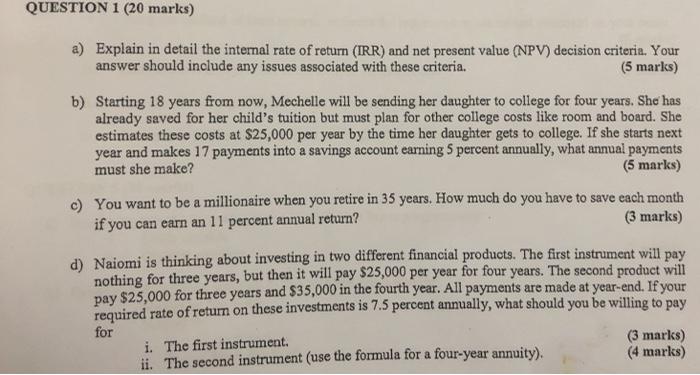

QUESTION 1 (20 marks) a) Explain in detail the internal rate of return (IRR) and net present value (NPV) decision criteria. Your answer should include any issues associated with these criteria. (5 marks) b) Starting 18 years from now, Mechelle will be sending her daughter to college for four years. She has already saved for her child's tuition but must plan for other college costs like room and board. She estimates these costs at $25,000 per year by the time her daughter gets to college. If she starts next year and makes 17 payments into a savings account earning 5 percent annually, what annual payments must she make? (5 marks) c) You want to be a millionaire when you retire in 35 years. How much do you have to save each month if you can earn an 11 percent annual return? (3 marks) d) Naiomi is thinking about investing in two different financial products. The first instrument will pay nothing for three years, but then it will pay $25,000 per year for four years. The second product will pay $25,000 for three years and $35,000 in the fourth year. All payments are made at year-end. If your required rate of return on these investments is 7.5 percent annually, what should you be willing to pay for i. The first instrument. (3 marks) ii. The second instrument (use the formula for a four-year annuity). (4 marks) QUESTION 1 (20 marks) a) Explain in detail the internal rate of return (IRR) and net present value (NPV) decision criteria. Your answer should include any issues associated with these criteria. (5 marks) b) Starting 18 years from now, Mechelle will be sending her daughter to college for four years. She has already saved for her child's tuition but must plan for other college costs like room and board. She estimates these costs at $25,000 per year by the time her daughter gets to college. If she starts next year and makes 17 payments into a savings account earning 5 percent annually, what annual payments must she make? (5 marks) c) You want to be a millionaire when you retire in 35 years. How much do you have to save each month if you can earn an 11 percent annual return? (3 marks) d) Naiomi is thinking about investing in two different financial products. The first instrument will pay nothing for three years, but then it will pay $25,000 per year for four years. The second product will pay $25,000 for three years and $35,000 in the fourth year. All payments are made at year-end. If your required rate of return on these investments is 7.5 percent annually, what should you be willing to pay for i. The first instrument. (3 marks) ii. The second instrument (use the formula for a four-year annuity). (4 marks)