Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1 (20 MARKS) Suppose in March 2018, the April crude palm oil futures contract is trading at RM1,255 while the May contract is trading

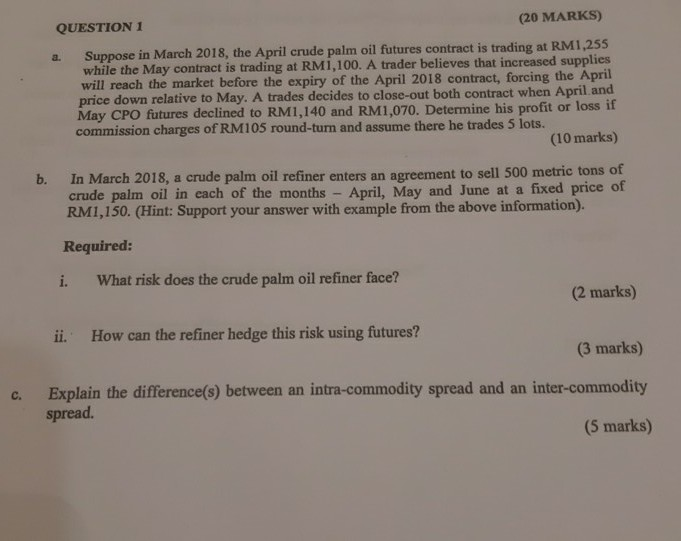

QUESTION 1 (20 MARKS) Suppose in March 2018, the April crude palm oil futures contract is trading at RM1,255 while the May contract is trading at RM1,100. A trader believes that increased supplies will reach the market before the expiry of the April 2018 contract, forcing the April price down relative to May. A trades decides to close-out both contract when April and May CPO futures declined to RM1,140 and RM1,070. Determine his profit or loss if commission charges of RM105 round-turn and assume there he trades 5 lots. (10 marks) b. In March 2018, a crude palm oil refiner enters an agreement to sell 500 metric tons of crude palm oil in each of the months - April, May and June at a fixed price of RM1,150. (Hint: Support your answer with example from the above information). Required: i. What risk does the crude palm oil refiner face? (2 marks) ii. How can the refiner hedge this risk using futures? (3 marks) C. Explain the difference(s) between an intra-commodity spread and an inter-commodity spread

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started