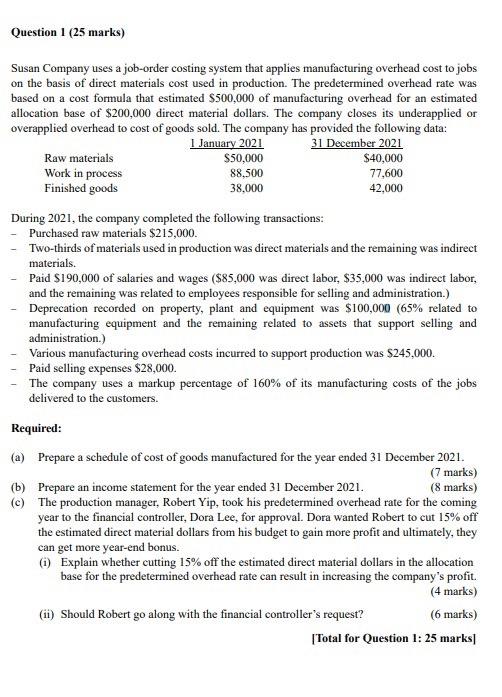

Question 1 (25 marks) Susan Company uses a job-order costing system that applies manufacturing overhead cost to jobs on the basis of direct materials cost used in production. The predetermined overhead rate was based on a cost formula that estimated $500,000 of manufacturing overhead for an estimated allocation base of $200,000 direct material dollars. The company closes its underapplied or overapplied overhead to cost of goods sold. The company has provided the following data: 1 January 2021 31 December 2021 Raw materials $50,000 $40,000 Work in process 88,500 77,600 Finished goods 38,000 42,000 During 2021, the company completed the following transactions: Purchased raw materials $215,000. Two-thirds of materials used in production was direct materials and the remaining was indirect materials. Paid $190,000 of salaries and wages ($85,000 was direct labor, $35,000 was indirect labor, and the remaining was related to employees responsible for selling and administration.) Deprecation recorded on property, plant and equipment was $100,000 (65% related to manufacturing equipment and the remaining related to assets that support selling and administration.) Various manufacturing overhead costs incurred to support production was $245,000 Paid selling expenses $28,000. The company uses a markup percentage of 160% of its manufacturing costs of the jobs delivered to the customers. Required: (a) Prepare a schedule of cost of goods manufactured for the year ended 31 December 2021. (7 marks) (b) Prepare an income statement for the year ended 31 December 2021. (8 marks) (c) The production manager, Robert Yip, took his predetermined overhead rate for the coming year to the financial controller, Dora Lee, for approval . Dora wanted Robert to cut 15% off the estimated direct material dollars from his budget to gain more profit and ultimately, they can get more year-end bonus. (1) Explain whether cutting 15% off the estimated direct material dollars in the allocation base for the predetermined overhead rate can result in increasing the company's profit. (4 marks) (ii) Should Robert go along with the financial controller's request? (6 marks) [Total for Question 1: 25 marks