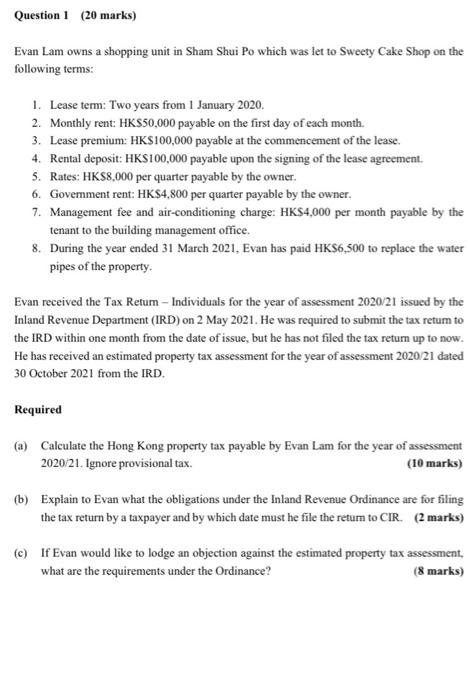

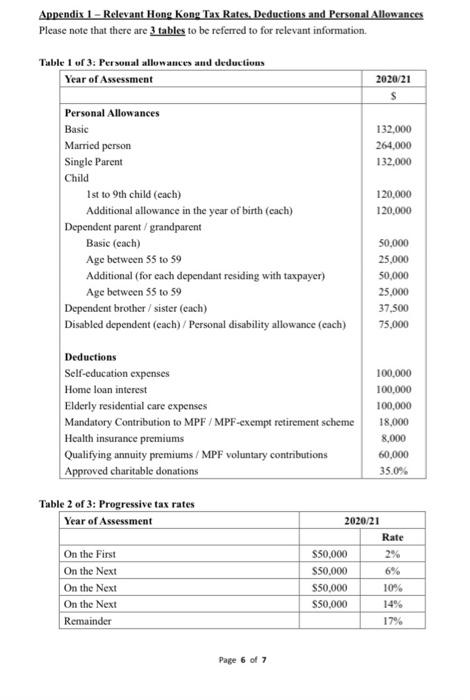

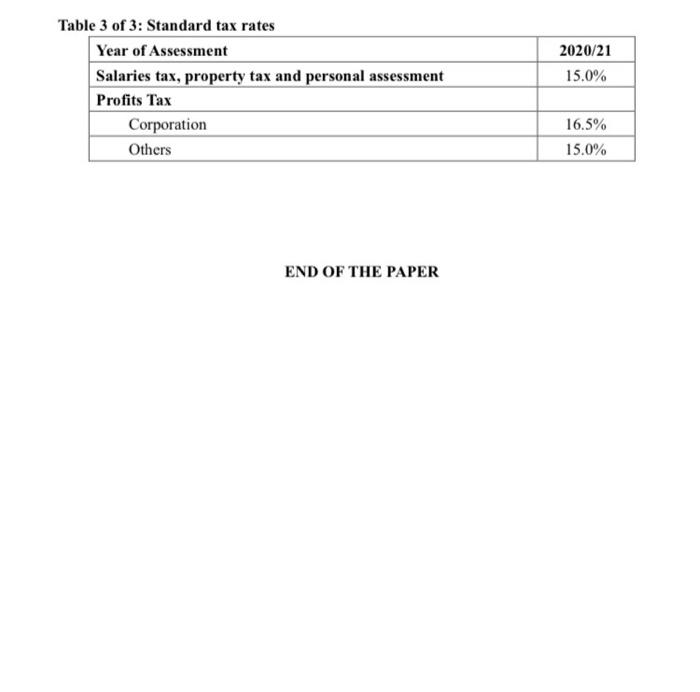

Question 1 (20 marks) Evan Lam owns a shopping unit in Sham Shui Po which was let to Sweety Cake Shop on the following terms: 1. Lease term: Two years from 1 January 2020. 2. Monthly rent: HK$50,000 payable on the first day of each month. 3. Lease premium: HKS100,000 payable at the commencement of the lease. 4. Rental deposit: HKS100,000 payable upon the signing of the lease agreement. 5. Rates: HK$8,000 per quarter payable by the owner. 6. Government rent: HK$4,800 per quarter payable by the owner. 7. Management fee and air-conditioning charge: HK$4,000 per month payable by the tenant to the building management office. 8. During the year ended 31 March 2021. Evan has paid HK$6,500 to replace the water pipes of the property Evan received the Tax Retum - Individuals for the year of assessment 2020/21 issued by the Inland Revenue Department (IRD) on 2 May 2021. He was required to submit the tax retum to the IRD within one month from the date of issue, but he has not filed the tax retum up to now. He has received an estimated property tax assessment for the year of assessment 2020/21 dated 30 October 2021 from the IRD. Required (a) Calculate the Hong Kong property tax payable by Evan Lam for the year of assessment 2020/21. Ignore provisional tax. (10 marks) (b) Explain to Evan what the obligations under the Inland Revenue Ordinance are for filing the tax return by a taxpayer and by which date must he file the retum to CIR. (2 marks) (c) If Evan would like to lodge an objection against the estimated property tax assessment, what are the requirements under the Ordinance? (8 marks) Appendix 1 - Relevant Hong Kong Tax Rates, Deductions and Personal Allowances Please note that there are 3 tables to be referred to for relevant information. Table 1 of 3: Personal allowances and deductions Year of Assessment 2020/21 132,000 264,000 132,000 120,000 120,000 Personal Allowances Basic Married person Single Parent Child Ist to 9th child (each) Additional allowance in the year of birth (each) Dependent parent/grandparent Basic (each) Age between 55 to 59 Additional (for each dependant residing with taxpayer) Age between 55 to 59 Dependent brother sister (cach) Disabled dependent (each) / Personal disability allowance (cach) 50,000 25,000 50,000 25,000 37,500 75,000 Deductions Self-education expenses Home loan interest Elderly residential care expenses Mandatory Contribution to MPF / MPF-exempt retirement scheme Health insurance premiums Qualifying annuity premiums / MPF voluntary contributions Approved charitable donations 100,000 100,000 100,000 18,000 8.000 60,000 35.0% Table 2 of 3: Progressive tax rates Year of Assessment On the First On the Next On the Next On the Next Remainder 2020/21 Rate $50,000 2% S50,000 6% S50.000 10% 550,000 17% Page 6 of 7 2020/21 15.0% Table 3 of 3: Standard tax rates Year of Assessment Salaries tax, property tax and personal assessment Profits Tax Corporation Others 16.5% 15.0% END OF THE PAPER Question 1 (20 marks) Evan Lam owns a shopping unit in Sham Shui Po which was let to Sweety Cake Shop on the following terms: 1. Lease term: Two years from 1 January 2020. 2. Monthly rent: HK$50,000 payable on the first day of each month. 3. Lease premium: HKS100,000 payable at the commencement of the lease. 4. Rental deposit: HKS100,000 payable upon the signing of the lease agreement. 5. Rates: HK$8,000 per quarter payable by the owner. 6. Government rent: HK$4,800 per quarter payable by the owner. 7. Management fee and air-conditioning charge: HK$4,000 per month payable by the tenant to the building management office. 8. During the year ended 31 March 2021. Evan has paid HK$6,500 to replace the water pipes of the property Evan received the Tax Retum - Individuals for the year of assessment 2020/21 issued by the Inland Revenue Department (IRD) on 2 May 2021. He was required to submit the tax retum to the IRD within one month from the date of issue, but he has not filed the tax retum up to now. He has received an estimated property tax assessment for the year of assessment 2020/21 dated 30 October 2021 from the IRD. Required (a) Calculate the Hong Kong property tax payable by Evan Lam for the year of assessment 2020/21. Ignore provisional tax. (10 marks) (b) Explain to Evan what the obligations under the Inland Revenue Ordinance are for filing the tax return by a taxpayer and by which date must he file the retum to CIR. (2 marks) (c) If Evan would like to lodge an objection against the estimated property tax assessment, what are the requirements under the Ordinance? (8 marks) Appendix 1 - Relevant Hong Kong Tax Rates, Deductions and Personal Allowances Please note that there are 3 tables to be referred to for relevant information. Table 1 of 3: Personal allowances and deductions Year of Assessment 2020/21 132,000 264,000 132,000 120,000 120,000 Personal Allowances Basic Married person Single Parent Child Ist to 9th child (each) Additional allowance in the year of birth (each) Dependent parent/grandparent Basic (each) Age between 55 to 59 Additional (for each dependant residing with taxpayer) Age between 55 to 59 Dependent brother sister (cach) Disabled dependent (each) / Personal disability allowance (cach) 50,000 25,000 50,000 25,000 37,500 75,000 Deductions Self-education expenses Home loan interest Elderly residential care expenses Mandatory Contribution to MPF / MPF-exempt retirement scheme Health insurance premiums Qualifying annuity premiums / MPF voluntary contributions Approved charitable donations 100,000 100,000 100,000 18,000 8.000 60,000 35.0% Table 2 of 3: Progressive tax rates Year of Assessment On the First On the Next On the Next On the Next Remainder 2020/21 Rate $50,000 2% S50,000 6% S50.000 10% 550,000 17% Page 6 of 7 2020/21 15.0% Table 3 of 3: Standard tax rates Year of Assessment Salaries tax, property tax and personal assessment Profits Tax Corporation Others 16.5% 15.0% END OF THE PAPER