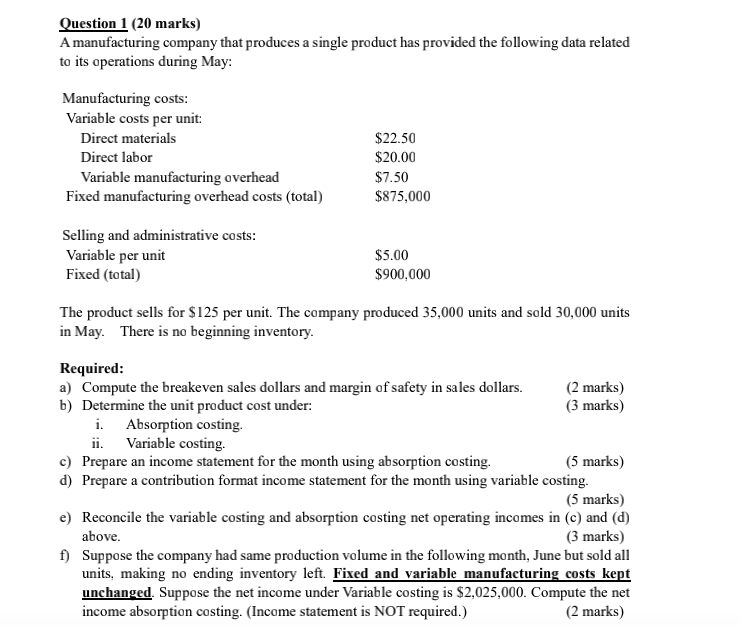

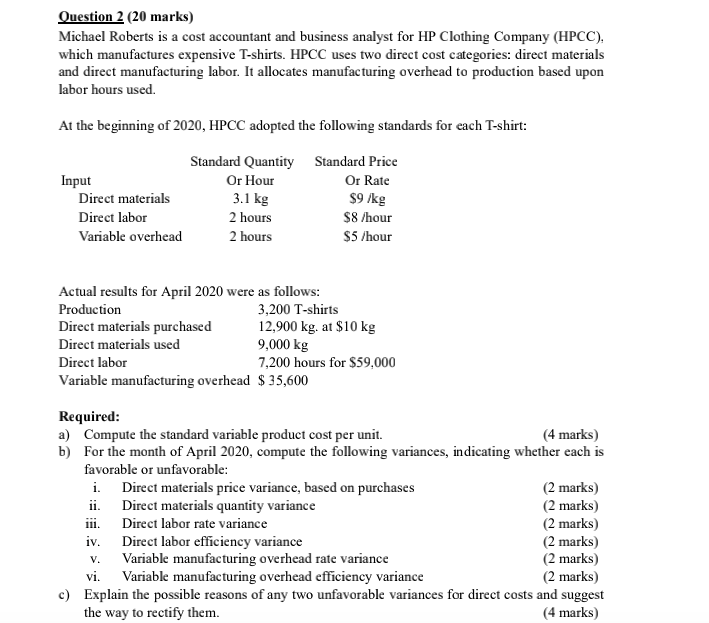

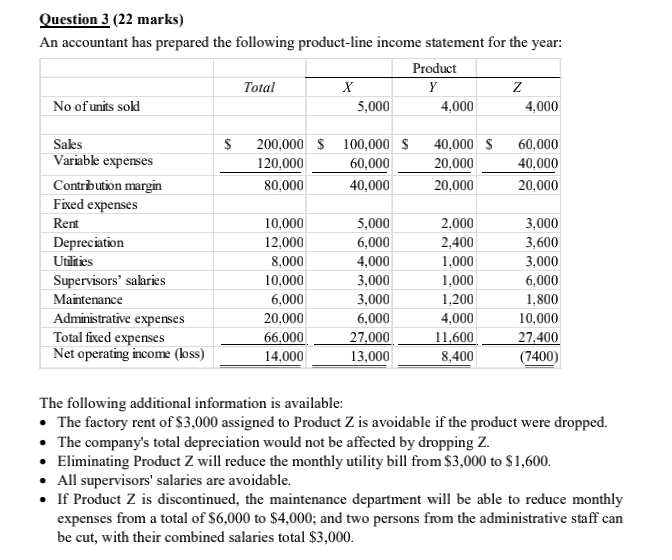

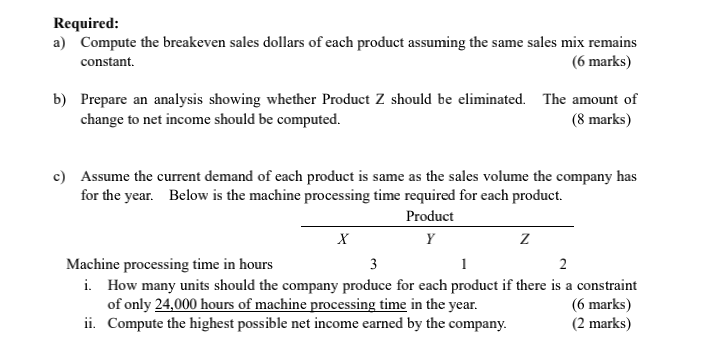

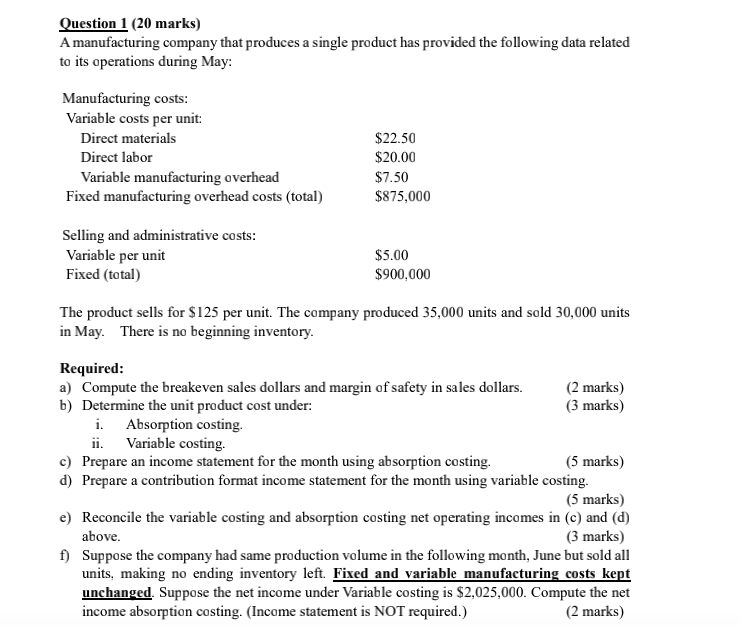

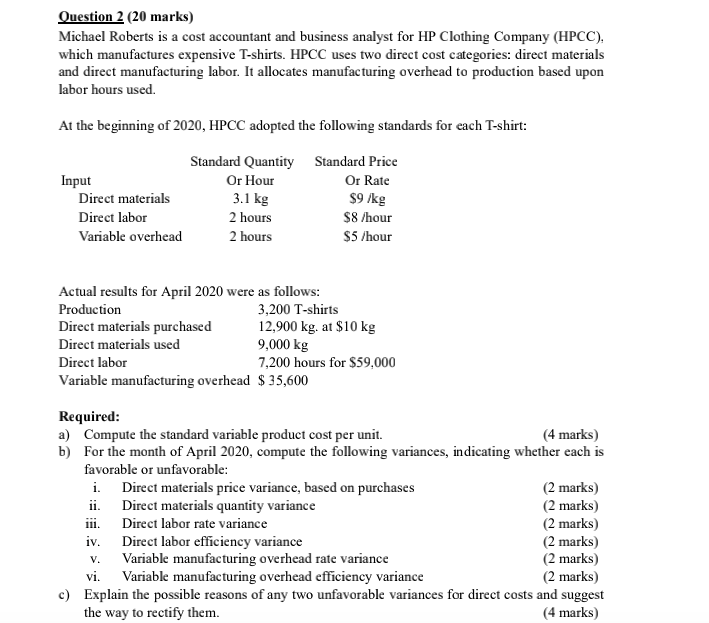

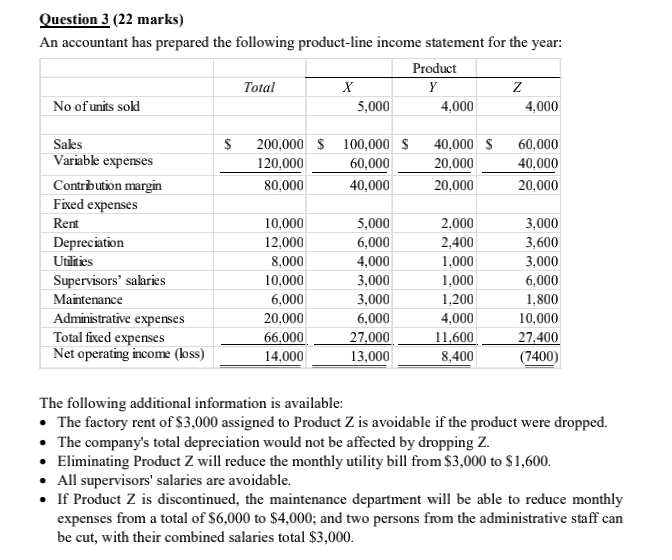

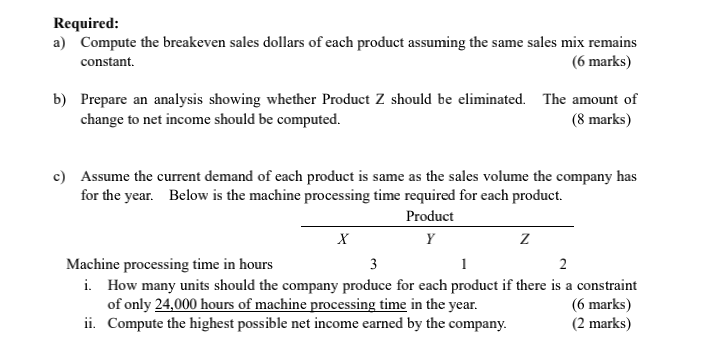

Question 1 (20 marks) A manufacturing company that produces a single product has provided the following data related to its operations during May: Manufacturing costs: Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead costs (total) $22.50 $20.00 $7.50 $875,000 Selling and administrative costs: Variable per unit Fixed (total) $5.00 $900,000 The product sells for $125 per unit. The company produced 35,000 units and sold 30,000 units in May. There is no beginning inventory. Required: a) Compute the breakeven sales dollars and margin of safety in sales dollars. (2 marks) b) Determine the unit product cost under: (3 marks) i. Absorption costing. ii. Variable costing. c) Prepare an income statement for the month using absorption costing. (5 marks) d) Prepare a contribution format income statement for the month using variable costing. (5 marks) e) Reconcile the variable costing and absorption costing net operating incomes in (C) and (d) above. (3 marks) f) Suppose the company had same production volume in the following month, June but sold all units, making no ending inventory left. Fixed and variable manufacturing costs kept unchanged. Suppose the net income under Variable costing is $2,025,000. Compute the net income absorption costing. (Income statement is NOT required.) (2 marks) Question 2 (20 marks) Michael Roberts is a cost accountant and business analyst for HP Clothing Company (HPCC), which manufactures expensive T-shirts. HPCC uses two direct cost categories: direct materials and direct manufacturing labor. It allocates manufacturing overhead to production based upon labor hours used. At the beginning of 2020, HPCC adopted the following standards for each T-shirt: Input Direct materials Direct labor Variable overhead Standard Quantity Standard Price Or Hour Or Rate 3.1 kg $9/kg 2 hours $8 /hour 2 hours $5/hour Actual results for April 2020 were as follows: Production 3,200 T-shirts Direct materials purchased 12,900 kg. at $10 kg Direct materials used 9,000 kg Direct labor 7,200 hours for $59.000 Variable manufacturing overhead $ 35,600 Required: a) Compute the standard variable product cost per unit. (4 marks) b) For the month of April 2020, compute the following variances, indicating whether each is favorable or unfavorable: i Direct materials price variance, based on purchases (2 marks) ii. Direct materials quantity variance (2 marks) Direct labor rate variance (2 marks) iv. Direct labor efficiency variance (2 marks) Variable manufacturing overhead rate variance (2 marks) vi. Variable manufacturing overhead efficiency variance (2 marks) c) Explain the possible reasons of any two unfavorable variances for direct costs and suggest the way to rectify them. (4 marks) V. Question 3 (22 marks) An accountant has prepared the following product-line income statement for the year: Product Total X Y z No of units sold 5,000 4.000 4,000 $ 200,000 $100,000 $ 120,000 60,000 80,000 40,000 40,000 $ 20,000 20.000 60,000 40,000 20,000 Sales Variable expenses Contribution margin Fixed expenses Rent Depreciation Utilities Supervisors' salaries Maintenance Administrative expenses Total fixed expenses Net operating income (loss) 10.000 12.000 8,000 10,000 6.000 20.000 66,000 14,000 5,000 6,000 4,000 3,000 3,000 6,000 27,000 13,000 2.000 2.400 1.000 1.000 1.200 4,000 11,600 8.400 3,000 3,600 3.000 6,000 1.800 10,000 27,400 (7400) The following additional information is available: The factory rent of $3,000 assigned to Product Z is avoidable if the product were dropped. The company's total depreciation would not be affected by dropping Z. Eliminating Product Z will reduce the monthly utility bill from $3,000 to $1,600. All supervisors' salaries are avoidable. If Product Z is discontinued, the maintenance department will be able to reduce monthly expenses from a total of $6,000 to $4,000; and two persons from the administrative staff can be cut, with their combined salaries total $3,000. Required: a) Compute the breakeven sales dollars of each product assuming the same sales mix remains constant. (6 marks) b) Prepare an analysis showing whether Product Z should be eliminated. The amount of change to net income should be computed. (8 marks) c) Assume the current demand of each product is same as the sales volume the company has for the year. Below is the machine processing time required for each product. Product X Y Z Machine processing time in hours 3 2 i. How many units should the company produce for each product if there is a constraint of only 24,000 hours of machine processing time in the year. (6 marks) ii. Compute the highest possible net income earned by the company. (2 marks)