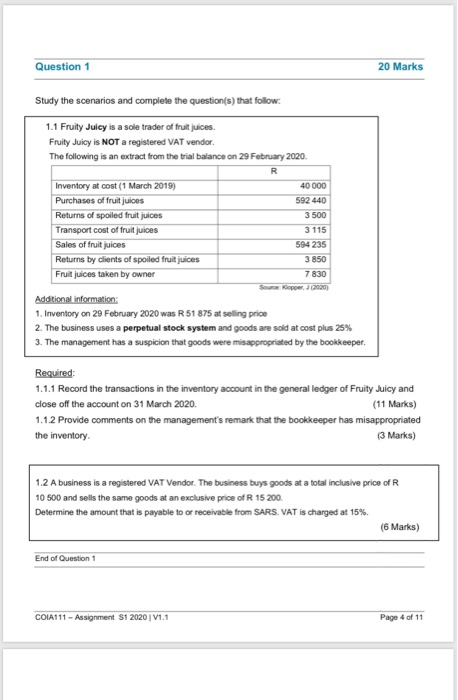

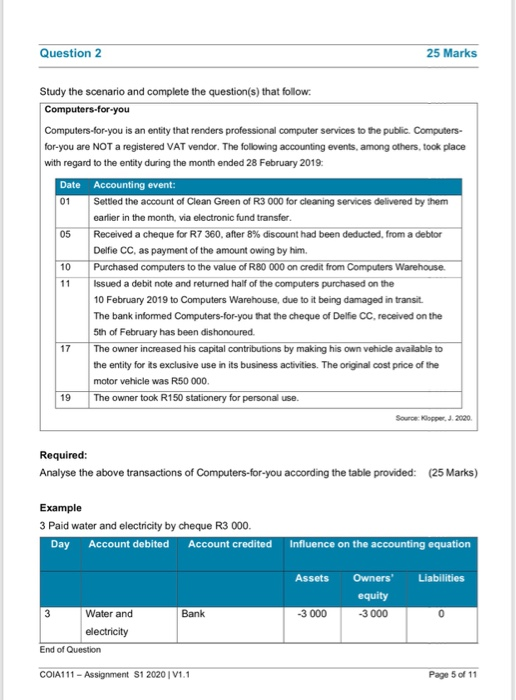

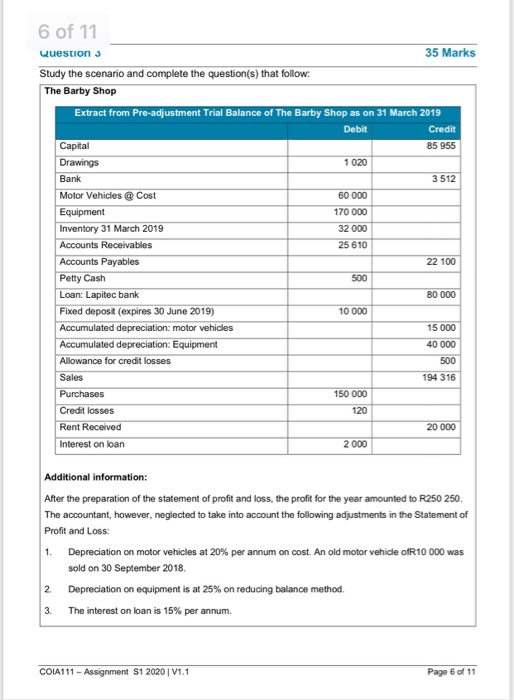

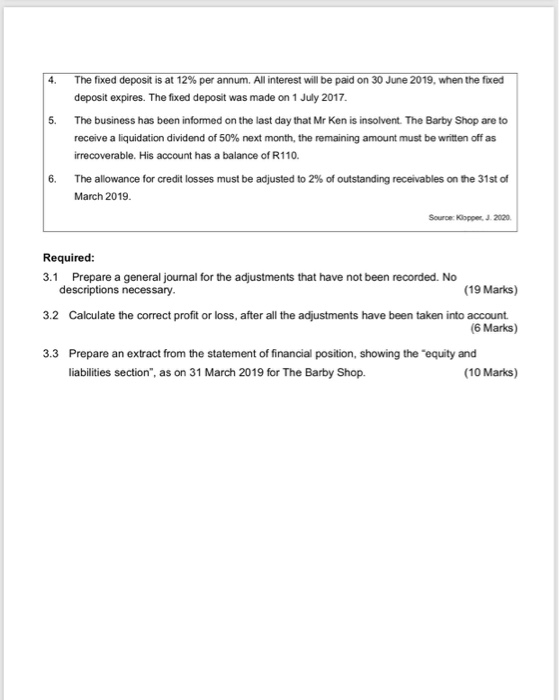

Question 1 20 Marks Study the scenarios and complete the question(s) that follow 1.1 Fruity Juicy is a sole trader of fruit juices. Fruity Juicy is NOT a registered VAT vendor The following is an extract from the trial balance on 29 February 2020. Inventory at cost (1 March 2019) Purchases of fruit juices Returns of spoiled fruit juices Transport cost of fruit juices Sales of fruit juices Returns by clients of spoiled fruit juices Fruit juices taken by owner R 40 000 592 440 3 500 3 115 594 235 3850 7830 Source per 2000 Additional information: 1. Inventory on 29 February 2020 was R51875 at selling price 2. The business uses a perpetual stock system and goods are sold at cost plus 25% 3. The management has a suspicion that goods were misappropriated by the bookkeeper. Required: 1.1.1 Record the transactions in the inventory account in the general ledger of Fruity Juicy and close off the account on 31 March 2020 (11 Marks) 1.1.2 Provide comments on the management's remark that the bookkeeper has misappropriated the inventory (3 Marks) 1.2 A business is a registered VAT Vendor. The business buys goods at a total inclusive price of R 10 500 and sells the same goods at an exclusive price of R 15 200. Determine the amount that is payable to or receivable from SARS. VAT is charged at 15%. (6 Marks) End of Question 1 COIA111- Assignment S1 2020 V1.1 Page 4 of 11 Question 2 25 Marks 01 05 Study the scenario and complete the question(s) that follow. Computers-for-you Computers-for-you is an entity that renders professional computer services to the public. Computers- for-you are NOT a registered VAT vendor. The following accounting events, among others, took place with regard to the entity during the month ended 28 February 2019: Date Accounting event: Settled the account of Clean Green of R3 000 for cleaning services delivered by them earlier in the month, via electronic fund transfer. Received a cheque for R7 360, after 8% discount had been deducted from a debtor Delfie CC, as payment of the amount owing by him. Purchased computers to the value of R80 000 on credit from Computers Warehouse. Issued a debit note and returned half of the computers purchased on the 10 February 2019 to Computers Warehouse, due to it being damaged in transit. The bank informed Computers-for-you that the cheque of Delfie CC, received on the 5th of February has been dishonoured. The owner increased his capital contributions by making his own vehicle available to the entity for its exclusive use in its business activities. The original cost price of the motor vehicle was R50 000 The owner took R150 stationery for personal use. Source: Kopper, 1.2000 10 11 17 19 Required: Analyse the above transactions of Computers-for-you according the table provided: (25 Marks) Example 3 Paid water and electricity by cheque R3 000. Day Account debited Account credited Influence on the accounting equation Assets Liabilities Owners' equity -3000 Bank -3000 0 Water and electricity End of Question COIA111 - Assignment S1 2020 V1.1 Page 5 of 11 6 of 11 Question 3 35 Marks Study the scenario and complete the question(s) that follow: The Barby Shop Extract from Pre-adjustment Trial Balance of The Barby Shop as on 31 March 2019 Debit Credit Capital 85 955 Drawings 1 020 Bank 3512 Motor Vehicles @ Cost 60 000 Equipment 170 000 Inventory 31 March 2019 32 000 Accounts Receivables 25 610 Accounts Payables 22 100 Petty Cash 500 Loan: Lapitec bank 80 000 Fixed deposit (expires 30 June 2019) 10 000 Accumulated depreciation: motor vehicles 15 000 Accumulated depreciation Equipment 40 000 Allowance for credit losses 500 Sales 194 316 Purchases 150 000 Credit losses 120 Rent Received 20 000 Interest on loan 2 000 Additional information: After the preparation of the statement of profit and loss, the profit for the year amounted to R250 250. The accountant, however, neglected to take into account the following adjustments in the Statement of Profit and Loss: 1. Depreciation on motor vehicles at 20% per annum on cost. An old motor vehicle of R10 000 was sold on 30 September 2018 2 Depreciation on equipment is at 25% on reducing balance method. The interest on loan is 15% per annum. 3 COLA111 - Assignment S1 2020 | V1.1 Page 6 of 11 4 5. The fixed deposit is at 12% per annum. All interest will be paid on 30 June 2019, when the fixed deposit expires. The fixed deposit was made on 1 July 2017. The business has been informed on the last day that Mr Ken is insolvent. The Barby Shop are to receive a liquidation dividend of 50% next month, the remaining amount must be written off as irrecoverable. His account has a balance of R110. 6. The allowance for credit losses must be adjusted to 2% of outstanding receivables on the 31st of March 2019. Source: Klopper. 1.2020 Required: 3.1 Prepare a general journal for the adjustments that have not been recorded. No descriptions necessary (19 Marks) 3.2 Calculate the correct profit or loss, after all the adjustments have been taken into account. (6 Marks) 3.3 Prepare an extract from the statement of financial position, showing the equity and liabilities section", as on 31 March 2019 for The Barby Shop. (10 Marks) Question 1 20 Marks Study the scenarios and complete the question(s) that follow 1.1 Fruity Juicy is a sole trader of fruit juices. Fruity Juicy is NOT a registered VAT vendor The following is an extract from the trial balance on 29 February 2020. Inventory at cost (1 March 2019) Purchases of fruit juices Returns of spoiled fruit juices Transport cost of fruit juices Sales of fruit juices Returns by clients of spoiled fruit juices Fruit juices taken by owner R 40 000 592 440 3 500 3 115 594 235 3850 7830 Source per 2000 Additional information: 1. Inventory on 29 February 2020 was R51875 at selling price 2. The business uses a perpetual stock system and goods are sold at cost plus 25% 3. The management has a suspicion that goods were misappropriated by the bookkeeper. Required: 1.1.1 Record the transactions in the inventory account in the general ledger of Fruity Juicy and close off the account on 31 March 2020 (11 Marks) 1.1.2 Provide comments on the management's remark that the bookkeeper has misappropriated the inventory (3 Marks) 1.2 A business is a registered VAT Vendor. The business buys goods at a total inclusive price of R 10 500 and sells the same goods at an exclusive price of R 15 200. Determine the amount that is payable to or receivable from SARS. VAT is charged at 15%. (6 Marks) End of Question 1 COIA111- Assignment S1 2020 V1.1 Page 4 of 11 Question 2 25 Marks 01 05 Study the scenario and complete the question(s) that follow. Computers-for-you Computers-for-you is an entity that renders professional computer services to the public. Computers- for-you are NOT a registered VAT vendor. The following accounting events, among others, took place with regard to the entity during the month ended 28 February 2019: Date Accounting event: Settled the account of Clean Green of R3 000 for cleaning services delivered by them earlier in the month, via electronic fund transfer. Received a cheque for R7 360, after 8% discount had been deducted from a debtor Delfie CC, as payment of the amount owing by him. Purchased computers to the value of R80 000 on credit from Computers Warehouse. Issued a debit note and returned half of the computers purchased on the 10 February 2019 to Computers Warehouse, due to it being damaged in transit. The bank informed Computers-for-you that the cheque of Delfie CC, received on the 5th of February has been dishonoured. The owner increased his capital contributions by making his own vehicle available to the entity for its exclusive use in its business activities. The original cost price of the motor vehicle was R50 000 The owner took R150 stationery for personal use. Source: Kopper, 1.2000 10 11 17 19 Required: Analyse the above transactions of Computers-for-you according the table provided: (25 Marks) Example 3 Paid water and electricity by cheque R3 000. Day Account debited Account credited Influence on the accounting equation Assets Liabilities Owners' equity -3000 Bank -3000 0 Water and electricity End of Question COIA111 - Assignment S1 2020 V1.1 Page 5 of 11 6 of 11 Question 3 35 Marks Study the scenario and complete the question(s) that follow: The Barby Shop Extract from Pre-adjustment Trial Balance of The Barby Shop as on 31 March 2019 Debit Credit Capital 85 955 Drawings 1 020 Bank 3512 Motor Vehicles @ Cost 60 000 Equipment 170 000 Inventory 31 March 2019 32 000 Accounts Receivables 25 610 Accounts Payables 22 100 Petty Cash 500 Loan: Lapitec bank 80 000 Fixed deposit (expires 30 June 2019) 10 000 Accumulated depreciation: motor vehicles 15 000 Accumulated depreciation Equipment 40 000 Allowance for credit losses 500 Sales 194 316 Purchases 150 000 Credit losses 120 Rent Received 20 000 Interest on loan 2 000 Additional information: After the preparation of the statement of profit and loss, the profit for the year amounted to R250 250. The accountant, however, neglected to take into account the following adjustments in the Statement of Profit and Loss: 1. Depreciation on motor vehicles at 20% per annum on cost. An old motor vehicle of R10 000 was sold on 30 September 2018 2 Depreciation on equipment is at 25% on reducing balance method. The interest on loan is 15% per annum. 3 COLA111 - Assignment S1 2020 | V1.1 Page 6 of 11 4 5. The fixed deposit is at 12% per annum. All interest will be paid on 30 June 2019, when the fixed deposit expires. The fixed deposit was made on 1 July 2017. The business has been informed on the last day that Mr Ken is insolvent. The Barby Shop are to receive a liquidation dividend of 50% next month, the remaining amount must be written off as irrecoverable. His account has a balance of R110. 6. The allowance for credit losses must be adjusted to 2% of outstanding receivables on the 31st of March 2019. Source: Klopper. 1.2020 Required: 3.1 Prepare a general journal for the adjustments that have not been recorded. No descriptions necessary (19 Marks) 3.2 Calculate the correct profit or loss, after all the adjustments have been taken into account. (6 Marks) 3.3 Prepare an extract from the statement of financial position, showing the equity and liabilities section", as on 31 March 2019 for The Barby Shop. (10 Marks)