Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 (20 marks) (a) Your investment advisor expects that interest rate will fall due to economic recession this year. Your parents decide to buy

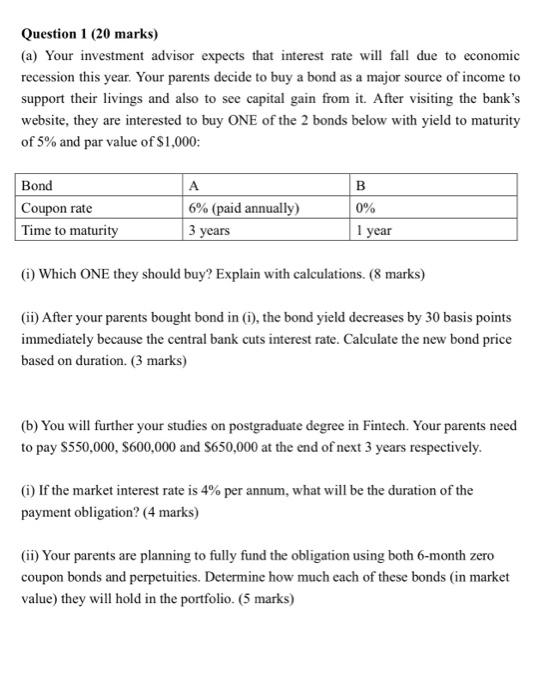

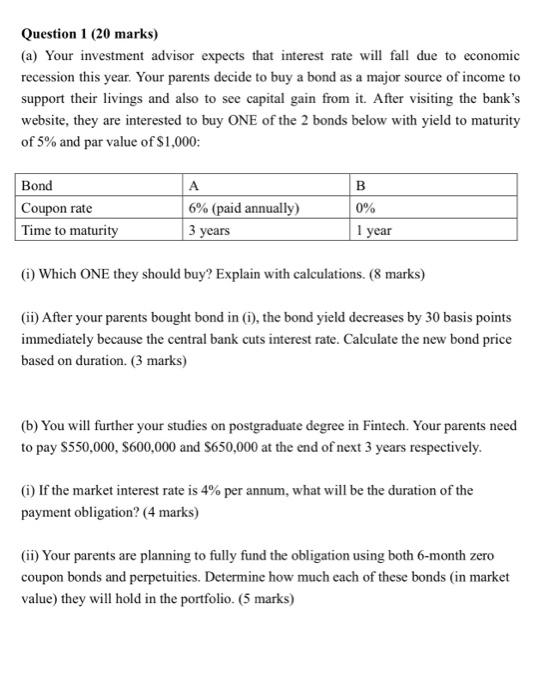

Question 1 (20 marks) (a) Your investment advisor expects that interest rate will fall due to economic recession this year. Your parents decide to buy a bond as a major source of income to support their livings and also to see capital gain from it. After visiting the bank's website, they are interested to buy ONE of the 2 bonds below with yield to maturity of 5% and par value of $1,000 : (i) Which ONE they should buy? Explain with calculations. (8 marks) (ii) After your parents bought bond in (i), the bond yield decreases by 30 basis points immediately because the central bank cuts interest rate. Calculate the new bond price based on duration. (3 marks) (b) You will further your studies on postgraduate degree in Fintech. Your parents need to pay $550,000,$600,000 and $650,000 at the end of next 3 years respectively. (i) If the market interest rate is 4% per annum, what will be the duration of the payment obligation? (4 marks)

Question 1 (20 marks) (a) Your investment advisor expects that interest rate will fall due to economic recession this year. Your parents decide to buy a bond as a major source of income to support their livings and also to see capital gain from it. After visiting the bank's website, they are interested to buy ONE of the 2 bonds below with yield to maturity of 5% and par value of $1,000 : (i) Which ONE they should buy? Explain with calculations. (8 marks) (ii) After your parents bought bond in (i), the bond yield decreases by 30 basis points immediately because the central bank cuts interest rate. Calculate the new bond price based on duration. (3 marks) (b) You will further your studies on postgraduate degree in Fintech. Your parents need to pay $550,000,$600,000 and $650,000 at the end of next 3 years respectively. (i) If the market interest rate is 4% per annum, what will be the duration of the payment obligation? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started