Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 3 5 pts Colton Corporation's semiannual bonds have a 1 2 - year maturity, an 7 . 1 0 % nominal coupon paid

Question

pts

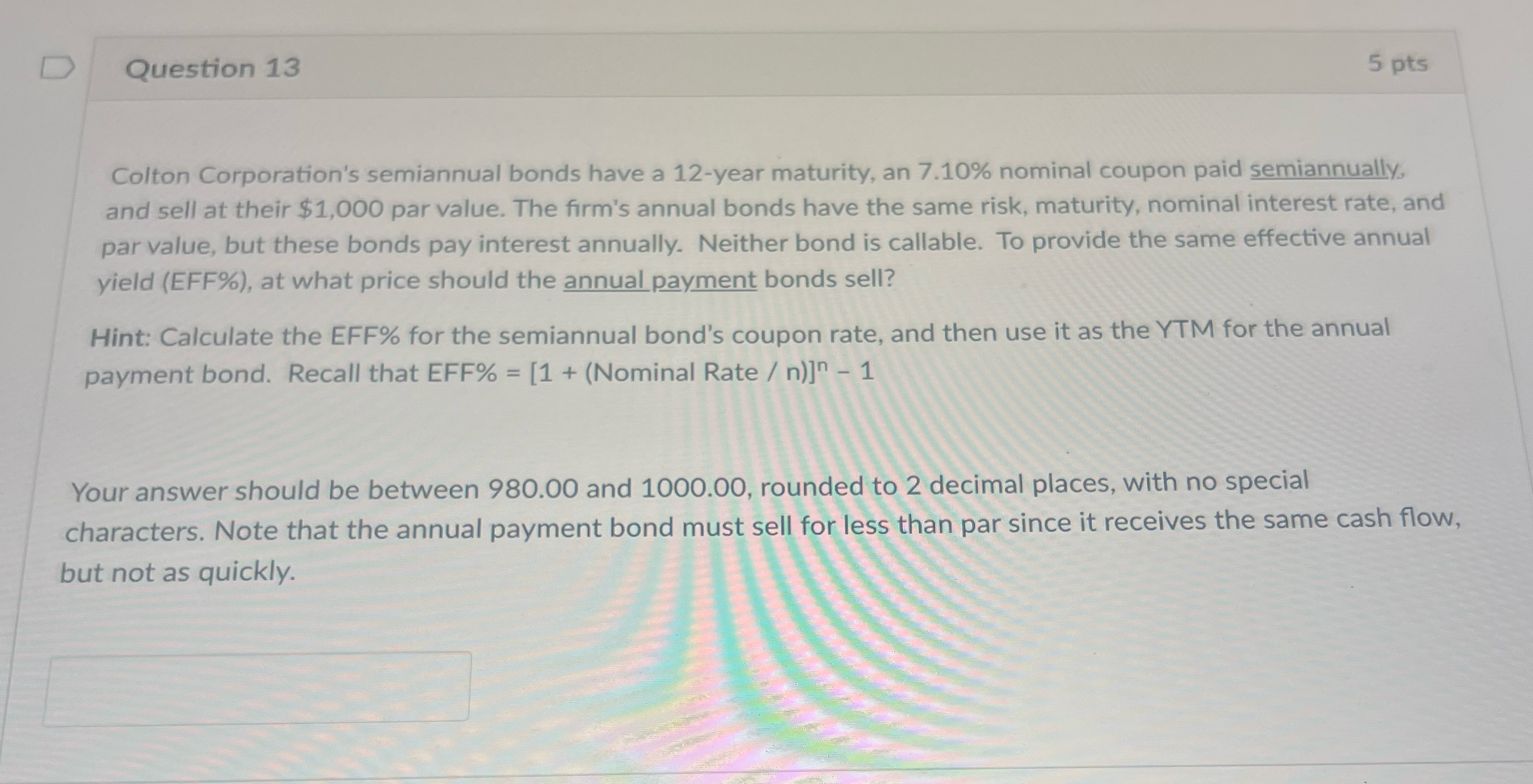

Colton Corporation's semiannual bonds have a year maturity, an nominal coupon paid semiannually, and sell at their $ par value. The firm's annual bonds have the same risk, maturity, nominal interest rate, and par value, but these bonds pay interest annually. Neither bond is callable. To provide the same effective annual yield EFF at what price should the annual payment bonds sell?

Hint: Calculate the EFF for the semiannual bond's coupon rate, and then use it as the YTM for the annual payment bond. Recall that EFF Nominal Rate

Your answer should be between and rounded to decimal places, with no special characters. Note that the annual payment bond must sell for less than par since it receives the same cash flow, but not as quickly.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started