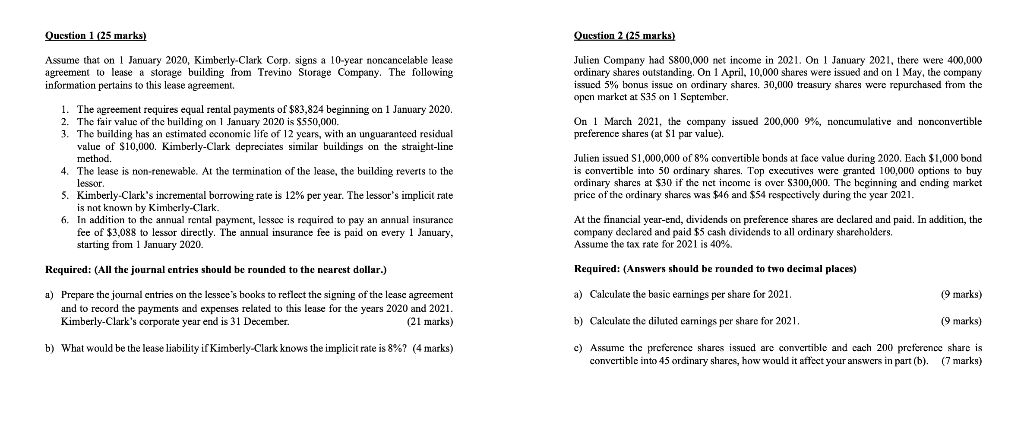

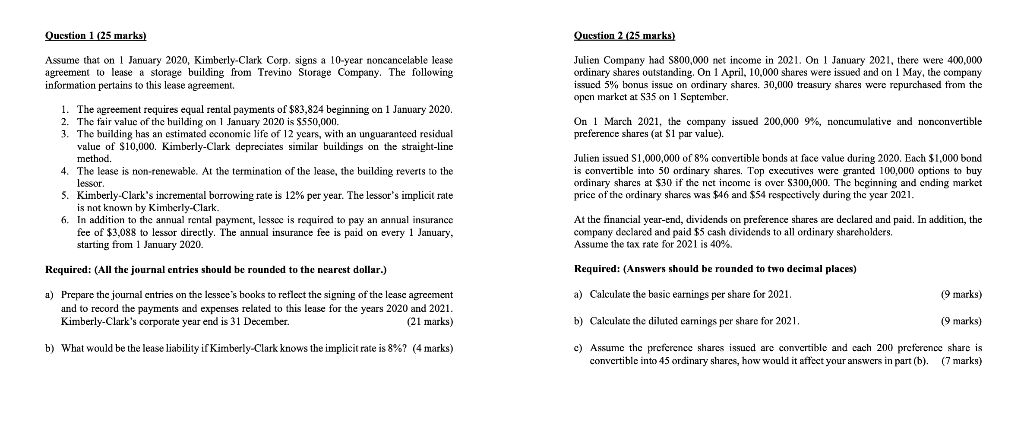

Question 1 (25 marks) Assume that on 1 January 2020, Kimberly-Clark Corp. signs a 10-year noncancelable lease agreement to lease a storage building from Trevino Storage Company. The following information pertains to this lease agreement. 1. The agreement requires equal rental payments of $83,824 beginning on 1 January 2020. 2. The fair value of the building on 1 January 2020 is $550,000 3. The building has an estimated economic life of 12 years, with an unguaranteed residual value of $10,000. Kimberly-Clark depreciates similar buildings on the straight-line method. 4. The lease is non-renewable. At the termination of the lease, the building reverts to the lessor. 5. Kimberly-Clark's incremental borrowing rate is 12% per year. The lessor's implicit rate is not known by Kimberly-Clark. 6. In addition to the annual rental payment, lessee is required to pay an annual insurance fee of $3,088 to lessor directly. The annual insurance fee is paid on every 1 January, starting from 1 January 2020. Question 2 (25 marks) Julien Company had $800,000 net income in 2021. On 1 January 2021, there were 400,000 ordinary shares outstanding. On 1 April, 10,000 shares were issued and on 1 May, the company issued 5% bonus issue on ordinary shares. 30,000 treasury shares were repurchased from the open market at $35 on 1 September. On 1 March 2021, the company issued 200.000 9%, noncumulative and nonconvertible preference shares (at $1 par value). Julien issued S1,000,000 of 8% convertible bonds at face value during 2020. Each $1,000 bond is convertiblc into 50 ordinary shares. Top executives were granted 100,000 options to buy ordinary sharcs at $30 if the net income is over $300,000. The beginning and ending market price of the ordinary shares was $46 and $54 respectively during the year 2021. At the financial year-end, dividends on preference shares are declared and paid. In addition, the company declared and paid $5 cash dividends to all ordinary shareholders. Assume the tax rate for 2021 is 40%. Required: (All the journal entries should be rounded to the nearest dollar.) Required: (Answers should be rounded to two decimal places) a) Calculate the basic earnings per share for 2021. (9 marks) a) Prepare the journal entries on the lessee's books to reflect the signing of the lease agreement and to record the payments and expenses related to this lease for the years 2020 and 2021. Kimberly-Clark's corporate year end is 31 December (21 marks) b) Calculate the diluted eamings per share for 2021, (9 marks) b) What would be the lease liability if Kimberly-Clark knows the implicitrate is 8%? (4 marks) c) Assume the preference shares issued are convertible and cach 200 preference share is convertiblc into 45 ordinary shares, how would it affect your answers in part (h). (7 marks)