Answered step by step

Verified Expert Solution

Question

1 Approved Answer

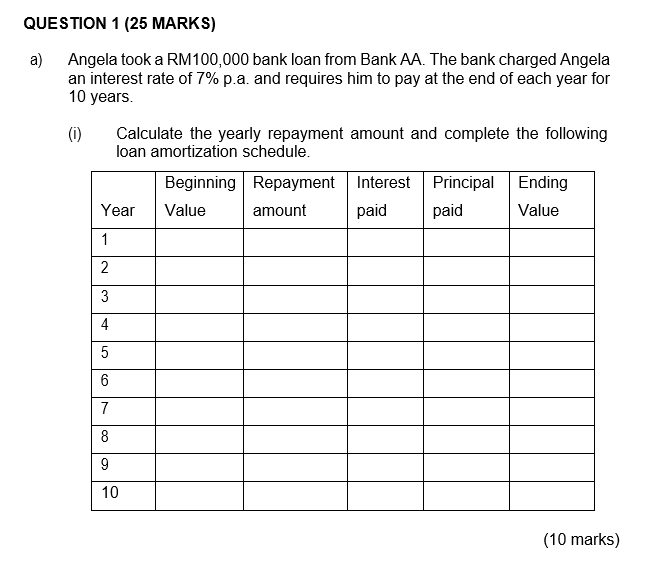

QUESTION 1 (25 MARKS) a) Angela took a RM100,000 bank loan from Bank AA. The bank charged Angela an interest rate of 7% p.a.

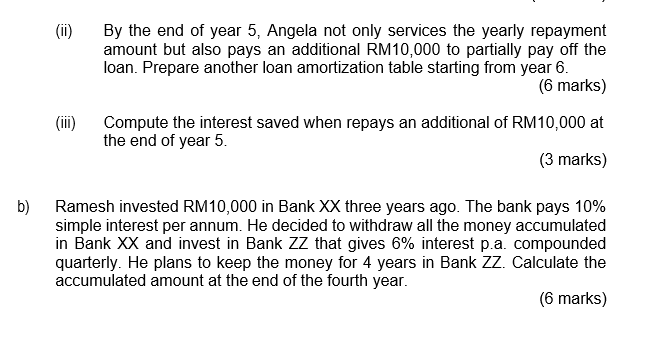

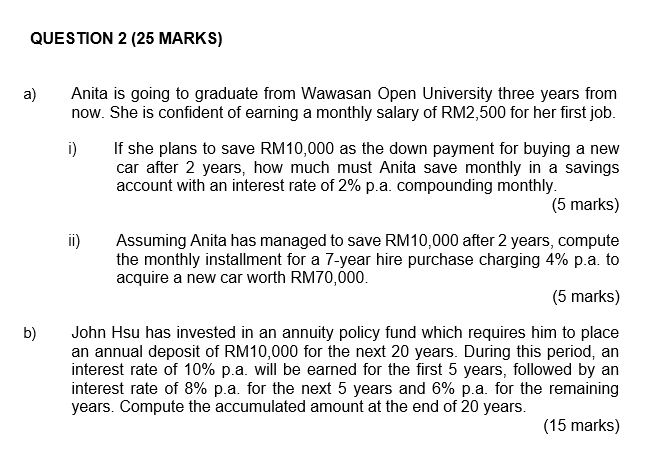

QUESTION 1 (25 MARKS) a) Angela took a RM100,000 bank loan from Bank AA. The bank charged Angela an interest rate of 7% p.a. and requires him to pay at the end of each year for 10 years. (i) Calculate the yearly repayment amount and complete the following loan amortization schedule. Beginning Repayment Year Value amount Interest paid Principal paid Ending Value 1 2 3 4 5 6 7 8 9 10 (10 marks) (ii) By the end of year 5, Angela not only services the yearly repayment amount but also pays an additional RM10,000 to partially pay off the loan. Prepare another loan amortization table starting from year 6. (6 marks) Compute the interest saved when repays an additional of RM10,000 at the end of year 5. (3 marks) b) Ramesh invested RM10,000 in Bank XX three years ago. The bank pays 10% simple interest per annum. He decided to withdraw all the money accumulated in Bank XX and invest in Bank ZZ that gives 6% interest p.a. compounded quarterly. He plans to keep the money for 4 years in Bank ZZ. Calculate the accumulated amount at the end of the fourth year. (6 marks) a) QUESTION 2 (25 MARKS) Anita is going to graduate from Wawasan Open University three years from now. She is confident of earning a monthly salary of RM2,500 for her first job. i) ii) If she plans to save RM10,000 as the down payment for buying a new car after 2 years, how much must Anita save monthly in a savings account with an interest rate of 2% p.a. compounding monthly. (5 marks) Assuming Anita has managed to save RM10,000 after 2 years, compute the monthly installment for a 7-year hire purchase charging 4% p.a. to acquire a new car worth RM70,000. (5 marks) b) John Hsu has invested in an annuity policy fund which requires him to place an annual deposit of RM10,000 for the next 20 years. During this period, an interest rate of 10% p.a. will be earned for the first 5 years, followed by an interest rate of 8% p.a. for the next 5 years and 6% p.a. for the remaining years. Compute the accumulated amount at the end of 20 years. (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started