Answered step by step

Verified Expert Solution

Question

1 Approved Answer

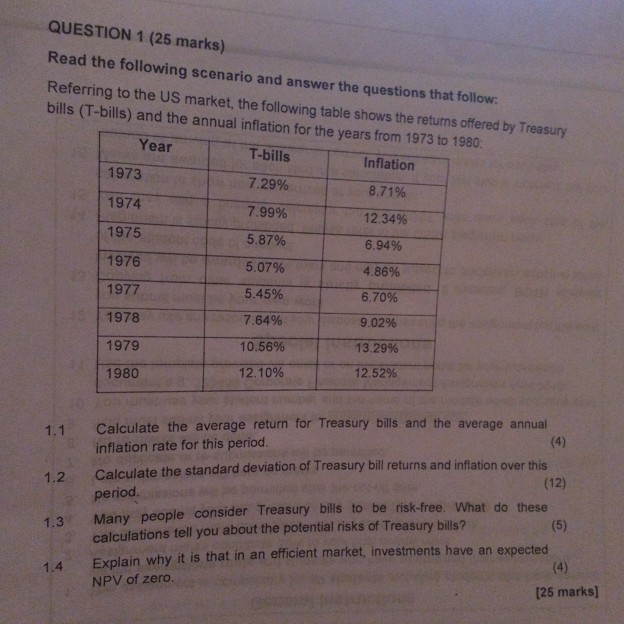

QUESTION 1 (25 marks) Read the following scenario and answer the questions that follow: Referring to the US market, the following table shows the returns

QUESTION 1 (25 marks) Read the following scenario and answer the questions that follow: Referring to the US market, the following table shows the returns offered by Treasury bills (T-bills) and the annual inflation for the years from 1973 to 1980: Year 1973 1974 1975 1976 1977 1978 1979 1980 T-bills 7.29% 7.99% 5.87% 5.07% 5.45% 7,64% 10.56% 12.10% Inflation 8.71% 12.34% 6.94% 4.86% 6.70% 9.02% 13 29% 12.52% 1.1 Calculate the average return for Treasury bills and the average annual Calculate the standard deviation of Treasury bill returns and infation over this 1.3 Many people consider Treasury bills to be risk-free. WWhat do these 1.4 Explain why it is that in an efficient market, investments have an expected inflation rate for this period. (12) period calculations tell you about the potential risks of Treasury bills? NPV of zero. 125 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started