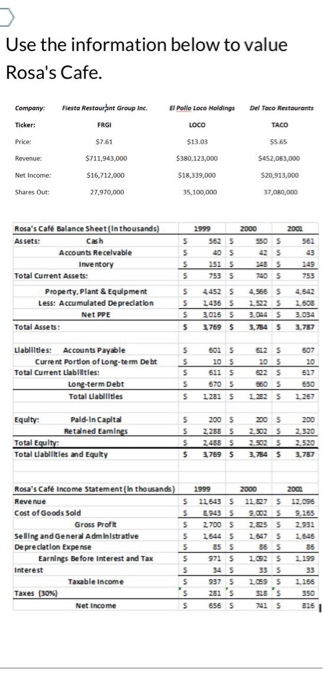

Use the information below to value Rosa's Cafe. Company: Ticker: Flesto Restaurant Group Ine. FRGI Del Taco Restaurants TACO Price: Pollo Loco Holdings LOCO $13.00 $380,123,000 $18,339,000 55.65 S452,083,000 57.61 $711,943,000 516,712,000 27,970,000 Revenues Net Income $20.913,000 Shares Out: 35,100,000 37,000,000 Rosa's Cafe Balance Sheet(In thousands) Assets: Accounts Recevable Inventory Total Current Assets Property. Plant & Equipment Less: Accumulated Deprecation Net PPE Total Assets: 5 5 $ 5 1999 2000 2000 5625 5505 561 405 425 1515 7535 753 4.9655 1.5225 4.542 2.500 5 5 5 $ 4452 14365 2016 5 37695 3.7845 3,787 s 607 Uabilities: Accounts Payable Current Portion of long-term Debt Total Current Liabilities: Long-term Debt Total Ulabilities 5 5 6015 305 511 5 670 $ 12815 105 522 5 5605 1.2525 517 650 1.267 $ 200 2005 22555 Equity: Pald-In Capital Retained tamings Total Equity Total Ulabilities and Equity 5 $ 5 $ 2005 2.5025 2.5025 3.7845 2.520 3.787 17595 Rosa's Caf Income Statement (In thousands) Revenue $ Cost of Goods Sold s Gross Profit 5 Selling and General Administrative Depreciation Expense 5 Earnings Before Interest and Tax 5 Interest 5 Taxable income 5 Taxes (30%) 's Net Income 5 1999 2000 2001 115435 12.095 9.365 2.700 5 2.525 5 26445 $ 1.646 855 86 5 85 9715 1.025 1.199 34 5 33 5 9375 1.0595 1.166 2015 6565 3151 Use the information below to value Rosa's Cafe. Company: Ticker: Flesto Restaurant Group Ine. FRGI Del Taco Restaurants TACO Price: Pollo Loco Holdings LOCO $13.00 $380,123,000 $18,339,000 55.65 S452,083,000 57.61 $711,943,000 516,712,000 27,970,000 Revenues Net Income $20.913,000 Shares Out: 35,100,000 37,000,000 Rosa's Cafe Balance Sheet(In thousands) Assets: Accounts Recevable Inventory Total Current Assets Property. Plant & Equipment Less: Accumulated Deprecation Net PPE Total Assets: 5 5 $ 5 1999 2000 2000 5625 5505 561 405 425 1515 7535 753 4.9655 1.5225 4.542 2.500 5 5 5 $ 4452 14365 2016 5 37695 3.7845 3,787 s 607 Uabilities: Accounts Payable Current Portion of long-term Debt Total Current Liabilities: Long-term Debt Total Ulabilities 5 5 6015 305 511 5 670 $ 12815 105 522 5 5605 1.2525 517 650 1.267 $ 200 2005 22555 Equity: Pald-In Capital Retained tamings Total Equity Total Ulabilities and Equity 5 $ 5 $ 2005 2.5025 2.5025 3.7845 2.520 3.787 17595 Rosa's Caf Income Statement (In thousands) Revenue $ Cost of Goods Sold s Gross Profit 5 Selling and General Administrative Depreciation Expense 5 Earnings Before Interest and Tax 5 Interest 5 Taxable income 5 Taxes (30%) 's Net Income 5 1999 2000 2001 115435 12.095 9.365 2.700 5 2.525 5 26445 $ 1.646 855 86 5 85 9715 1.025 1.199 34 5 33 5 9375 1.0595 1.166 2015 6565 3151