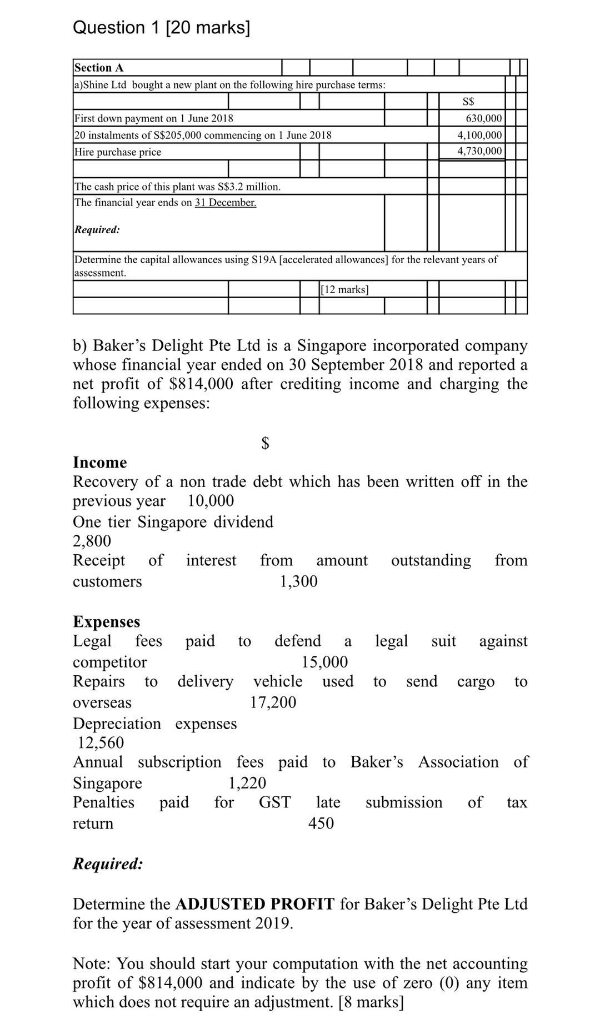

Question 1 (20 marks] Section A a)Shine Ltd bought a new plant on the following hire purchase terms First down payment on 1 June 2018 20 instalments of S$205,000 commencing on 1 June 2018 Hire purchase price S$ 630,000 4.100.000 4.730.000 The cash price of this plant was S$3.2 million. The financial year ends on 31 December. Required: Determine the capital allowances using S19A (accelerated allowances) for the relevant years of assessment (12 marks] b) Baker's Delight Pte Ltd is a Singapore incorporated company whose financial year ended on 30 September 2018 and reported a net profit of $814,000 after crediting income and charging the following expenses: $ Income Recovery of a non trade debt which has been written off in the previous year 10,000 One tier Singapore dividend 2,800 Receipt of interest from amount outstanding from customers 1,300 Expenses Legal fees paid to defend legal suit against competitor 15,000 Repairs to delivery vehicle used to send cargo to Overseas 17,200 Depreciation expenses 12,560 Annual subscription fees paid to Baker's Association of Singapore 1,220 Penalties paid for GST late submission of tax return 450 Required: Determine the ADJUSTED PROFIT for Baker's Delight Pte Ltd for the year of assessment 2019. Note: You should start your computation with the net accounting profit of $814,000 and indicate by the use of zero (0) any item which does not require an adjustment. [8 marks] Question 1 (20 marks] Section A a)Shine Ltd bought a new plant on the following hire purchase terms First down payment on 1 June 2018 20 instalments of S$205,000 commencing on 1 June 2018 Hire purchase price S$ 630,000 4.100.000 4.730.000 The cash price of this plant was S$3.2 million. The financial year ends on 31 December. Required: Determine the capital allowances using S19A (accelerated allowances) for the relevant years of assessment (12 marks] b) Baker's Delight Pte Ltd is a Singapore incorporated company whose financial year ended on 30 September 2018 and reported a net profit of $814,000 after crediting income and charging the following expenses: $ Income Recovery of a non trade debt which has been written off in the previous year 10,000 One tier Singapore dividend 2,800 Receipt of interest from amount outstanding from customers 1,300 Expenses Legal fees paid to defend legal suit against competitor 15,000 Repairs to delivery vehicle used to send cargo to Overseas 17,200 Depreciation expenses 12,560 Annual subscription fees paid to Baker's Association of Singapore 1,220 Penalties paid for GST late submission of tax return 450 Required: Determine the ADJUSTED PROFIT for Baker's Delight Pte Ltd for the year of assessment 2019. Note: You should start your computation with the net accounting profit of $814,000 and indicate by the use of zero (0) any item which does not require an adjustment. [8 marks]