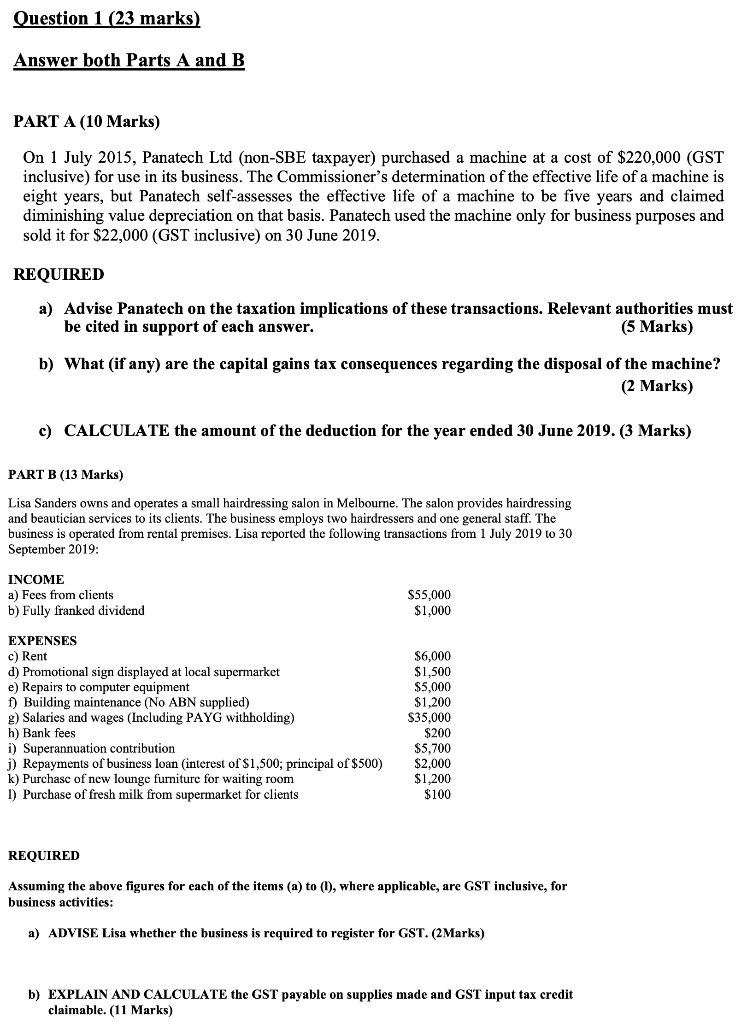

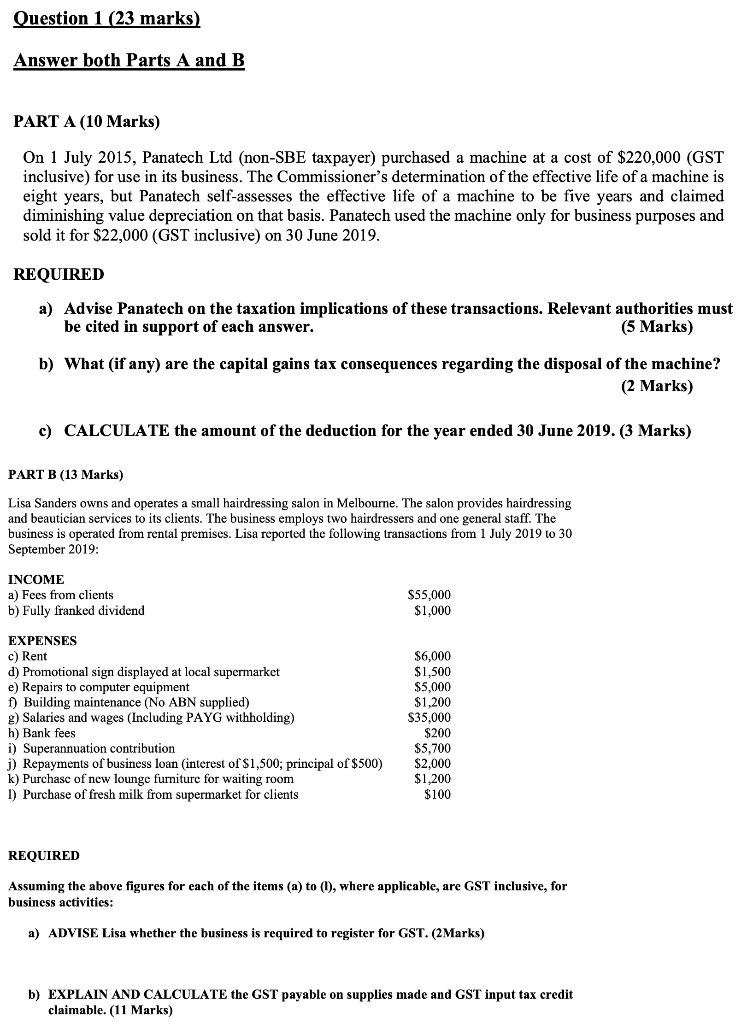

Question 1 (23 marks) Answer both Parts A and B PART A (10 Marks) On 1 July 2015, Panatech Ltd (non-SBE taxpayer) purchased a machine at a cost of $220,000 (GST inclusive) for use in its business. The Commissioner's determination of the effective life of a machine is eight years, but Panatech self-assesses the effective life of a machine to be five years and claimed diminishing value depreciation on that basis. Panatech used the machine only for business purposes and sold it for $22,000 (GST inclusive) on 30 June 2019. REQUIRED a) Advise Panatech on the taxation implications of these transactions. Relevant authorities must be cited in support of each answer. (5 Marks) b) What (if any) are the capital gains tax consequences regarding the disposal of the machine? (2 Marks) c) CALCULATE the amount of the deduction for the year ended 30 June 2019. (3 Marks) PART B (13 Marks) Lisa Sanders owns and operates a small hairdressing salon in Melbourne. The salon provides hairdressing and beautician services to its clients. The business employs two hairdressers and one general staff. The business is operated from rental premises. Lisa reported the following transactions from 1 July 2019 to 30 September 2019: INCOME a) Fees from clients b) Fully franked dividend $55,000 $1,000 EXPENSES c) Rent d) Promotional sign displayed at local supermarket e) Repairs to computer equipment f) Building maintenance (No ABN supplied) g) Salaries and wages (Including PAYG withholding) h) Bank fees i) Superannuation contribution j) Repayments of business loan interest of $1,500; principal of $500) k) Purchase of new lounge furniture for waiting room 1) Purchase of fresh milk from supermarket for clients $6,000 $1,500 $5,000 $1,200 $35,000 $200 $5,700 $2.000 $1.200 $100 REQUIRED Assuming the above figures for each of the items (a) to (), where applicable, are GST inclusive, for business activities: a) ADVISE Lisa whether the business is required to register for GST. (2Marks) b) EXPLAIN AND CALCULATE the GST payable on supplies made and GST input tax credit claimable. (11 Marks) Question 1 (23 marks) Answer both Parts A and B PART A (10 Marks) On 1 July 2015, Panatech Ltd (non-SBE taxpayer) purchased a machine at a cost of $220,000 (GST inclusive) for use in its business. The Commissioner's determination of the effective life of a machine is eight years, but Panatech self-assesses the effective life of a machine to be five years and claimed diminishing value depreciation on that basis. Panatech used the machine only for business purposes and sold it for $22,000 (GST inclusive) on 30 June 2019. REQUIRED a) Advise Panatech on the taxation implications of these transactions. Relevant authorities must be cited in support of each answer. (5 Marks) b) What (if any) are the capital gains tax consequences regarding the disposal of the machine? (2 Marks) c) CALCULATE the amount of the deduction for the year ended 30 June 2019. (3 Marks) PART B (13 Marks) Lisa Sanders owns and operates a small hairdressing salon in Melbourne. The salon provides hairdressing and beautician services to its clients. The business employs two hairdressers and one general staff. The business is operated from rental premises. Lisa reported the following transactions from 1 July 2019 to 30 September 2019: INCOME a) Fees from clients b) Fully franked dividend $55,000 $1,000 EXPENSES c) Rent d) Promotional sign displayed at local supermarket e) Repairs to computer equipment f) Building maintenance (No ABN supplied) g) Salaries and wages (Including PAYG withholding) h) Bank fees i) Superannuation contribution j) Repayments of business loan interest of $1,500; principal of $500) k) Purchase of new lounge furniture for waiting room 1) Purchase of fresh milk from supermarket for clients $6,000 $1,500 $5,000 $1,200 $35,000 $200 $5,700 $2.000 $1.200 $100 REQUIRED Assuming the above figures for each of the items (a) to (), where applicable, are GST inclusive, for business activities: a) ADVISE Lisa whether the business is required to register for GST. (2Marks) b) EXPLAIN AND CALCULATE the GST payable on supplies made and GST input tax credit claimable. (11 Marks)