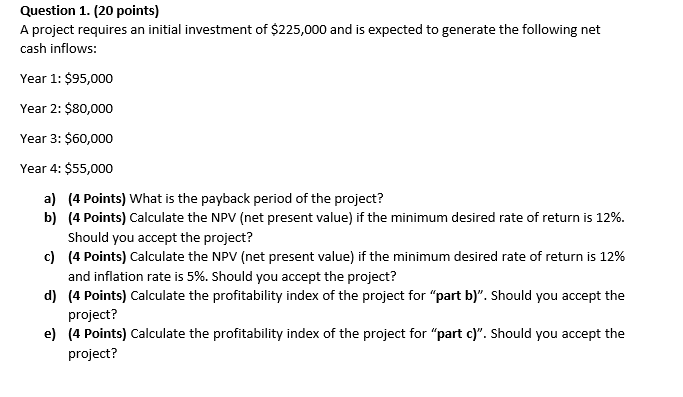

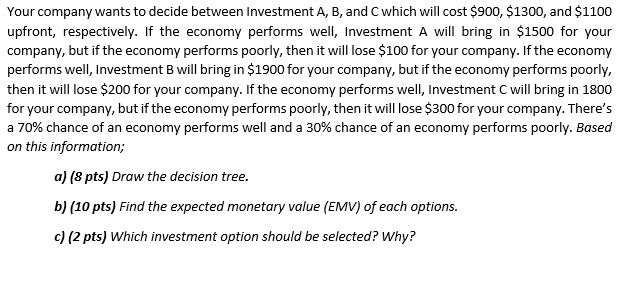

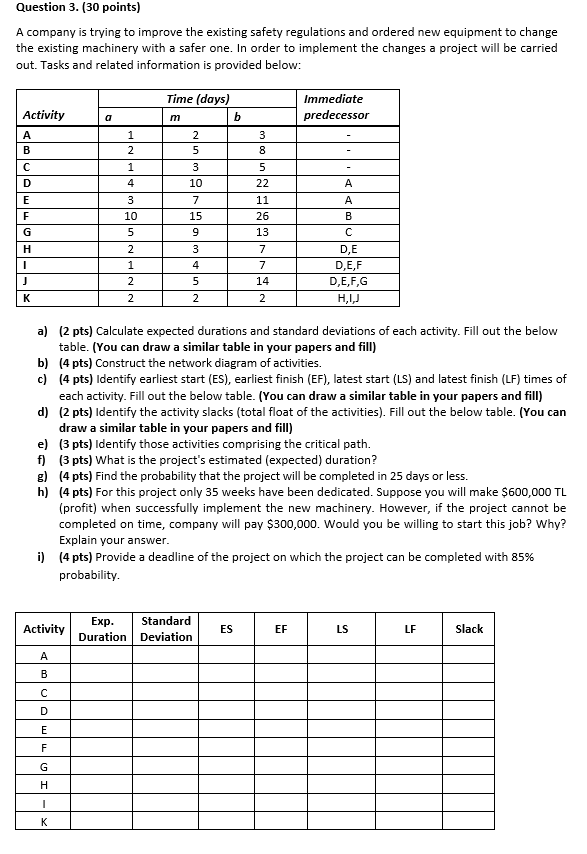

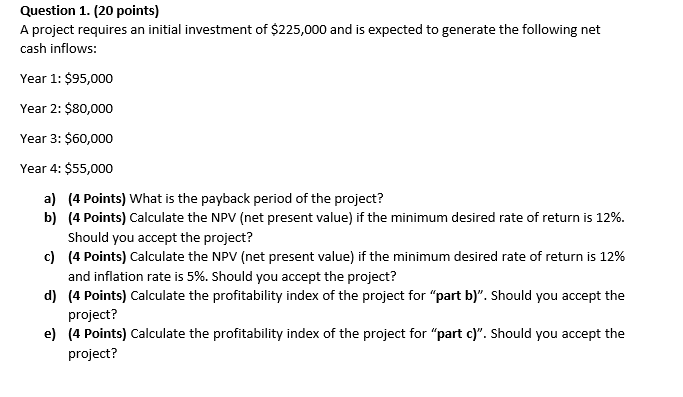

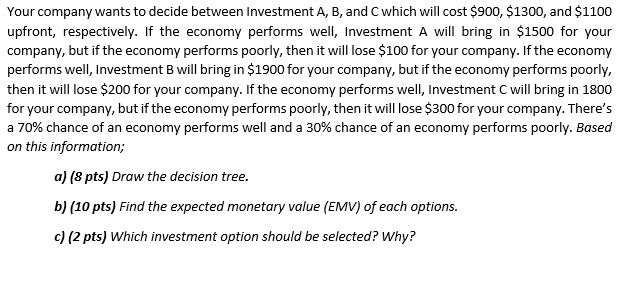

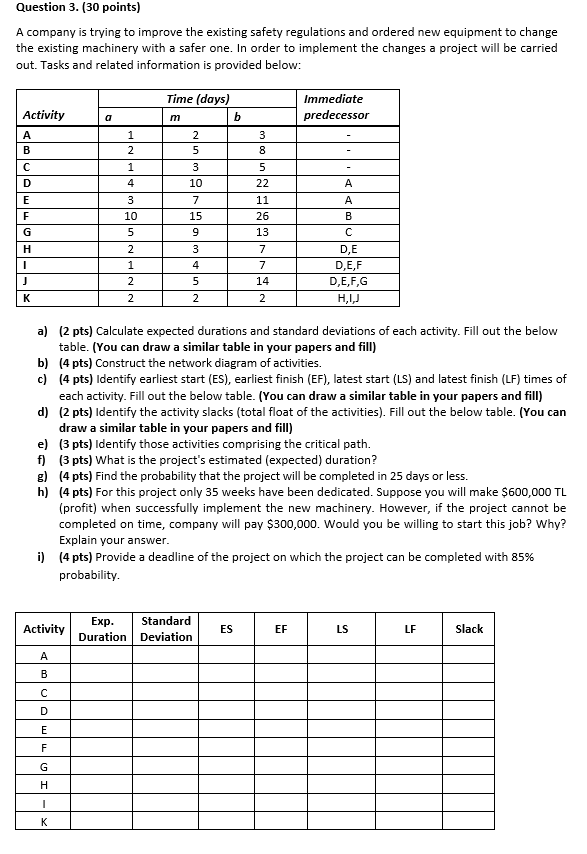

Question 1. (20 points) A project requires an initial investment of $225,000 and is expected to generate the following net cash inflows: Year 1: $95,000 Year 2: $80,000 Year 3: $60,000 Year 4: $55,000 a) (4 Points) What is the payback period of the project? b) (4 Points) Calculate the NPV (net present value) if the minimum desired rate of return is 12%. Should you accept the project? c) (4 Points) Calculate the NPV (net present value) if the minimum desired rate of return is 12% and inflation rate is 5%. Should you accept the project? d) (4 Points) Calculate the profitability index of the project for "part b)". Should you accept the project? e) (4 Points) Calculate the profitability index of the project for "part c)". Should you accept the project? Your company wants to decide between Investment A, B, and C which will cost $900, $1300, and $1100 upfront, respectively. If the economy performs well, Investment A will bring in $1500 for your company, but if the economy performs poorly, then it will lose $100 for your company. If the economy performs well, Investment B will bring in $1900 for your company, but if the economy performs poorly, then it will lose $200 for your company. If the economy performs well, Investment C will bring in 1800 for your company, but if the economy performs poorly, then it will lose $300 for your company. There's a 70% chance of an economy performs well and a 30% chance of an economy performs poorly. Based on this information; a) (8 pts) Draw the decision tree. b) (10 pts) Find the expected monetary value (EMV) of each options. c) (2 pts) Which investment option should be selected? Why? Question 3. (30 points) A company is trying to improve the existing safety regulations and ordered new equipment to change the existing machinery with a safer one. In order to implement the changes a project will be carried out. Tasks and related information is provided below: Time (days) b Immediate predecessor a m 1 2 1 4 Activity A B D E F G H I J K 2 5 3 10 7 15 9 3 10 5 3 8 5 22 11 26 13 7 7 14 A A B DE D,E,F D,E,F,G , 2 3 1 4 2 2 5 2 2 a) (2 pts) Calculate expected durations and standard deviations of each activity. Fill out the below table. (You can draw a similar table in your papers and fill) b) (4 pts) Construct the network diagram of activities. c) (4 pts) Identify earliest start (ES), earliest finish (EF), latest start (LS) and latest finish (LF) times of each activity. Fill out the below table. (You can draw a similar table in your papers and fill) d) (2 pts) Identify the activity slacks (total float of the activities). Fill out the below table. (You can draw a similar table in your papers and fill) e) (3 pts) Identify those activities comprising the critical path. f) (3 pts) What is the project's estimated (expected) duration? g) (4 pts) Find the probability that the project will be completed in 25 days or less. h) (4 pts) For this project only 35 weeks have been dedicated. Suppose you will make $600,000 TL (profit) when successfully implement the new machinery. However, if the project cannot be completed on time, company will pay $300,000. Would you be willing to start this job? Why? Explain your answer. i) (4 pts) Provide a deadline of the project on which the project can be completed with 85% probability. Activity Exp. Standard Duration Deviation ES EF LS LF Slack A B C D E F G H I K Question 1. (20 points) A project requires an initial investment of $225,000 and is expected to generate the following net cash inflows: Year 1: $95,000 Year 2: $80,000 Year 3: $60,000 Year 4: $55,000 a) (4 Points) What is the payback period of the project? b) (4 Points) Calculate the NPV (net present value) if the minimum desired rate of return is 12%. Should you accept the project? c) (4 Points) Calculate the NPV (net present value) if the minimum desired rate of return is 12% and inflation rate is 5%. Should you accept the project? d) (4 Points) Calculate the profitability index of the project for "part b)". Should you accept the project? e) (4 Points) Calculate the profitability index of the project for "part c)". Should you accept the project? Your company wants to decide between Investment A, B, and C which will cost $900, $1300, and $1100 upfront, respectively. If the economy performs well, Investment A will bring in $1500 for your company, but if the economy performs poorly, then it will lose $100 for your company. If the economy performs well, Investment B will bring in $1900 for your company, but if the economy performs poorly, then it will lose $200 for your company. If the economy performs well, Investment C will bring in 1800 for your company, but if the economy performs poorly, then it will lose $300 for your company. There's a 70% chance of an economy performs well and a 30% chance of an economy performs poorly. Based on this information; a) (8 pts) Draw the decision tree. b) (10 pts) Find the expected monetary value (EMV) of each options. c) (2 pts) Which investment option should be selected? Why? Question 3. (30 points) A company is trying to improve the existing safety regulations and ordered new equipment to change the existing machinery with a safer one. In order to implement the changes a project will be carried out. Tasks and related information is provided below: Time (days) b Immediate predecessor a m 1 2 1 4 Activity A B D E F G H I J K 2 5 3 10 7 15 9 3 10 5 3 8 5 22 11 26 13 7 7 14 A A B DE D,E,F D,E,F,G , 2 3 1 4 2 2 5 2 2 a) (2 pts) Calculate expected durations and standard deviations of each activity. Fill out the below table. (You can draw a similar table in your papers and fill) b) (4 pts) Construct the network diagram of activities. c) (4 pts) Identify earliest start (ES), earliest finish (EF), latest start (LS) and latest finish (LF) times of each activity. Fill out the below table. (You can draw a similar table in your papers and fill) d) (2 pts) Identify the activity slacks (total float of the activities). Fill out the below table. (You can draw a similar table in your papers and fill) e) (3 pts) Identify those activities comprising the critical path. f) (3 pts) What is the project's estimated (expected) duration? g) (4 pts) Find the probability that the project will be completed in 25 days or less. h) (4 pts) For this project only 35 weeks have been dedicated. Suppose you will make $600,000 TL (profit) when successfully implement the new machinery. However, if the project cannot be completed on time, company will pay $300,000. Would you be willing to start this job? Why? Explain your answer. i) (4 pts) Provide a deadline of the project on which the project can be completed with 85% probability. Activity Exp. Standard Duration Deviation ES EF LS LF Slack A B C D E F G H I K