Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Moon Kee is selling Guangdong dessert cuisines, which is very successful from a small shop in which visitors are queuing up for dinning every

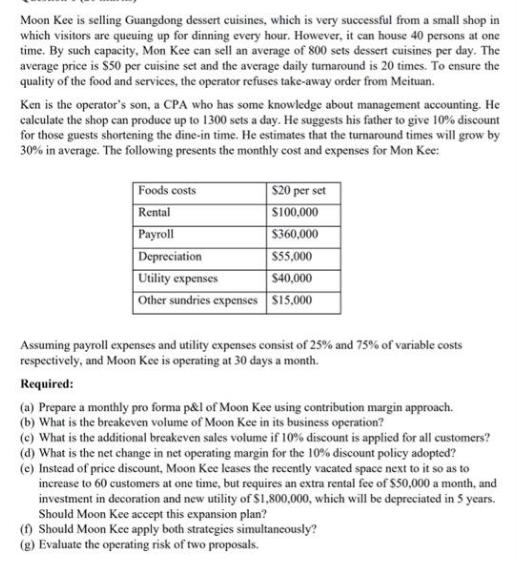

Moon Kee is selling Guangdong dessert cuisines, which is very successful from a small shop in which visitors are queuing up for dinning every hour. However, it can house 40 persons at one time. By such capacity, Mon Kee can sell an average of 800 sets dessert cuisines per day. The average price is $50 per cuisine set and the average daily turnaround is 20 times. To ensure the quality of the food and services, the operator refuses take-away order from Meituan. Ken is the operator's son, a CPA who has some knowledge about management accounting. He calculate the shop can produce up to 1300 sets a day. He suggests his father to give 10% discount for those guests shortening the dine-in time. He estimates that the turnaround times will grow by 30% in average. The following presents the monthly cost and expenses for Mon Kee: Foods costs Rental Payroll Depreciation Utility expenses Other sundries expenses $20 per set $100,000 $360,000 $55,000 $40,000 $15,000 Assuming payroll expenses and utility expenses consist of 25% and 75% of variable costs respectively, and Moon Kee is operating at 30 days a month. Required: (a) Prepare a monthly pro forma p&l of Moon Kee using contribution margin approach. (b) What is the breakeven volume of Moon Kee in its business operation? (c) What is the additional breakeven sales volume if 10% discount is applied for all customers? (d) What is the net change in net operating margin for the 10% discount policy adopted? (e) Instead of price discount, Moon Kee leases the recently vacated space next to it so as to increase to 60 customers at one time, but requires an extra rental fee of $50,000 a month, and investment in decoration and new utility of $1,800,000, which will be depreciated in 5 years. Should Moon Kee accept this expansion plan? (f) Should Moon Kee apply both strategies simultaneously? (g) Evaluate the operating risk of two proposals.

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Moon Kees Pro Forma PL and Expansion Analysis a Monthly Pro Forma PL with Contribution Margin Approach Item Current With 10 Discount With Expansion Sa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started