Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1 ( 3 0 marks ) The Covid - 1 9 pandemic slowed down international travel in 2 0 2 0 and early 2

QUESTION marks The Covid pandemic slowed down international travel in and early

However, Jake was able to fly to China in March of to negotiate several new supplier

contracts on behalf of Canaroma. The travels costs, which were paid by Canaroma, totaled

$ This amount includes extra airfare of $ to allow Jake to bring his spouse on

the trip.

Jake incurred the following expenses out of pocket:

Car operating expenses Jan to June

Transportation other than car & accommodation in Canada

Client entertainment meals

Advertising and promotion

Tablet computer

$

$

$

$

$

In Jake was granted an option to acquire shares of Canaroma for $ per

share. At that time, Canaroma shares were trading for $ a share. In July when

Canaroma shares were trading for $ per share, Jake exercised the option and acquired

shares. Jake did not sell any shares in

On February Jake borrowed $ from his bank, and he invested the money

in common stock and a year municipal bond. The bank loan has an interest rate of

compounded annually and Jake is required to make interest payments on the loan at

the end of every month. Jake did not repay any of the principle amount of the loan in

The municipal bond pays interest at with all interest and principal due at maturity in

During Jake received dividends from Canadian public companies totaling $

Jake also received $ in dividends from Canaroma.

Required:

Determine Jake's employment income for tax purposes and his property income for tax purposes

for the taxation year. Be sure to clearly identify your employment income calculation

and your property income calculation. You must provide a brief explanation for any amounts

omitted from the calculation.

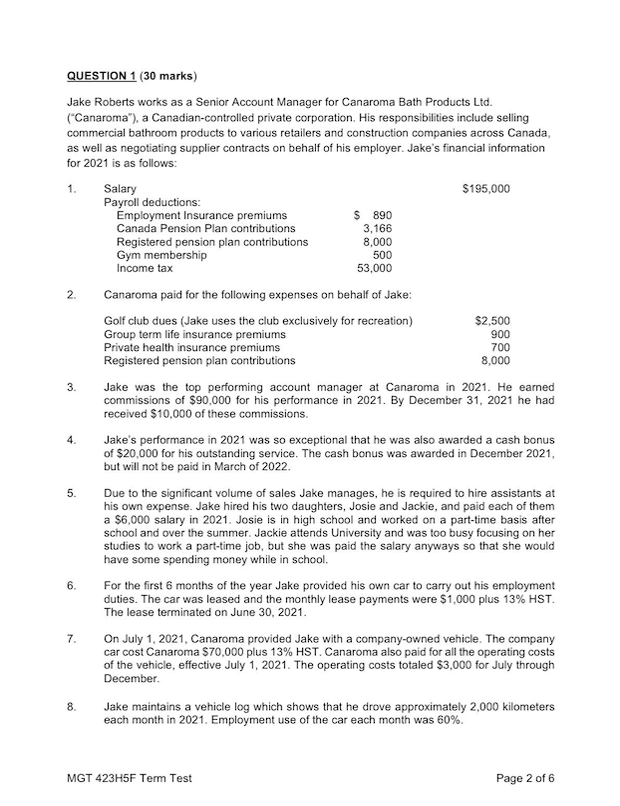

Jake Roberts works as a Senior Account Manager for Canaroma Bath Products Ltd

Canaroma a Canadiancontrolled private corporation. His responsibilities include selling

commercial bathroom products to various retailers and construction companies across Canada,

as well as negotiating supplier contracts on behalf of his employer. Jake's financial information

for is as follows:

Salary

Payroll deductions:

Employment Insurance premiums

Canada Pension Plan contributions

Registered pension plan contributions

Gym membership

Income tax

$

$

$

Canaroma paid for the following expenses on behalf of Jake:

Golf club dues Jake uses the club exclusively for recreation

$

Group term life insurance premiums

Private health insurance premiums

Registered pension plan contributions

Jake was the top performing account manager at Canaroma in He earned

commissions of $ for his performance in By December he had

received $ of these commissions.

Jake's performance in was so exceptional that he was also awarded a cash bonus

of $ for his outstanding service. The cash bonus was awarded in December

but will not be paid in March of

Due to the significant volume of sales Jake manages, he is required to hire assistants at

his own expense. Jake hired his two daughters, Josie and Jackie, and paid each of them

a $ salary in Josie is in high school and worked on a parttime basis after

school and over the summer. Jackie attends University and was too busy focusing on her

studies to work a parttime job, but she was paid the salary anyways so that she would

have some spending money while in school.

For the first months of the year Jake provided his own car to carry out his employment

duties. The car was leased and the monthly lease payments were $ plus HST

The lease terminated on June

On July Canaroma provided Jake with a companyowned vehicle. The company

car cost Canaroma $ plus HST Canaroma also paid for all the operating costs

of the vehicle, effective July The operating costs totaled $ for July through

December.

Jake maintains a vehicle log which shows that he drove approximately kilometers

each month in Employment use of the car each month was

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started