Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1 (25 MARKS) The table below shows annual returns for Orkid Berhad and one of its major competitors, Bunga Raya Berhad. Encik Ghazali is

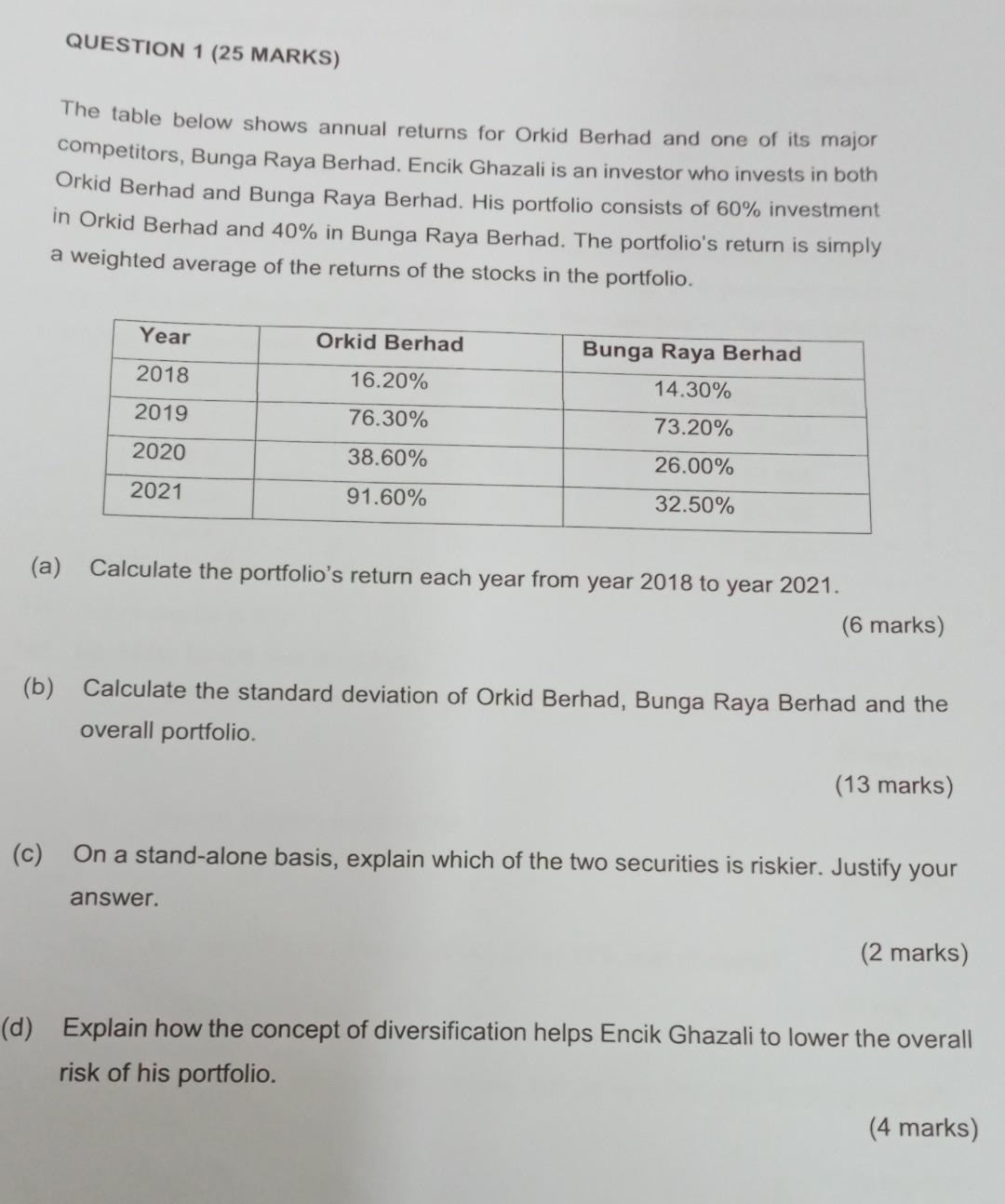

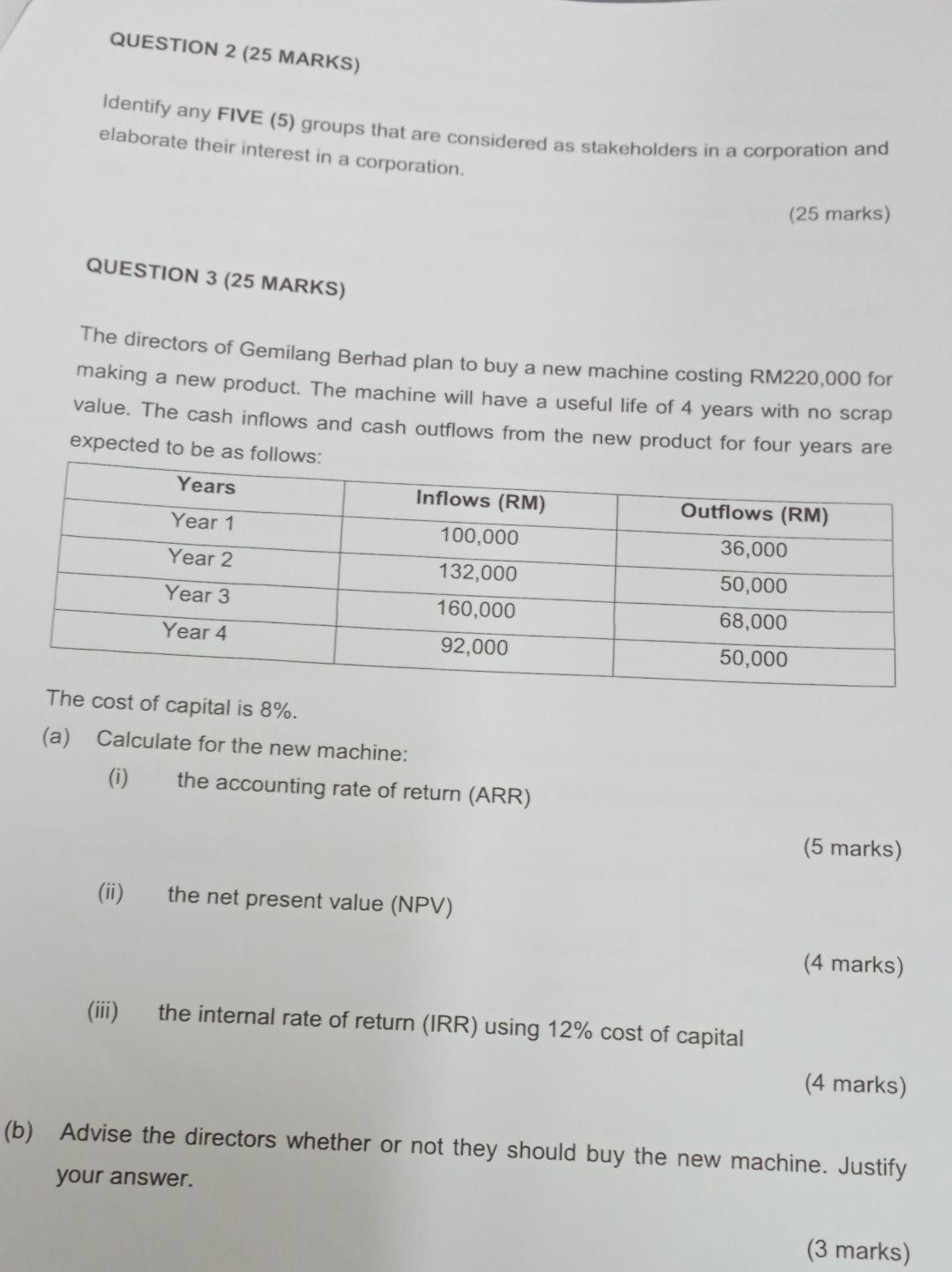

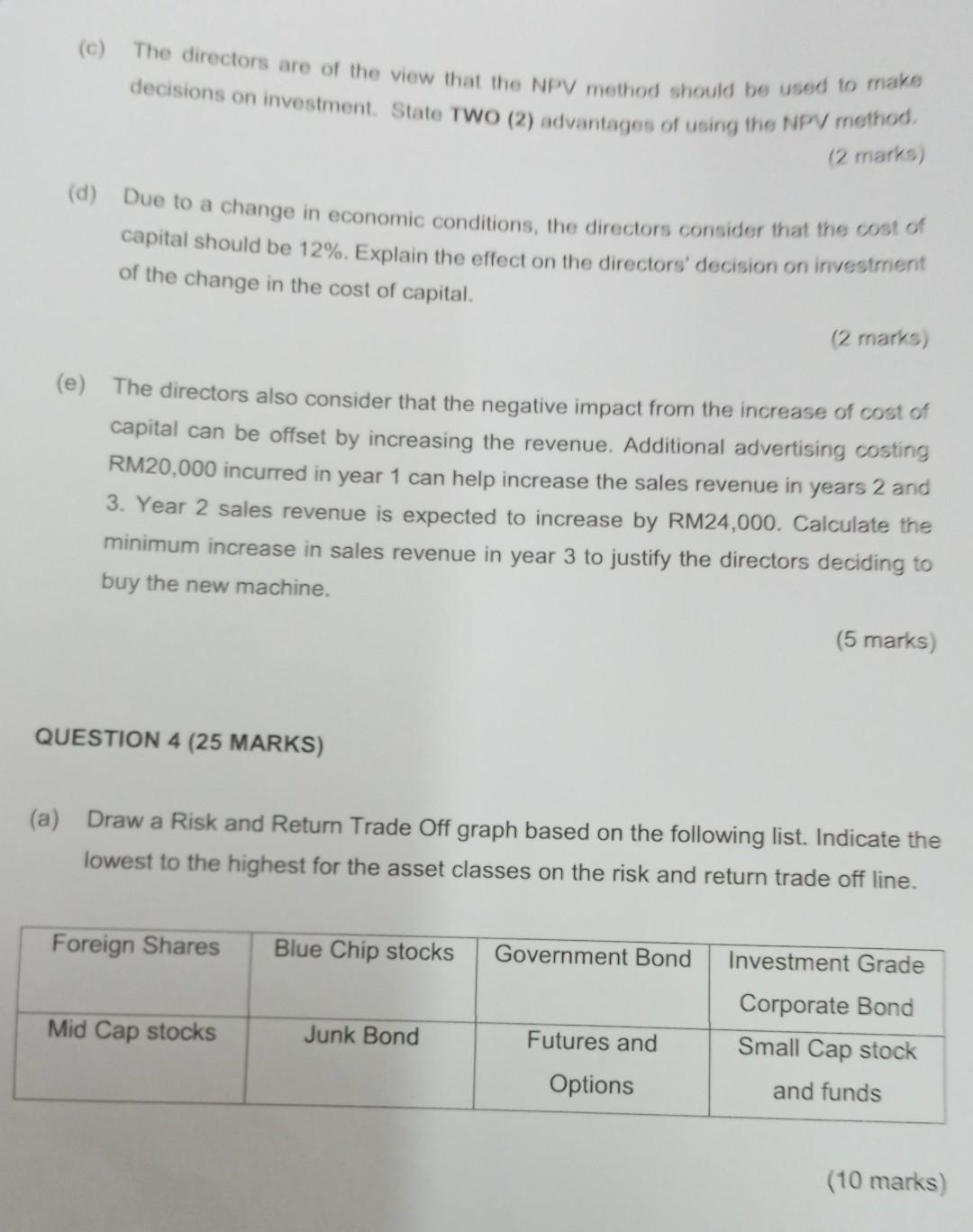

QUESTION 1 (25 MARKS) The table below shows annual returns for Orkid Berhad and one of its major competitors, Bunga Raya Berhad. Encik Ghazali is an investor who invests in both Orkid Berhad and Bunga Raya Berhad. His portfolio consists of 60% investment in Orkid Berhad and 40% in Bunga Raya Berhad. The portfolio's return is simply a weighted average of the returns of the stocks in the portfolio. (a) Calculate the portfolio's return each year from year 2018 to year 2021. (6 marks) (b) Calculate the standard deviation of Orkid Berhad, Bunga Raya Berhad and the overall portfolio. (13 marks) (c) On a stand-alone basis, explain which of the two securities is riskier. Justify your answer. (2 marks) (d) Explain how the concept of diversification helps Encik Ghazali to lower the overall risk of his portfolio. (4 marks) Identify any FIVE (5) groups that are considered as stakeholders in a corporation and elaborate their interest in a corporation. (25 marks) QUESTION 3 (25 MARKS) The directors of Gemilang Berhad plan to buy a new machine costing RM220,000 for making a new product. The machine will have a useful life of 4 years with no scrap value. The cash inflows and cash outflows from the new product for four expected to be as follows: The cost of capital is 8%. (a) Calculate for the new machine: (i) the accounting rate of return (ARR) (5 marks) (ii) the net present value (NPV) (4 marks) (iii) the internal rate of return (IRR) using 12% cost of capital (4 marks) b) Advise the directors whether or not they should buy the new machine. Justify your answer. (c) The directors are of the view that the NPV method should be used to make decisions on investment. State TWO (2) advantages of using the NPV method. (2 marks) (d) Due to a change in economic conditions, the directors consider that the cost of capital should be 12%. Explain the effect on the directors' decision on investment of the change in the cost of capital. (2 marks) (e) The directors also consider that the negative impact from the increase of cost of capital can be offset by increasing the revenue. Additional advertising costing RM20,000 incurred in year 1 can help increase the sales revenue in years 2 and 3. Year 2 sales revenue is expected to increase by RM24,000. Calculate the minimum increase in sales revenue in year 3 to justify the directors deciding to buy the new machine. (5 marks) QUESTION 4 (25 MARKS) (a) Draw a Risk and Return Trade Off graph based on the following list. Indicate the lowest to the highest for the asset classes on the risk and return trade off line. (10 marks) (b) As a student of Introduction to Financial Management, you are required to elaborate Principle 1: The risk-return trade-off to your tutor. Write a thorough explanation on the risk-return trade off theory. (8 marks) (c) Explain any SEVEN (7) characteristics of a corporation. (7 marks) END OF FINAL ASSIGNMENT

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started