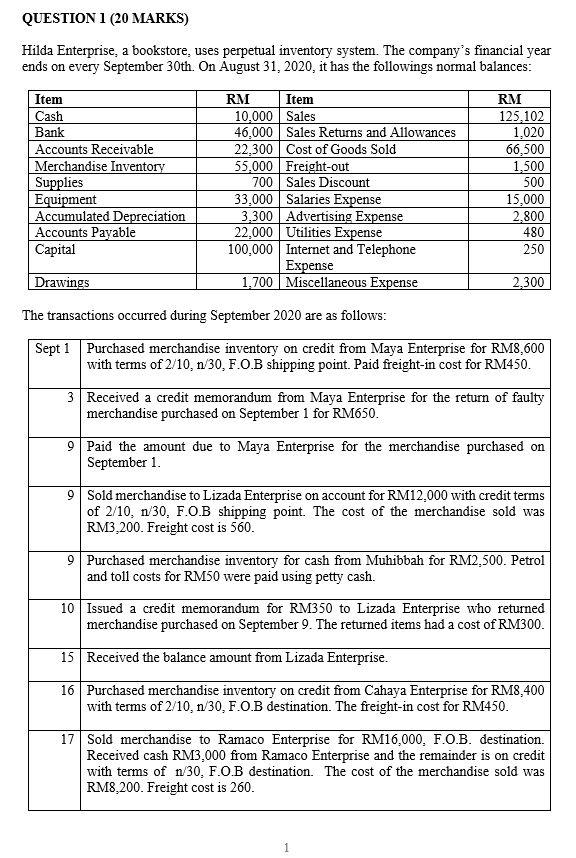

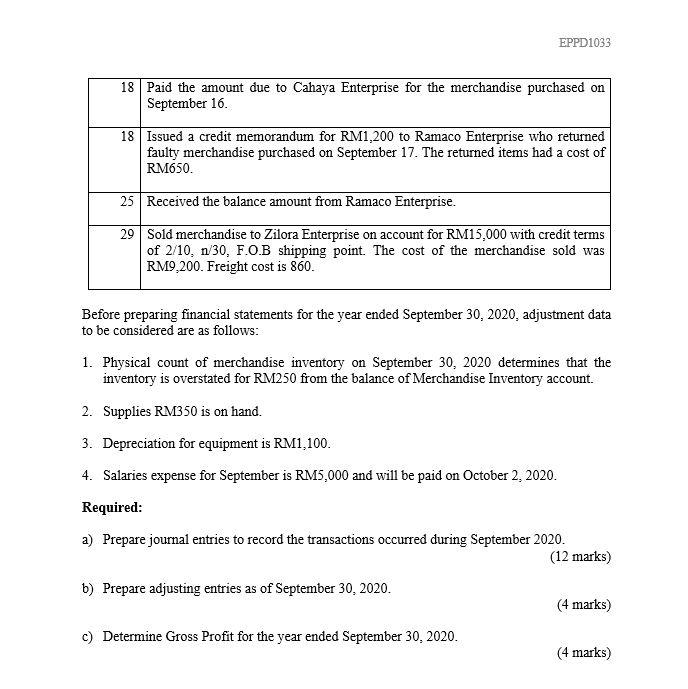

QUESTION 1 (20 MARKS) Hilda Enterprise, a bookstore, uses perpetual inventory system. The company's financial year ends on every September 30th. On August 31, 2020, it has the followings normal balances: Item Cash Bank Accounts Receivable Merchandise Inventory Supplies Equipment Accumulated Depreciation Accounts Payable Capital RM Item 10.000 Sales 46,000 Sales Returns and Allowances 22,300 Cost of Goods Sold 55.000 Freight-out 700 Sales Discount 33,000 Salaries Expense 3.300 Advertising Expense 22,000 Utilities Expense 100,000 Internet and Telephone Expense 1,700 Miscellaneous Expense RM 125,102 1,020 66,500 1,500 500 15,000 2.800 480 250 Drawings 2.300 The transactions occurred during September 2020 are as follows: Sept 1 Purchased merchandise inventory on credit from Maya Enterprise for RM8,600 with terms of 2/10, n/30, F.O.B shipping point. Paid freight-in cost for RM450. 3 Received a credit memorandum from Maya Enterprise for the return of faulty merchandise purchased on September 1 for RM650. 9 Paid the amount due to Maya Enterprise for the merchandise purchased on September 1. 9 Sold merchandise to Lizada Enterprise on account for RM12.000 with credit terms of 2/10, n/30, F.O.B shipping point. The cost of the merchandise sold was RM3,200. Freight cost is 560. 9 Purchased merchandise inventory for cash from Muhibbah for RM2,500. Petrol and toll costs for RM50 were paid using petty cash. 10 Issued a credit memorandum for RM350 to Lizada Enterprise who returned merchandise purchased on September 9. The returned items had a cost of RM300. 15 Received the balance amount from Lizada Enterprise. 16 Purchased merchandise inventory on credit from Cahaya Enterprise for RM8,400 with terms of 2/10,n/30, F.O.B destination. The freight-in cost for RM450. 17 Sold merchandise to Ramaco Enterprise for RM16,000, F.O.B. destination. Received cash RM3,000 from Ramaco Enterprise and the remainder is on credit with terms of n/30, F.OB destination. The cost of the merchandise sold was RM8,200. Freight cost is 260. EPPD1033 18 Paid the amount due to Cahaya Enterprise for the merchandise purchased on September 16. 18 Issued a credit memorandum for RM1,200 to Ramaco Enterprise who returned faulty merchandise purchased on September 17. The returned items had a cost of RM650. 25 Received the balance amount from Ramaco Enterprise. 29 Sold merchandise to Zilora Enterprise on account for RM15,000 with credit terms of 2/10, n/30, F.O.B shipping point. The cost of the merchandise sold was RM9,200. Freight cost is 860. Before preparing financial statements for the year ended September 30, 2020, adjustment data to be considered are as follows: 1. Physical count of merchandise inventory on September 30, 2020 determines that the inventory is overstated for RM250 from the balance of Merchandise Inventory account. 2. Supplies RM350 is on hand. 3. Depreciation for equipment is RM1,100. 4. Salaries expense for September is RM5,000 and will be paid on October 2, 2020. Required: a) Prepare journal entries to record the transactions occurred during September 2020. (12 marks) b) Prepare adjusting entries as of September 30, 2020. (4 marks) c) Determine Gross Profit for the year ended September 30, 2020. (4 marks)