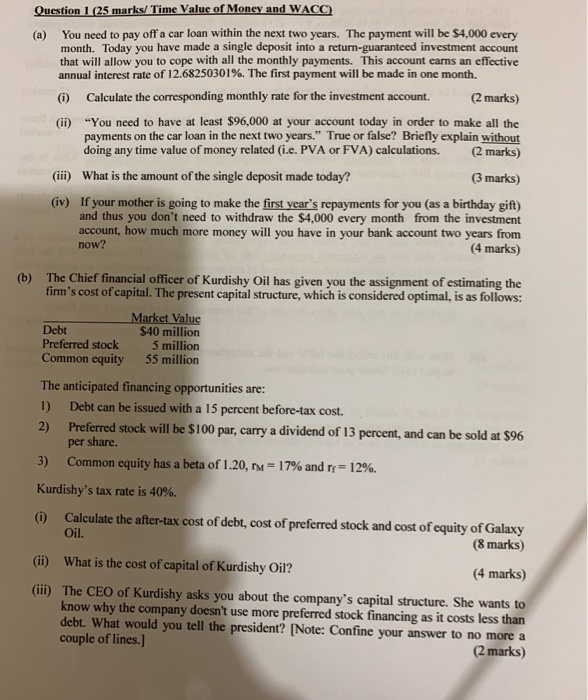

Question 1 (25 marks/ Time Value of Money and WACC) (a) You need to pay off a car loan within the next two years. The payment will be $4,000 every month. Today you have made a single deposit into a return-guaranteed investment account that will allow you to cope with all the monthly payments. This account earns an effective annual interest rate of 12.68250301%. The first payment will be made in one month. 0 Calculate the corresponding monthly rate for the investment account. (2 marks) (ii) "You need to have at least $96,000 at your account today in order to make all the payments on the car loan in the next two years." True or false? Briefly explain without doing any time value of money related (.e. PVA or FVA) calculations. (2 marks) (iii) What is the amount of the single deposit made today? (3 marks) (iv) If your mother is going to make the first year's repayments for you (as a birthday gift) and thus you don't need to withdraw the $4,000 every month from the investment account, how much more money will you have in your bank account two years from now? (4 marks) Debt (b) The Chief financial officer of Kurdishy Oil has given you the assignment of estimating the firm's cost of capital. The present capital structure, which is considered optimal, is as follows: Market Value $40 million Preferred stock 5 million Common equity 55 million The anticipated financing opportunities are: 1) Debt can be issued with a 15 percent before-tax cost. 2) Preferred stock will be $100 par, carry a dividend of 13 percent, and can be sold at $96 per share. 3) Common equity has a beta of 1.20, rm = 17% and fr=12%. Kurdishy's tax rate is 40%. 0 Calculate the after-tax cost of debt, cost of preferred stock and cost of equity of Galaxy Oil. (8 marks) (ii) What is the cost of capital of Kurdishy Oil? (4 marks) (iii) The CEO of Kurdishy asks you about the company's capital structure. She wants to know why the company doesn't use more preferred stock financing as it costs less than debt. What would you tell the president? [Note: Confine your answer to no more a couple of lines.) (2 marks)