Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 (25 marks) Asakabank enters into an interest rate swap denominated in local currency UZS. Asakabank aims to hedge its interest rate risk exposure

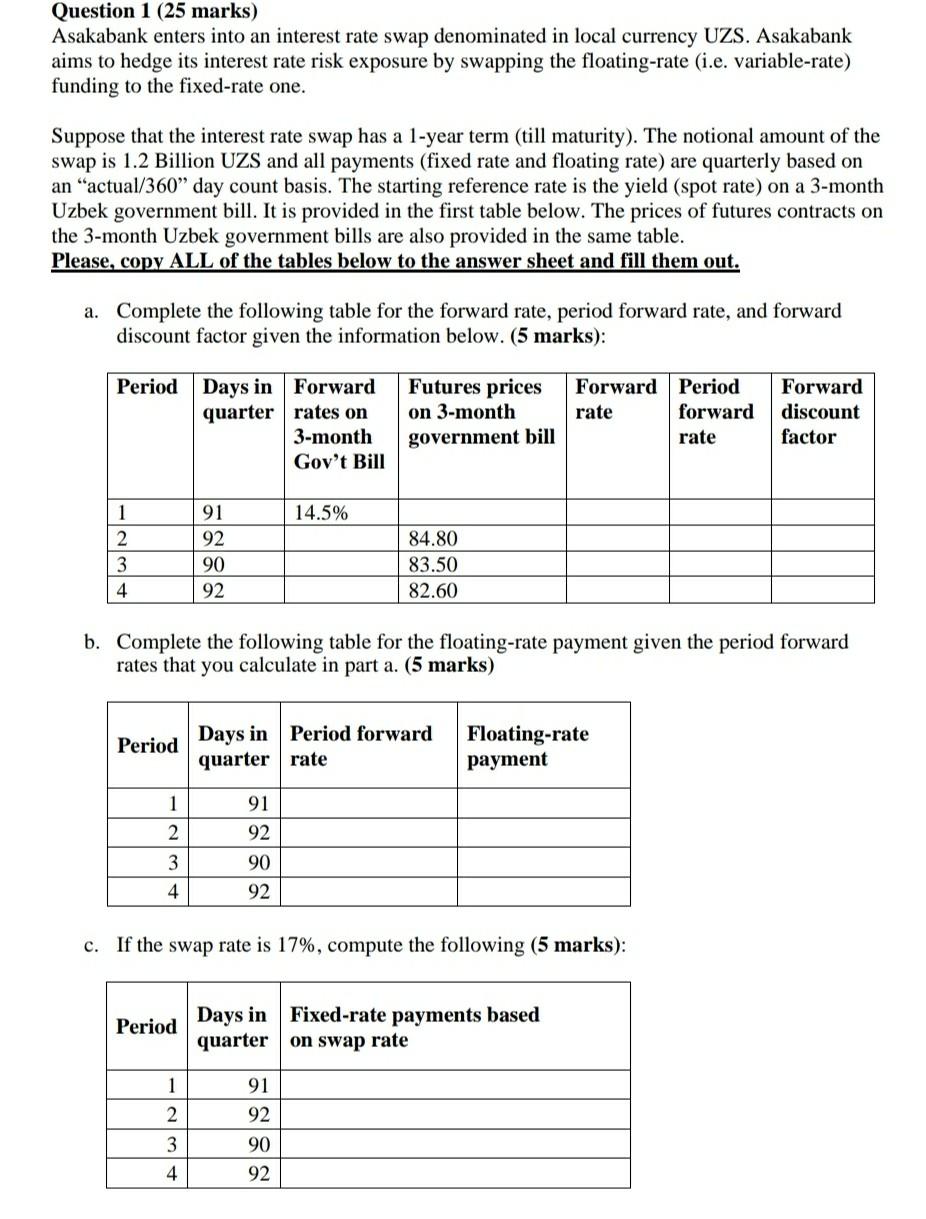

Question 1 (25 marks) Asakabank enters into an interest rate swap denominated in local currency UZS. Asakabank aims to hedge its interest rate risk exposure by swapping the floating-rate (i.e. variable-rate) funding to the fixed-rate one. Suppose that the interest rate swap has a 1-year term (till maturity). The notional amount of the swap is 1.2 Billion UZS and all payments (fixed rate and floating rate) are quarterly based on an "actual/360" day count basis. The starting reference rate is the yield (spot rate) on a 3-month Uzbek government bill. It is provided in the first table below. The prices of futures contracts on the 3-month Uzbek government bills are also provided in the same table. Please, copy ALL of the tables below to the answer sheet and fill them out. a. Complete the following table for the forward rate, period forward rate, and forward discount factor given the information below. (5 marks): Period Days in Forward rates on Futures prices on 3-month Forward Period Forward rate forward quarter discount 3-month government bill rate factor Gov't Bill 1 91 14.5% 2 92 84.80 3 90 83.50 4 92 82.60 b. Complete the following table for the floating-rate payment given the period forward rates that you calculate in part a. (5 marks) Days in Period forward Period Floating-rate payment quarter rate 1 91 2 92 3 90 4 92 c. If the swap rate is 17%, compute the following (5 marks): Period Days in Fixed-rate payments based quarter on swap rate 1 91 2 92 3 90 4 92 Question 1 (25 marks) Asakabank enters into an interest rate swap denominated in local currency UZS. Asakabank aims to hedge its interest rate risk exposure by swapping the floating-rate (i.e. variable-rate) funding to the fixed-rate one. Suppose that the interest rate swap has a 1-year term (till maturity). The notional amount of the swap is 1.2 Billion UZS and all payments (fixed rate and floating rate) are quarterly based on an "actual/360" day count basis. The starting reference rate is the yield (spot rate) on a 3-month Uzbek government bill. It is provided in the first table below. The prices of futures contracts on the 3-month Uzbek government bills are also provided in the same table. Please, copy ALL of the tables below to the answer sheet and fill them out. a. Complete the following table for the forward rate, period forward rate, and forward discount factor given the information below. (5 marks): Period Days in Forward rates on Futures prices on 3-month Forward Period Forward rate forward quarter discount 3-month government bill rate factor Gov't Bill 1 91 14.5% 2 92 84.80 3 90 83.50 4 92 82.60 b. Complete the following table for the floating-rate payment given the period forward rates that you calculate in part a. (5 marks) Days in Period forward Period Floating-rate payment quarter rate 1 91 2 92 3 90 4 92 c. If the swap rate is 17%, compute the following (5 marks): Period Days in Fixed-rate payments based quarter on swap rate 1 91 2 92 3 90 4 92

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started