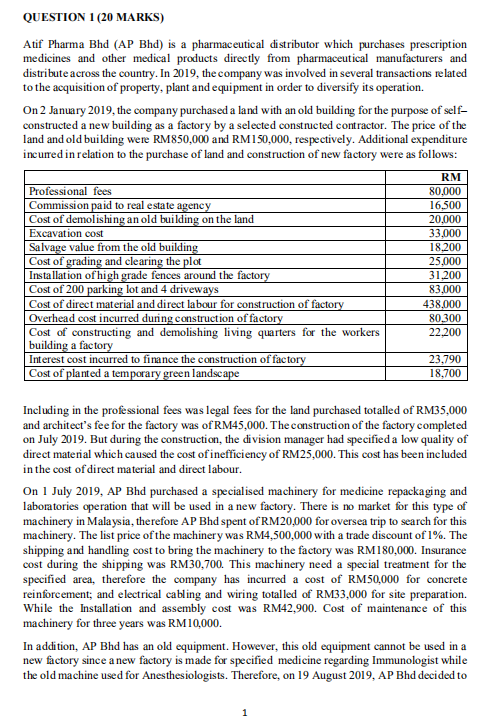

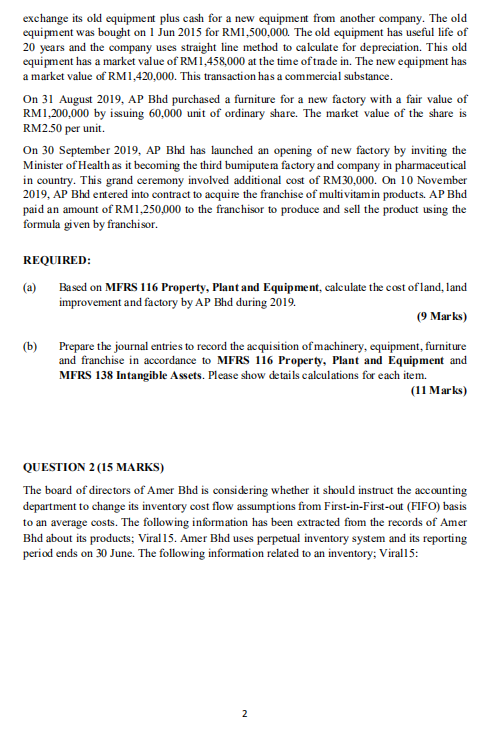

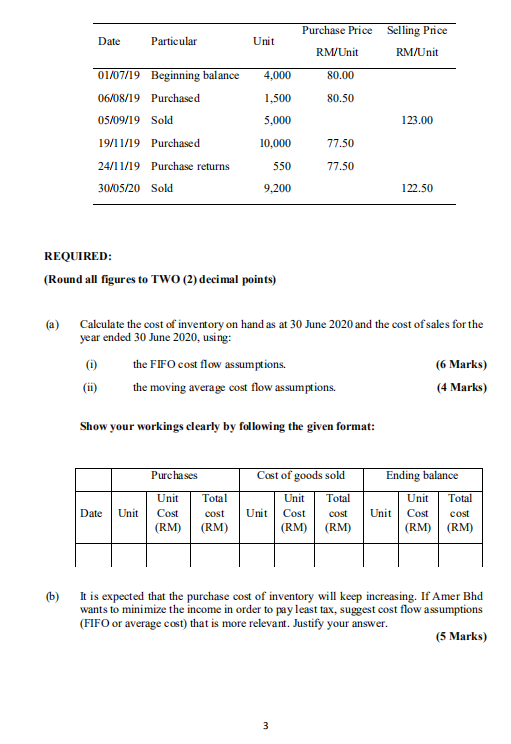

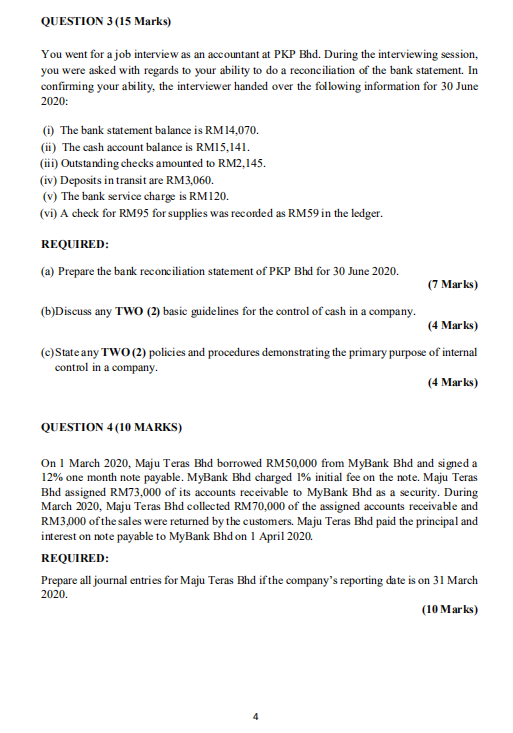

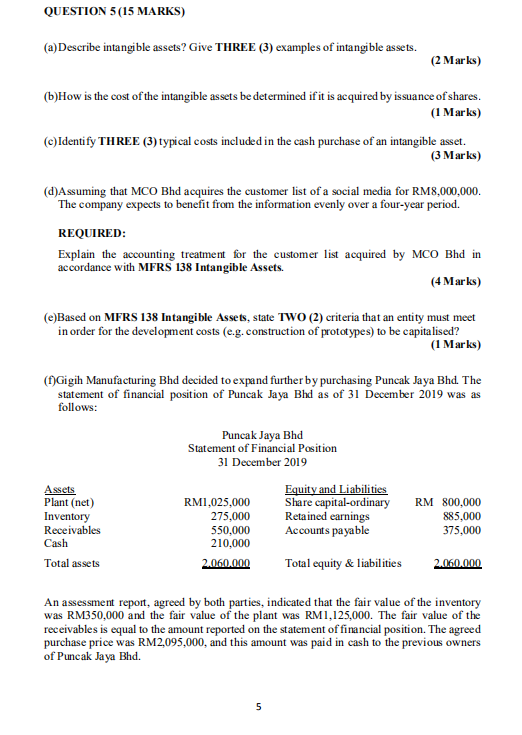

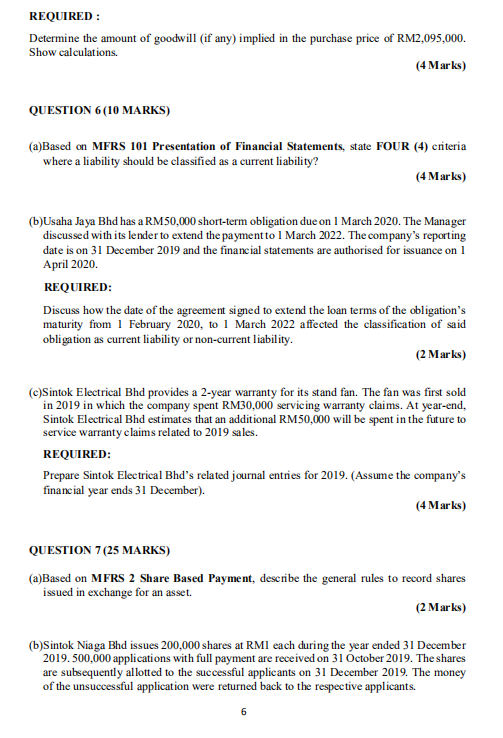

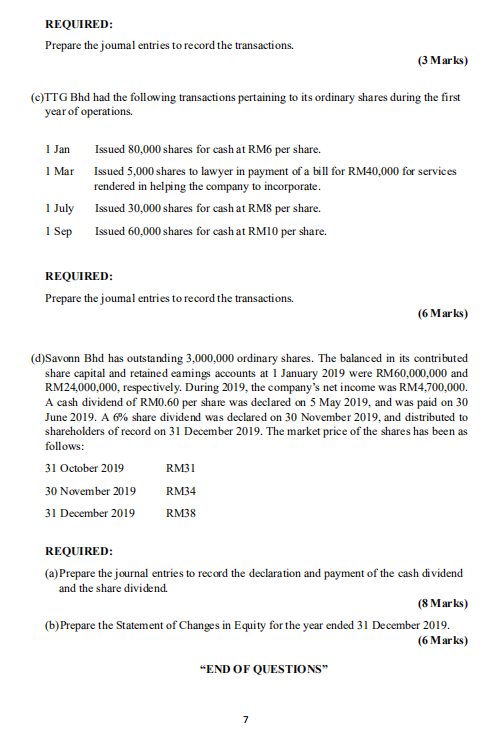

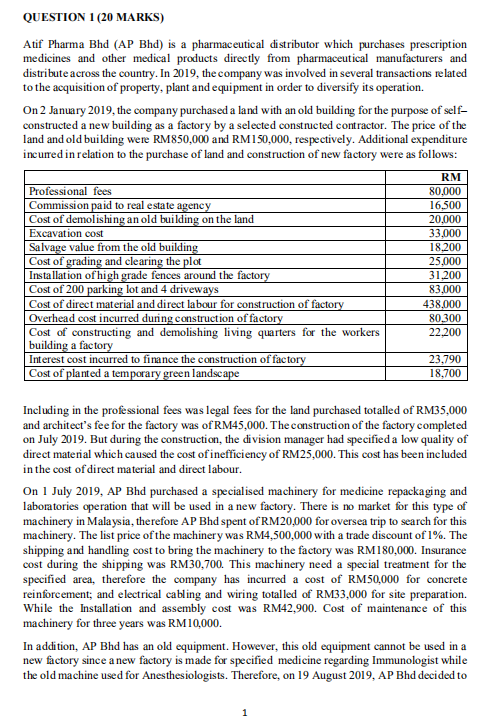

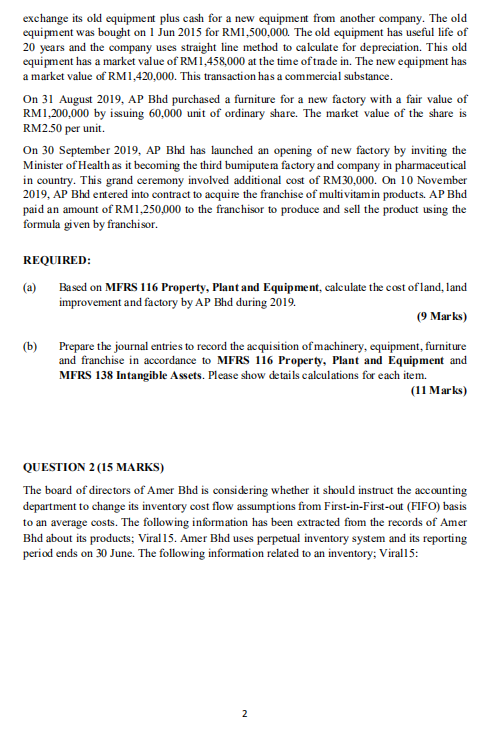

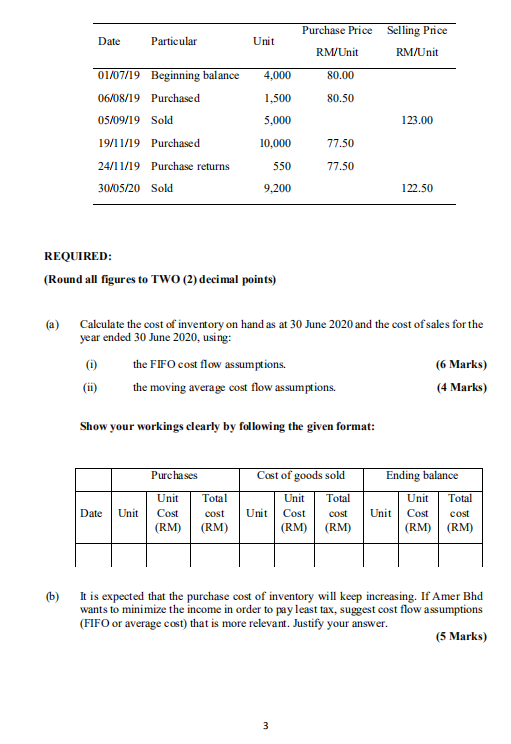

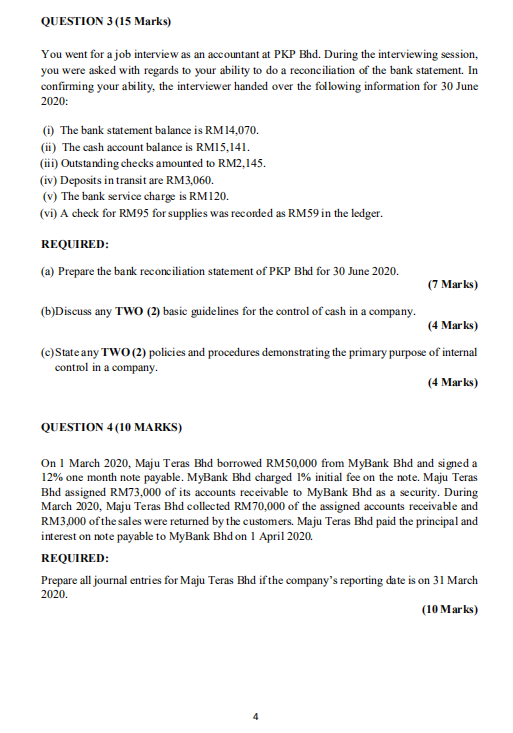

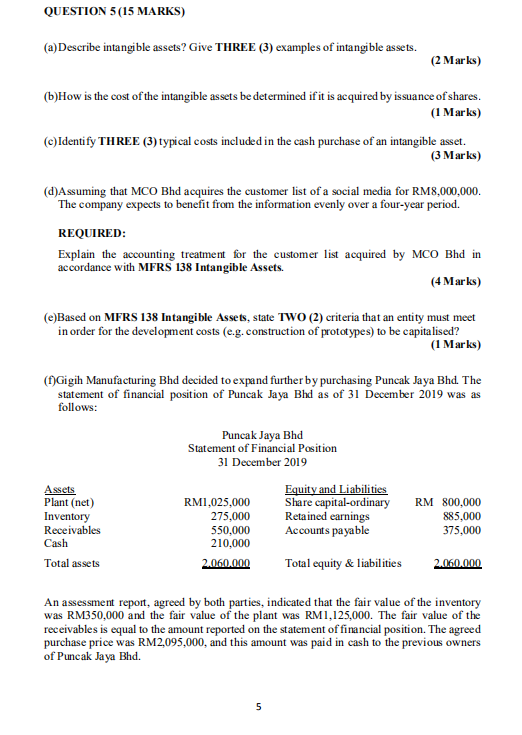

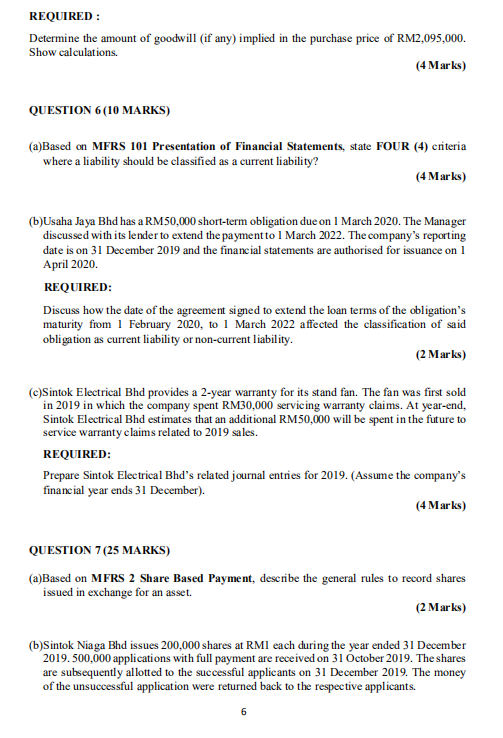

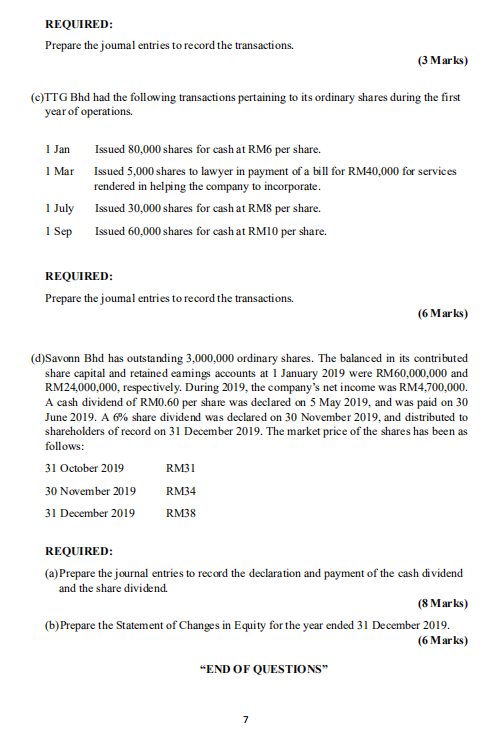

QUESTION 1 (20 MARKS) Atif Pharma Bhd (AP Bhd) is a pharmaceutical distributor which purchases prescription medicines and other medical products directly from pharmaceutical manufacturers and distribute across the country. In 2019, the company was involved in several transactions related to the acquisition of property, plant and equipment in order to diversify its operation. On 2 January 2019, the company purchased a land with an old building for the purpose of self- constructed a new building as a factory by a selected constructed contractor. The price of the land and old building were RM850,000 and RM150,000, respectively. Additional expenditure incurred in relation to the purchase of land and construction of new factory were as follows: Professional fees Commission paid to real estate agency Cost of demolishing an old building on the land Excavation cost Salvage value from the old building Cost of grading and clearing the plot Installation of high grade fences around the factory Cost of 200 parking lot and 4 driveways Cost of direct material and direct labour for construction of factory Overhead cost incurred during construction of factory Cost of constructing and demolishing living quarters for the workers building a factory Interest cost incurred to finance the construction of factory Cost of planted a temporary green landscape RM 80.000 16.500 20.000 33.000 18.200 25.000 31,200 83.000 438.000 80,300 22.200 23,790 18,700 Including in the professional fees was legal fees for the land purchased totalled of RM35,000 and architect's fee for the factory was of RM45,000. The construction of the factory completed on July 2019. But during the construction, the division manager had specified a low quality of direct material which caused the cost of inefficiency of RM25,000. This cost has been included in the cost of direct material and direct labour. On 1 July 2019, AP Bhd purchased a specialised machinery for medicine repackaging and laboratories operation that will be used in a new factory. There is no market for this type of machinery in Malaysia, therefore AP Bhd spent of RM20,000 for oversea trip to search for this machinery. The list price of the machinery was RM4,500,000 with a trade discount of 1%. The shipping and handling cost to bring the machinery to the factory was RM180,000. Insurance cost during the shipping was RM30,700. This machinery need a special treatment for the specified area, therefore the company has incurred a cost of RM50,000 for concrete reinforcement; and electrical cabling and wiring totalled of RM33,000 for site preparation. While the Installation and assembly cost was RM42,900. Cost of maintenance of this machinery for three years was RM10,000. In addition, AP Bhd has an old equipment. However, this old equipment cannot be used in a new factory since a new factory is made for specified medicine regarding Immunologist while the old machine used for Anesthesiologists. Therefore, on 19 August 2019, AP Bhd decided to 1 exchange its old equipment plus cash for a new equipment from another company. The old equipment was bought on 1 Jun 2015 for RM1,500,000. The old equipment has useful life of 20 years and the company uses straight line method to calculate for depreciation. This old equipment has a market value of RM 1,458,000 at the time of trade in. The new equipment has a market value of RM1,420,000. This transaction has a commercial substance. On 31 August 2019, AP Bhd purchased a furniture for a new factory with a fair value of RM1,200,000 by issuing 60,000 unit of ordinary share. The market value of the share is RM2.50 per unit. On 30 September 2019, AP Bhd has launched an opening of new factory by inviting the Minister of Health as it becoming the third bumiputera factory and company in pharmaceutical in country. This grand ceremony involved additional cost of RM30,000. On 10 November 2019, AP Bhd entered into contract to acquire the franchise of multivitam in products. AP Bhd paid an amount of RM1,250,000 to the franchisor to produce and sell the product using the formula given by franchisor. REQUIRED: Based on MFRS 116 Property, Plant and Equipment, calculate the cost ofland, land improvement and factory by AP Bhd during 2019. (9 Marks) (a) (b) Prepare the journal entries to record the acquisition of machinery, equipment, furniture and franchise in accordance to MFRS 116 Property, Plant and Equipment and MFRS 138 Intangible Assets. Please show details calculations for each item. (11 Marks) QUESTION 2 (15 MARKS) The board of directors of Amer Bhd is considering whether it should instruct the accounting department to change its inventory cost flow assumptions from First-in-First-out (FIFO) basis to an average costs. The following information has been extracted from the records of Amer Bhd about its products; Viral 15. Amer Bhd uses perpetual inventory system and its reporting period ends on 30 June. The following information related to an inventory; Virall5: 2 Date Particular Unit Purchase Price Selling Price RM/Unit RM/Unit 4,000 80.00 80.50 1,500 5.000 123.00 01/07/19 Beginning balance 06/08/19 Purchased 05/09/19 Sold 19/11/19 Purchased 24/11/19 Purchase returns 30/05/20 Sold 10,000 77.50 550 77.50 9,200 122.50 REQUIRED: (Round all figures to TWO (2) decimal points) (a) Calculate the cost of inventory on hand as at 30 June 2020 and the cost of sales for the year ended 30 June 2020, using: (1) the FIFO cost flow assumptions. (6 Marks) the moving average cost flow assumptions. (4 Marks) Show your workings clearly by following the given format: Ending balance Purchases Unit Total Cost cost (RM) (RM) Cost of goods sold Unit Total Unit Cost (RM) (RM) Date Unit cost Unit Unit Total Cost cost (RM) (RM) (b) It is expected that the purchase cost of inventory will keep increasing. If Amer Bhd wants to minimize the income in order to pay least tax, suggest cost flow assumptions (FIFO or average cost) that is more relevant. Justify your answer. (5 Marks) 3 QUESTION 3 (15 Marks) You went for a job interview as an accountant at PKP Bhd. During the interviewing session, you were asked with regards to your ability to do a reconciliation of the bank statement. In confirming your ability, the interviewer handed over the following information for 30 June 2020: (1) The bank statement balance is RM14.070. (ii) The cash account balance is RM15,141. (iii) Outstanding checks amounted to RM2,145. (iv) Deposits in transit are RM3,060. (v) The bank service charge is RM120. (vi) A check for RM95 for supplies was recorded as RM59 in the ledger. REQUIRED: (a) Prepare the bank reconciliation statement of PKP Bhd for 30 June 2020. (7 Marks) (b)Discuss any TWO (2) basic guidelines for the control of cash in a company. (4 Marks) (e)State any TWO (2) policies and procedures demonstrating the primary purpose of internal control in a company. (4 Marks) QUESTION 4(10 MARKS) On 1 March 2020, Maju Teras Bhd borrowed RM50,000 from MyBank Bhd and signed a 12% one month note payable. MyBank Bhd charged 1% initial fee on the note. Maju Teras Bhd assigned RM73,000 of its accounts receivable to MyBank Bhd as a security. During March 2020, Maju Teras Bhd collected RM70,000 of the assigned accounts receivable and RM3,000 of the sales were returned by the customers. Maju Teras Bhd paid the principal and interest on note payable to MyBank Bhd on 1 April 2020. REQUIRED: Prepare all journal entries for Maju Teras Bhd if the company's reporting date is on 31 March 2020. (10 Marks) 4 QUESTION 5 (15 MARKS) (a) Describe intangible assets? Give THREE (3) examples of intangible assets. (2 Marks) (b) How is the cost of the intangible assets be determined if it is acquired by issuance of shares. (1 Marks) (c)Identify THREE (3) typical costs included in the cash purchase of an intangible asset. (3 Marks) (d)Assuming that MCO Bhd acquires the customer list of a social media for RM8,000,000. The company expects to benefit from the information evenly over a four-year period. REQUIRED: Explain the accounting treatment for the customer list acquired by MCO Bhd in accordance with MFRS 138 Intangible Assets. (4 Marks) (e)Based on MFRS 138 Intangible Assets, state TWO (2) criteria that an entity must meet in order for the development costs (e.g.construction of prototypes) to be capitalised? (1 Marks) (f)Gigih Manufacturing Bhd decided to expand further by purchasing Puncak Jaya Bhd. The statement of financial position of Puncak Jaya Bhd as of 31 December 2019 was as follows: Puncak Jaya Bhd Statement of Financial Position 31 December 2019 Assets Plant (net) Inventory Receivables Cash Total assets RM1,025,000 275,000 550,000 210,000 2.060.000 Equity and Liabilities Share capital-ordinary Retained earnings Accounts payable RM 800,000 885,000 375,000 Total equity & liabilities 2.060.000 An assessment report, agreed by both parties, indicated that the fair value of the inventory was RM350,000 and the fair value of the plant was RM1,125,000. The fair value of the receivables is equal to the amount reported on the statement of financial position. The agreed purchase price was RM2,095,000, and this amount was paid in cash to the previous owners of Puncak Jaya Bhd. 5 REQUIRED : Determine the amount of goodwill (if any) implied in the purchase price of RM2,095,000. Show calculations (4 Marks) QUESTION 6(10 MARKS) (a) Based on MFRS 101 Presentation of Financial Statements, state FOUR (4) criteria where a liability should be classified as a current liability? (4 Marks) (b)Usaha Jaya Bhd has a RM50,000 short-term obligation due on 1 March 2020. The Manager discussed with its lender to extend the payment to 1 March 2022. The company's reporting date is on 31 December 2019 and the financial statements are authorised for issuance on 1 April 2020. REQUIRED: Discuss how the date of the agreement signed to extend the loan terms of the obligation's maturity from 1 February 2020, to 1 March 2022 affected the classification of said obligation as current liability or non-current liability. (2 Marks) (c)Sintok Electrical Bhd provides a 2-year warranty for its stand fan. The fan was first sold in 2019 in which the company spent RM30,000 servicing warranty claims. At year-end, Sintok Electrical Bhd estimates that an additional RM50,000 will be spent in the future to service warranty claims related to 2019 sales. REQUIRED: Prepare Sintok Electrical Bhd's related journal entries for 2019. (Assume the company's financial year ends 31 December). (4 Marks) QUESTION 7(25 MARKS) (a) Based on MFRS 2 Share Based Payment, describe the general rules to record shares issued in exchange for an asset. (2 Marks) (b)Sintok Niaga Bhd issues 200,000 shares at RM1 each during the year ended 31 December 2019.500,000 applications with full payment are received on 31 October 2019. The shares are subsequently allotted to the successful applicants on 31 December 2019. The money of the unsuccessful application were returned back to the respective applicants. 6 REQUIRED: Prepare the joumal entries to record the transactions. (3 Marks) (C)TTG Bhd had the following transactions pertaining to its ordinary shares during the first year of operations. 1 Jan 1 Mar Issued 80,000 shares for cash at RM6 per share. Issued 5,000 shares to lawyer in payment of a bill for RM40,000 for services rendered in helping the company to incorporate. 1 July Issued 30,000 shares for cash at RM8 per share. 1 Sep Issued 60,000 shares for cash at RM10 per share. REQUIRED: Prepare the joumal entries to record the transactions. (6 Marks) (d)Savonn Bhd has outstanding 3,000,000 ordinary shares. The balanced in its contributed share capital and retained eamings accounts at 1 January 2019 were RM60,000,000 and RM24,000,000, respectively. During 2019, the company's net income was RM4,700,000. A cash dividend of RM0.60 per share was declared on 5 May 2019, and was paid on 30 June 2019. A 6% share dividend was declared on 30 November 2019, and distributed to shareholders of record on 31 December 2019. The market price of the shares has been as follows: 31 October 2019 RM31 30 November 2019 RM34 31 December 2019 RM38 REQUIRED: (a)Prepare the journal entries to record the declaration and payment of the cash dividend and the share dividend (8 Marks) (b)Prepare the Statement of Changes in Equity for the year ended 31 December 2019. (6 Marks) "END OF QUESTIONS 7