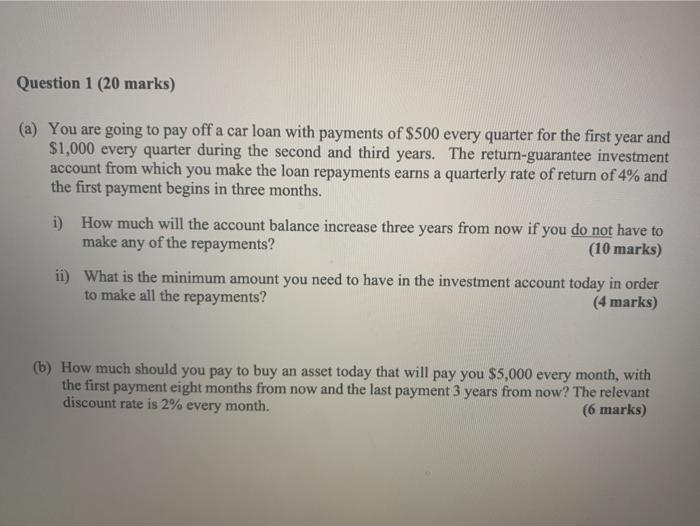

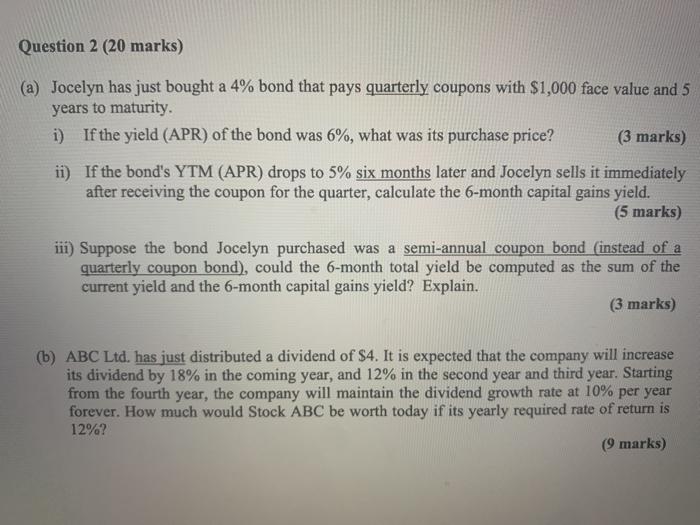

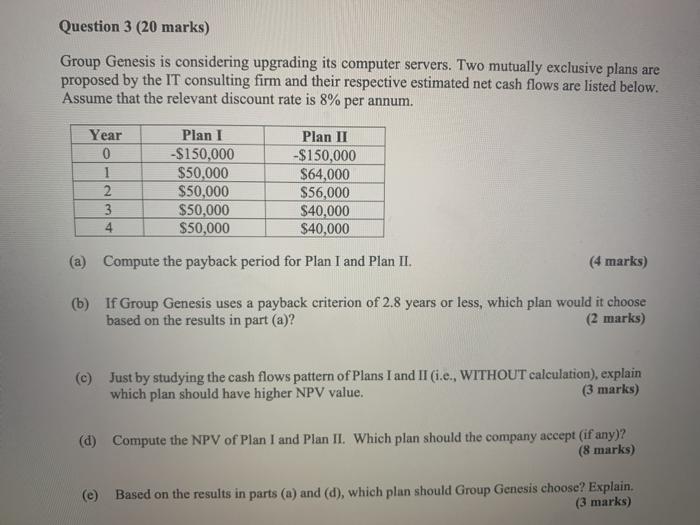

Question 1 (20 marks) (a) You are going to pay off a car loan with payments of $500 every quarter for the first year and $1,000 every quarter during the second and third years. The return-guarantee investment account from which you make the loan repayments earns a quarterly rate of return of 4% and the first payment begins in three months. i) How much will the account balance increase three years from now if you do not have to make any of the repayments? (10 marks) ii) What is the minimum amount you need to have in the investment account today in order to make all the repayments? (4 marks) (b) How much should you pay to buy an asset today that will pay you $5,000 every month, with the first payment eight months from now and the last payment 3 years from now? The relevant discount rate is 2% every month. (6 marks) Question 2 (20 marks) (a) Jocelyn has just bought a 4% bond that pays quarterly coupons with $1,000 face value and 5 years to maturity. i) If the yield (APR) of the bond was 6%, what was its purchase price? (3 marks) ii) If the bond's YTM (APR) drops to 5% six months later and Jocelyn sells it immediately after receiving the coupon for the quarter, calculate the 6-month capital gains yield. (5 marks) iii) Suppose the bond Jocelyn purchased was a semi-annual coupon bond (instead of a quarterly coupon bond), could the 6-month total yield be computed as the sum of the current yield and the 6-month capital gains yield? Explain. (3 marks) (b) ABC Ltd. has just distributed a dividend of $4. It is expected that the company will increase its dividend by 18% in the coming year, and 12% in the second year and third year. Starting from the fourth year, the company will maintain the dividend growth rate at 10% per year forever. How much would Stock ABC be worth today if its yearly required rate of return is 12%? (9 marks) Question 3 (20 marks) Group Genesis is considering upgrading its computer servers. Two mutually exclusive plans are proposed by the IT consulting firm and their respective estimated net cash flows are listed below. Assume that the relevant discount rate is 8% per annum. Year 0 1 2 3 4 Plan 1 -$150,000 $50,000 $50,000 $50,000 $50,000 Plan II -$150,000 $64,000 $56,000 $40,000 $40,000 (a) Compute the payback period for Plan I and Plan II. (4 marks) (b) If Group Genesis uses a payback criterion of 2.8 years or less, which plan would it choose based on the results in part (a)? (2 marks) (e) Just by studying the cash flows pattern of Plans I and II (i.e., WITHOUT calculation), explain which plan should have higher NPV value. (3 marks) (d) Compute the NPV of Plan I and Plan II. Which plan should the company accept (if any)? (8 marks) (e) Based on the results in parts (a) and (d), which plan should Group Genesis choose? Explain