Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1 [ 3 8 MARKS ] [ 6 9 MINUTES ] IGNORE TAXATION & VAT Hold Ltd is a South African company operating in

QUESTION

MARKS

MINUTES

IGNORE TAXATION & VAT

Hold Ltd is a South African company operating in the construction industry. Hold Ltd

is listed on the JSE Ltd and has been a key player in the construction industry since

Hold Ltd has a December yearend.

In January the board members of Hold Ltd decided to expand their business

and identified that in order to fund this expansion, they will need to obtain a foreign

loan as the interest rates are better suited for the needs of the company and they will

have to purchase inventory from a foreign supplier, who has better quality inventory,

as their market research has identified that better quality inventory will address the

needs of their customers. Hold Ltd entered into the following foreign transactions:

Transaction

On January Hold Ltd obtained a loan of $ at a marketrelated interest

rate of per annum. Hold Ltd is required to make a repayment of $ annually

in arrears with the first payment due on December

Transaction

On September Hold Ltd placed an order amounting to $ to purchase

inventory from a supplier in the USA. The inventory was shipped free on board, at the

agreed port of departure. The inventory was delivered to the Port NewarkElizabeth

Marine Terminal, New Jersey USA on September which is the agreed port

of departure. The inventory was loaded on the ship on September but the

ship only departed to South Africa on October

The total amount owing was paid on January of the inventory was still on

hand by December and its estimated net residual value was R

End of Question

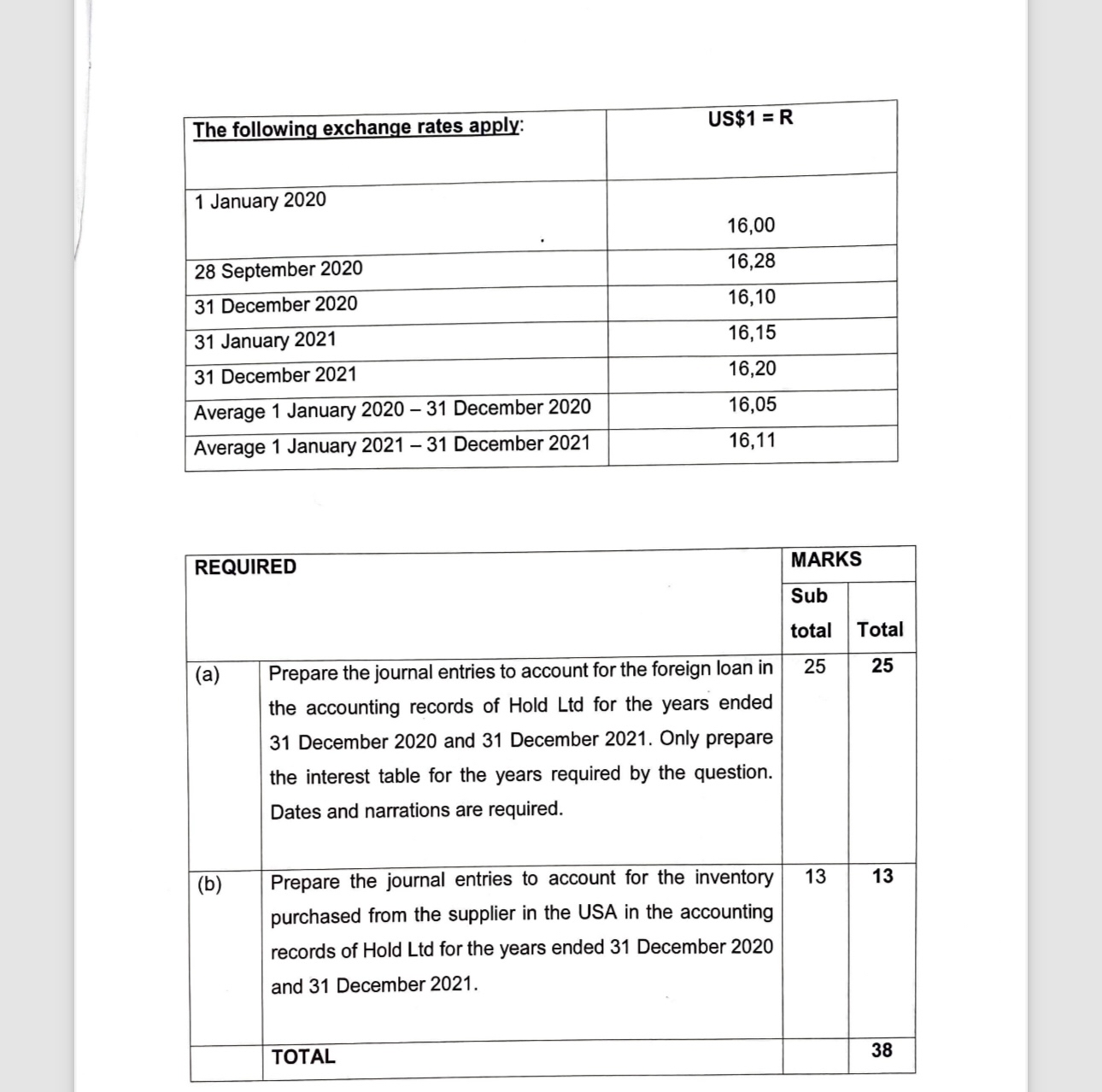

tableThe following exchange rates apply:,US$ R January September December January December Average January December Average January December

tableREQUIREDMARKStableSubtotalTotalatablePrepare the journal entries to account for the foreign loan inthe accounting records of Hold Ltd for the years ended December and December Only preparethe interest table for the years required by the question.Dates and narrations are required.btablePrepare the journal entries to account for the inventorypurchased from the supplier in the USA in the accountingrecords of Hold Ltd for the years ended December and December TOTAL,,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started