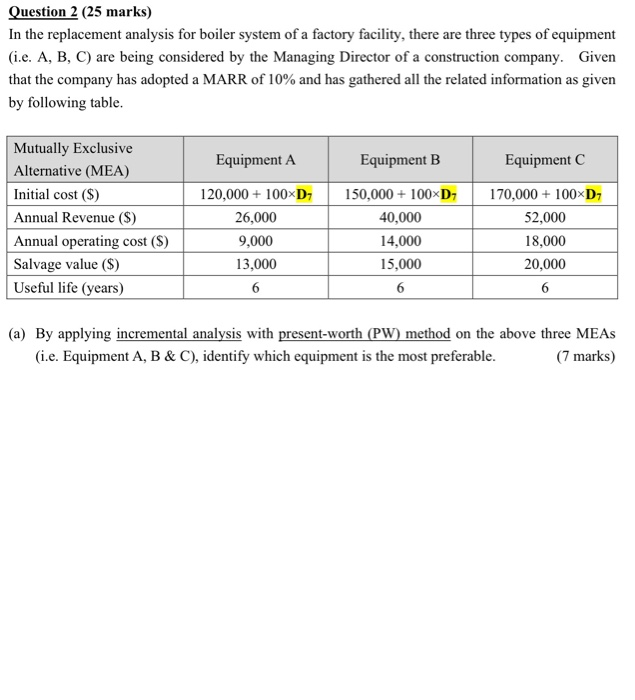

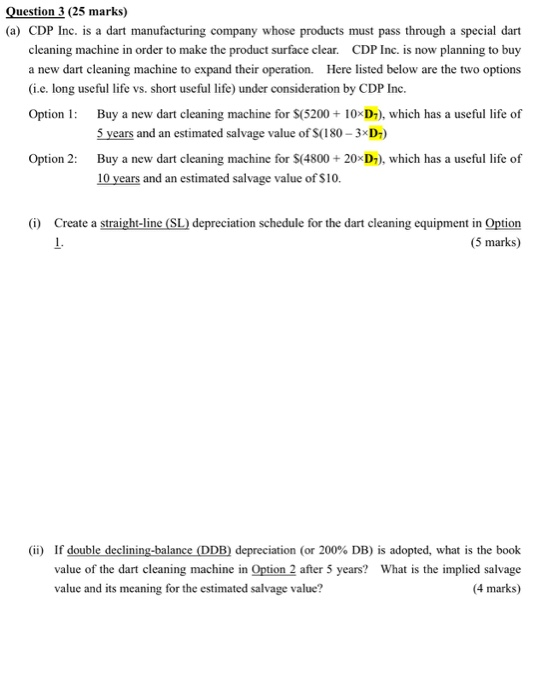

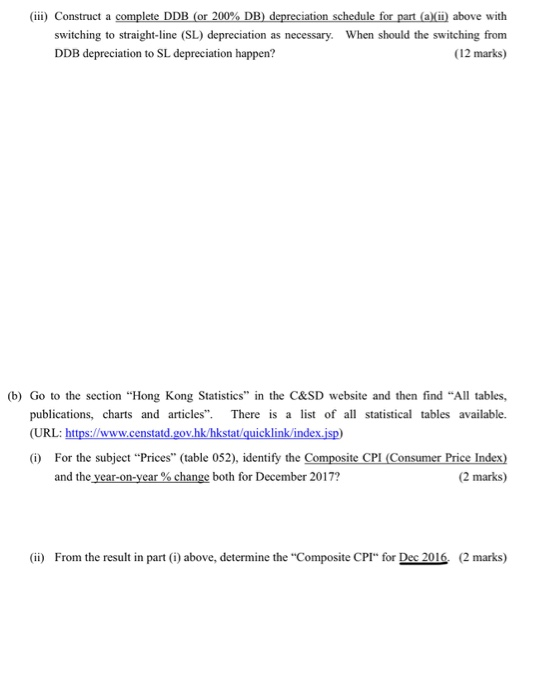

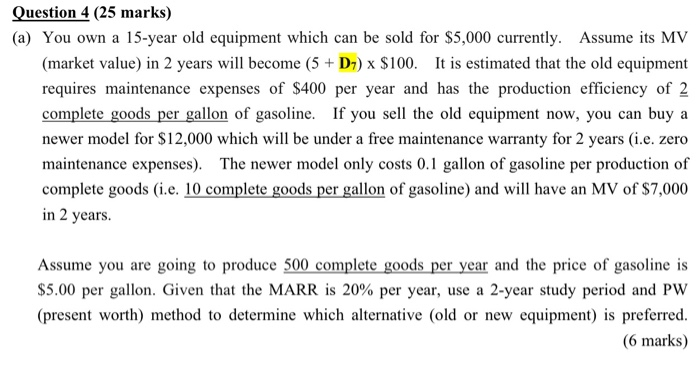

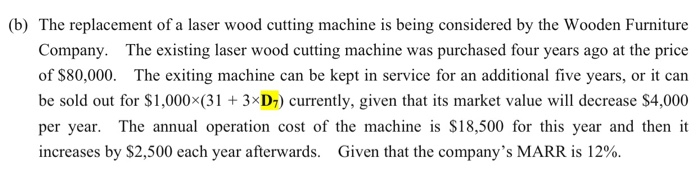

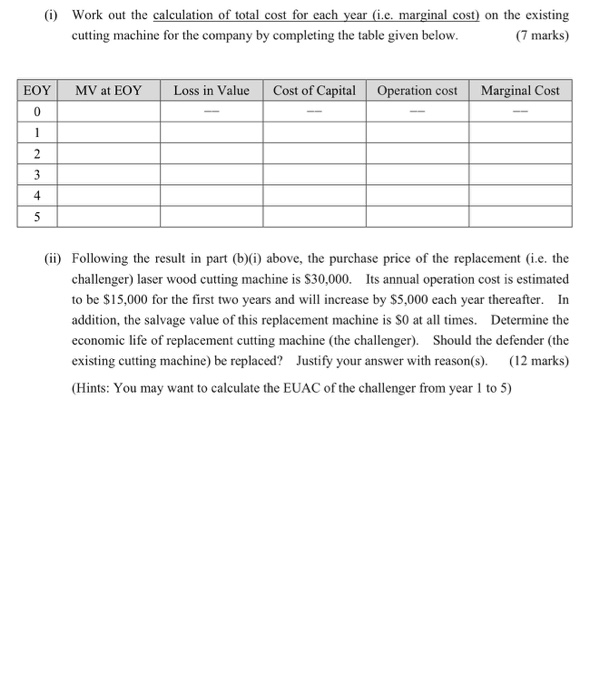

Question 1 (25 marks) D7-8 Sakura International Limited is considering to setup a new production line to produce their product - rice balls in an industry building for a 6-year contract. Harvey is the financial manager of the company, who has estimated that the total cost for purchasing rice cooking machines and packing machines is about $800,000; whereas the fitting out works (i.e. one-time installation works for the new production line) costs $7,200,000, monthly rent and electricity costs S(160,000 + 1000xD) monthly operation and maintenance (including materials, labour expenses) costs $260,000. In addition, the expected monthly revenue would be S650,000 and the company can get S120,000 back at the end of contract. Given that the company's minimum acceptable rate of return (MARR) is 12% annually. (a) Draw a cash flow diagram to indicate all the cash flows of this new production line. Clearly (3 marks) label all the key values in the diagram. (b) Use future worth (FW) method to evaluate whether this proposed production line shall be 3 marks) constructed. Justify your answer with reason(s). (c) Use annual worth (AW) method to repeat the calculation in part (b) above. Does the financial (4 marks) manager need to change his decision accordingly? (d) Determine the internal rate of return (IRR) of the new production line. (5 marks) (Hints: You may want to try2% and396 monthly rates by using linear interpolation method) (e) Given that the annual re-investing interest rate is 18%, determine the external rate of return (5 marks) (ERR) of the new production line. (f) Determine the simple payback period and the discounted payback period for the new production line. (N.B. The S120,000 getting back at the end of contract can simply be ignored (5 marks) in the calculation.) Question 2 (25 marks) In the replacement analysis for boiler system of a factory facility, there are three types of equipment (i.e. A, B, C) are being considered by the Managing Director of a construction company. Given that the company has adopted a MARR of 10% and has gathered all the related information as given by following table Mutually Exclusive Alternative (MEA) Initial cost (S) Annual Revenue (S) Annual operating cost (S) Salvage value (S) Useful life (years) Equipment A Equipment B Equipment C 120,000+100xD 150,000+ 100xD 170,000 + 100xD 26,000 9,000 13,000 40,000 14,000 15,000 52,000 18,000 20,000 (a) By applying incremental analysis with present-worth (PW) method on the above three MEAs onthe above t (i.e. Equipment A, B & C), identify which equipment is the most preferable (ie. Equipment A B&C), identify (7 marks) (b) Assume that the useful life of Equipment B is now changed to 4 years, and selection is limited to make ONLY between equipment B and equipment C (i) By applying annual-worth (AW) method and repeatability assumption, determine which (5 marks) equipment should be chosen. (ii) By applying future-worth (FW) method and co-terminated assumption with study period of (6 marks) 6 years, determine which equipment should be chosen. (ii) By applying present-worth (PW) method and repeatability assumption with study period of (7 marks) 12 years, determine which equipment shall be chosen. Question 3 (25 marks) (a) CDP Inc. is a dart manufacturing company whose products must pass through a special dart cleaning machine in order to make the product surface clear CDP Inc. is now planning to buy a new dart cleaning machine to expand their operation. Here listed below are the two options (i.c. long useful life vs. short useful life) under consideration by CDP Inc. Option Buy a new dart cleaning machine for S(5200+10D), which has a useful life of 5 years and an estimated salvage value of S(180-3D- Option 2 Buy a new dart cleaning machine for $(4800 20xD1, which has a useful life of 10 years and an estimated salvage value of S10. (i) Create a straight-line (SL) depreciation schedule for the dart cleaning equipment in Option (5 marks) If double declining-balance (DDB) depreciation (or 200% DE) is adopted, what is the book value of the dart cleaning machine in Option 2 after 5 years? What is the implied salvage value and its meaning for the estimated salvage value? (ii) 4 marks (iii) Construct a complete DDB (or 200% DB) depreciation schedule for part (a)(ii) above with switching to straight-line (SL) depreciation as necessary.When should the switching from (12 marks) DDB depreciation to SL depreciation happen? (b) Go to the section "Hong Kong Statistics" in the C&SD website and then find "All tables, publications, charts and articles". There is a list ofall statistical tables available. (i) For the subject "Prices" (table 052), identify the Composite CPI(Consumer Price Index) ) 2 marks) (URL: https://www.censtatd and the year-on-year % change both for December 2017? andthevearon-year% (i) From the result in part (i) above, determine the "Composite CPI" for Dec 2016 (2 marks) Question 4 (25 marks) (a) You own a 15-year old equipment which can be sold for $5,000 currently. Assume its MV (market value) in 2 years will become (5 + Di) x $100. It is estimated that the old equipment requires maintenance expenses of $400 per year and has the production efficiency of 2 complete goods per gallon of gasoline. If you sell the old equipment now, you can buy a maintenance expenses) The newer model only costs 0.1 gallon of gasoline per production of complete goods (i.e. 10 complete goods per gallon of gasoline) and wi have an MV of $7,000 in 2 years. Assume you are going to produce 500 complete goods per year and the price of gasoline is $5.00 per gallon. Given that the MARR is 20% per year, use a 2-year study period and PW (present worth) method to determine which alternative (old or new equipment) is preferred. (6 marks) (b) The replacement of a laser wood cutting machine is being considered by the Wooden Furniture Company. The existing laser wood cutting machine was purchased four years ago at the price of $80,000. The exiting machine can be kept in service for an additional five years, or it can be sold out for $1,000x(313xD) currently, given that its market value will decrease $4,000 per year. The annual operation cost of the machine is S18,500 for this year and then it increases by $2,500 each year afterwards. Given that the company's MARR is 12%. (i) Work out the calculation of total cost for each year (i.e. marginal cost) on the existing (7 marks) cutting machine for the company by completing the table given below. EOY 0 MV at EOY Loss in Value Cost of Capital Operation cost Marginal Cost (ii) Following the result in part (b)(i) above, the purchase price of the replacement i.e. the challenger) laser wood cutting machine is S30,000. Its annual operation cost is estimated to be $15,000 for the first two years and will increase by $5,000 each year thereafter. In addition, the salvage value of this replacement machine is S0 at all times. Determine the economic life of replacement cutting machine (the challenge Should the defender (the existing cutting machine) be replaced? Justify your answer with reason(s). (12 marks) (Hints: You may want to calculate the EUAC of the challenger from year 1 to 5) Question 1 (25 marks) D7-8 Sakura International Limited is considering to setup a new production line to produce their product - rice balls in an industry building for a 6-year contract. Harvey is the financial manager of the company, who has estimated that the total cost for purchasing rice cooking machines and packing machines is about $800,000; whereas the fitting out works (i.e. one-time installation works for the new production line) costs $7,200,000, monthly rent and electricity costs S(160,000 + 1000xD) monthly operation and maintenance (including materials, labour expenses) costs $260,000. In addition, the expected monthly revenue would be S650,000 and the company can get S120,000 back at the end of contract. Given that the company's minimum acceptable rate of return (MARR) is 12% annually. (a) Draw a cash flow diagram to indicate all the cash flows of this new production line. Clearly (3 marks) label all the key values in the diagram. (b) Use future worth (FW) method to evaluate whether this proposed production line shall be 3 marks) constructed. Justify your answer with reason(s). (c) Use annual worth (AW) method to repeat the calculation in part (b) above. Does the financial (4 marks) manager need to change his decision accordingly? (d) Determine the internal rate of return (IRR) of the new production line. (5 marks) (Hints: You may want to try2% and396 monthly rates by using linear interpolation method) (e) Given that the annual re-investing interest rate is 18%, determine the external rate of return (5 marks) (ERR) of the new production line. (f) Determine the simple payback period and the discounted payback period for the new production line. (N.B. The S120,000 getting back at the end of contract can simply be ignored (5 marks) in the calculation.) Question 2 (25 marks) In the replacement analysis for boiler system of a factory facility, there are three types of equipment (i.e. A, B, C) are being considered by the Managing Director of a construction company. Given that the company has adopted a MARR of 10% and has gathered all the related information as given by following table Mutually Exclusive Alternative (MEA) Initial cost (S) Annual Revenue (S) Annual operating cost (S) Salvage value (S) Useful life (years) Equipment A Equipment B Equipment C 120,000+100xD 150,000+ 100xD 170,000 + 100xD 26,000 9,000 13,000 40,000 14,000 15,000 52,000 18,000 20,000 (a) By applying incremental analysis with present-worth (PW) method on the above three MEAs onthe above t (i.e. Equipment A, B & C), identify which equipment is the most preferable (ie. Equipment A B&C), identify (7 marks) (b) Assume that the useful life of Equipment B is now changed to 4 years, and selection is limited to make ONLY between equipment B and equipment C (i) By applying annual-worth (AW) method and repeatability assumption, determine which (5 marks) equipment should be chosen. (ii) By applying future-worth (FW) method and co-terminated assumption with study period of (6 marks) 6 years, determine which equipment should be chosen. (ii) By applying present-worth (PW) method and repeatability assumption with study period of (7 marks) 12 years, determine which equipment shall be chosen. Question 3 (25 marks) (a) CDP Inc. is a dart manufacturing company whose products must pass through a special dart cleaning machine in order to make the product surface clear CDP Inc. is now planning to buy a new dart cleaning machine to expand their operation. Here listed below are the two options (i.c. long useful life vs. short useful life) under consideration by CDP Inc. Option Buy a new dart cleaning machine for S(5200+10D), which has a useful life of 5 years and an estimated salvage value of S(180-3D- Option 2 Buy a new dart cleaning machine for $(4800 20xD1, which has a useful life of 10 years and an estimated salvage value of S10. (i) Create a straight-line (SL) depreciation schedule for the dart cleaning equipment in Option (5 marks) If double declining-balance (DDB) depreciation (or 200% DE) is adopted, what is the book value of the dart cleaning machine in Option 2 after 5 years? What is the implied salvage value and its meaning for the estimated salvage value? (ii) 4 marks (iii) Construct a complete DDB (or 200% DB) depreciation schedule for part (a)(ii) above with switching to straight-line (SL) depreciation as necessary.When should the switching from (12 marks) DDB depreciation to SL depreciation happen? (b) Go to the section "Hong Kong Statistics" in the C&SD website and then find "All tables, publications, charts and articles". There is a list ofall statistical tables available. (i) For the subject "Prices" (table 052), identify the Composite CPI(Consumer Price Index) ) 2 marks) (URL: https://www.censtatd and the year-on-year % change both for December 2017? andthevearon-year% (i) From the result in part (i) above, determine the "Composite CPI" for Dec 2016 (2 marks) Question 4 (25 marks) (a) You own a 15-year old equipment which can be sold for $5,000 currently. Assume its MV (market value) in 2 years will become (5 + Di) x $100. It is estimated that the old equipment requires maintenance expenses of $400 per year and has the production efficiency of 2 complete goods per gallon of gasoline. If you sell the old equipment now, you can buy a maintenance expenses) The newer model only costs 0.1 gallon of gasoline per production of complete goods (i.e. 10 complete goods per gallon of gasoline) and wi have an MV of $7,000 in 2 years. Assume you are going to produce 500 complete goods per year and the price of gasoline is $5.00 per gallon. Given that the MARR is 20% per year, use a 2-year study period and PW (present worth) method to determine which alternative (old or new equipment) is preferred. (6 marks) (b) The replacement of a laser wood cutting machine is being considered by the Wooden Furniture Company. The existing laser wood cutting machine was purchased four years ago at the price of $80,000. The exiting machine can be kept in service for an additional five years, or it can be sold out for $1,000x(313xD) currently, given that its market value will decrease $4,000 per year. The annual operation cost of the machine is S18,500 for this year and then it increases by $2,500 each year afterwards. Given that the company's MARR is 12%. (i) Work out the calculation of total cost for each year (i.e. marginal cost) on the existing (7 marks) cutting machine for the company by completing the table given below. EOY 0 MV at EOY Loss in Value Cost of Capital Operation cost Marginal Cost (ii) Following the result in part (b)(i) above, the purchase price of the replacement i.e. the challenger) laser wood cutting machine is S30,000. Its annual operation cost is estimated to be $15,000 for the first two years and will increase by $5,000 each year thereafter. In addition, the salvage value of this replacement machine is S0 at all times. Determine the economic life of replacement cutting machine (the challenge Should the defender (the existing cutting machine) be replaced? Justify your answer with reason(s). (12 marks) (Hints: You may want to calculate the EUAC of the challenger from year 1 to 5)