Answered step by step

Verified Expert Solution

Question

1 Approved Answer

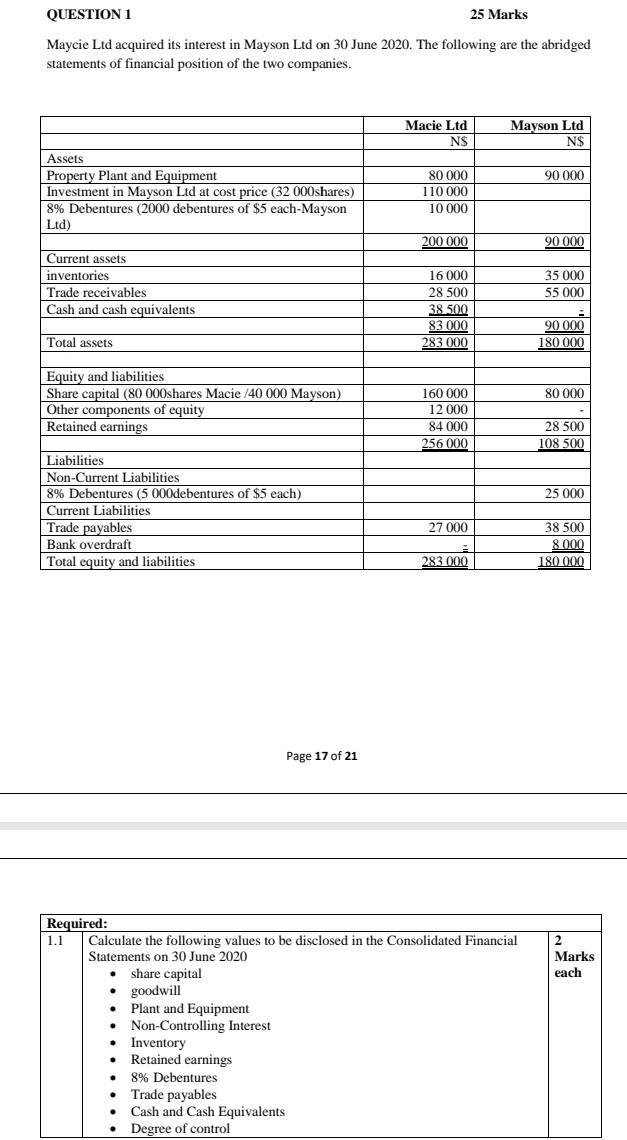

QUESTION 1 25 Marks Maycie Ltd acquired its interest in Mayson Ltd on 30 June 2020. The following are the abridged statements of financial position

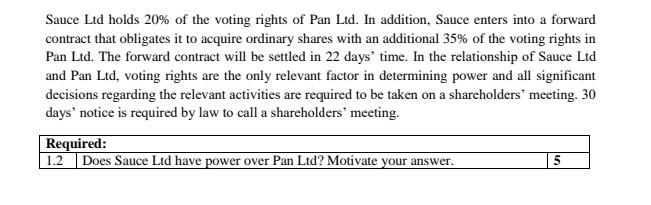

QUESTION 1 25 Marks Maycie Ltd acquired its interest in Mayson Ltd on 30 June 2020. The following are the abridged statements of financial position of the two companies. Macie Ltd NS Mayson Ltd NS 90 000 Assets Property Plant and Equipment Investment in Mayson Ltd at cost price (32 000shares) 8% Debentures (2000 debentures of $5 each-Mayson Ltd) 80 000 110 000 10 000 200 000 90 000 Current assets inventories Trade receivables Cash and cash equivalents 35 000 55 000 16 000 28 500 38.500 83 000 283 000 90 000 180 000 Total assets 80 000 Equity and liabilities Share capital (80 000shares Macie/40 000 Mayson) Other components of equity Retained earnings 160 000 12 000 84 000 256 000 28 500 108 500 25 000 Liabilities Non-Current Liabilities 8% Debentures (5 000debentures of $5 each) Current Liabilities Trade payables Bank overdraft Total equity and liabilities 27 000 38 500 8.000 180.000 283 000 Page 17 of 21 Required: 1.1 Calculate the following values to be disclosed in the Consolidated Financial Statements on 30 June 2020 share capital 2 Marks each goodwill Plant and Equipment Non-Controlling Interest Inventory Retained earnings 8% Debentures Trade payables Cash and Cash Equivalents Degree of control Sauce Ltd holds 20% of the voting rights of Pan Ltd. In addition, Sauce enters into a forward contract that obligates it to acquire ordinary shares with an additional 35% of the voting rights in Pan Ltd. The forward contract will be settled in 22 days' time. In the relationship of Sauce Ltd and Pan Ltd, voting rights are the only relevant factor in determining power and all significant decisions regarding the relevant activities are required to be taken on a shareholders' meeting. 30 days' notice is required by law to call a shareholders' meeting. Required: 1.2 Does Sauce Ltd have power over Pan Ltd? Motivate your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started