Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 3 ( a ) What does the acronym CVA stand for and what are its regulatory implications? [ 3 marks ] ( b

Question

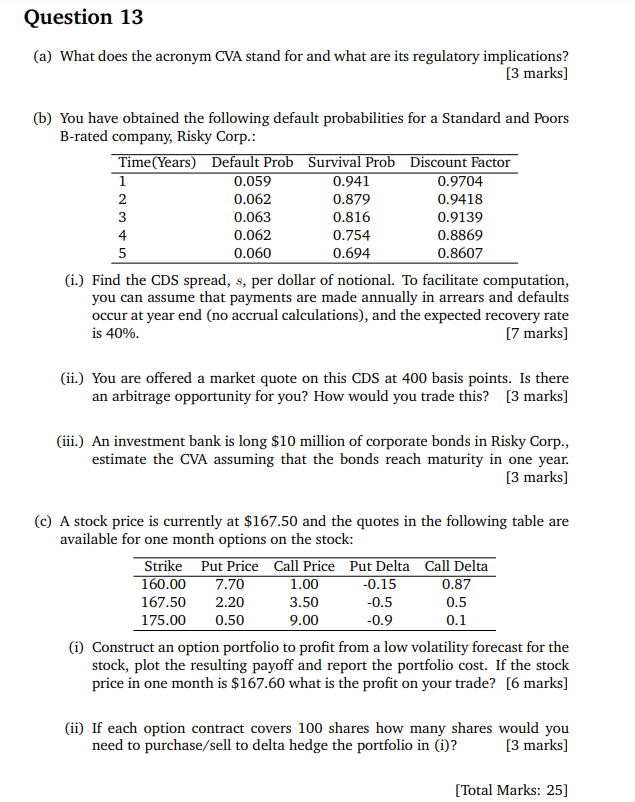

a What does the acronym CVA stand for and what are its regulatory implications?

marks

b You have obtained the following default probabilities for a Standard and Poors

Brated company, Risky Corp.:

i Find the CDS spread, per dollar of notional. To facilitate computation,

you can assume that payments are made annually in arrears and defaults

occur at year end no accrual calculations and the expected recovery rate

is

marks

ii You are offered a market quote on this CDS at basis points. Is there

an arbitrage opportunity for you? How would you trade this? marks

iii An investment bank is long $ million of corporate bonds in Risky Corp.,

estimate the CVA assuming that the bonds reach maturity in one year.

marks

c A stock price is currently at $ and the quotes in the following table are

available for one month options on the stock:

i Construct an option portfolio to profit from a low volatility forecast for the

stock, plot the resulting payoff and report the portfolio cost. If the stock

price in one month is $ what is the profit on your trade? marks

ii If each option contract covers shares how many shares would you

need to purchasesell to delta hedge the portfolio in i

marks

Total Marks:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started