Answered step by step

Verified Expert Solution

Question

1 Approved Answer

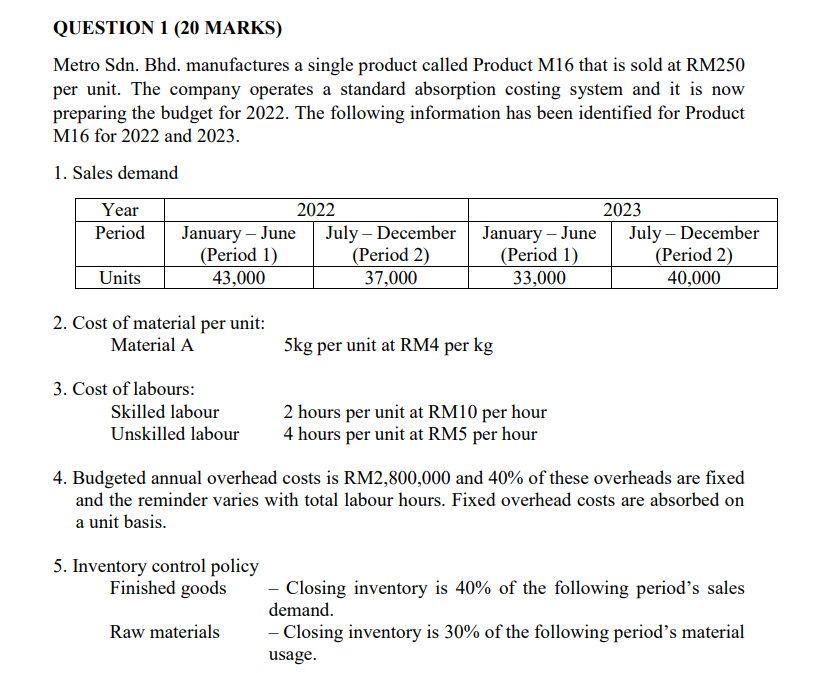

QUESTION 1 (20 MARKS) Metro Sdn. Bhd. manufactures a single product called Product M16 that is sold at RM250 per unit. The company operates a

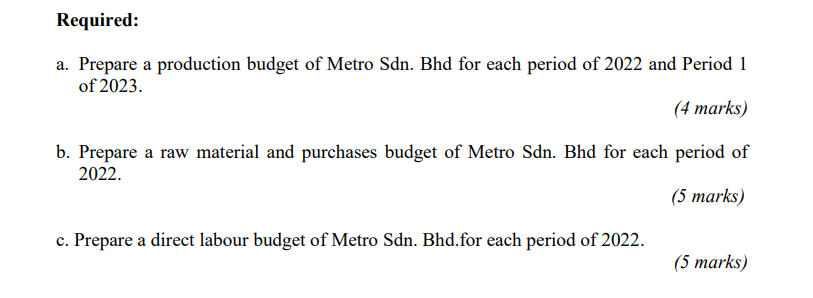

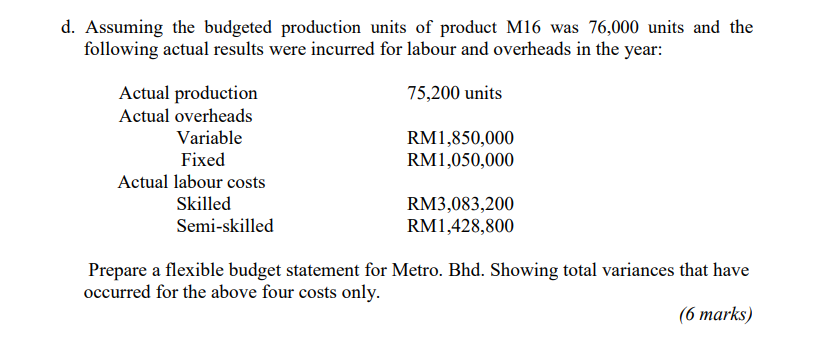

QUESTION 1 (20 MARKS) Metro Sdn. Bhd. manufactures a single product called Product M16 that is sold at RM250 per unit. The company operates a standard absorption costing system and it is now preparing the budget for 2022. The following information has been identified for Product M16 for 2022 and 2023. 1. Sales demand Year Period 2022 2023 January - June July - December January - June July - December (Period 1) (Period 2) (Period 1) (Period 2) 43,000 37,000 33,000 40,000 Units 2. Cost of material per unit: Material A 5kg per unit at RM4 per kg 3. Cost of labours: Skilled labour 2 hours per unit at RM10 per hour Unskilled labour 4 hours per unit at RM5 per hour 4. Budgeted annual overhead costs is RM2,800,000 and 40% of these overheads are fixed and the reminder varies with total labour hours. Fixed overhead costs are absorbed on a unit basis. 5. Inventory control policy Finished goods Closing inventory is 40% of the following period's sales demand. Raw materials - Closing inventory is 30% of the following period's material usage. Required: a. Prepare a production budget of Metro Sdn. Bhd for each period of 2022 and Period 1 of 2023. (4 marks) b. Prepare a raw material and purchases budget of Metro Sdn. Bhd for each period of 2022. (5 marks) c. Prepare a direct labour budget of Metro Sdn. Bhd.for each period of 2022. (5 marks) d. Assuming the budgeted production units of product M16 was 76,000 units and the following actual results were incurred for labour and overheads in the year: 75,200 units Actual production Actual overheads Variable Fixed Actual labour costs Skilled Semi-skilled RM1,850,000 RM1,050,000 RM3,083,200 RM1,428,800 Prepare a flexible budget statement for Metro. Bhd. Showing total variances that have occurred for the above four costs only. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started