Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 (3 marks) On December 10 2018, a January Swiss franc call option with an exercise price of 90 had a price of $5.10.

Question 1 (3 marks)

On December 10 2018, a January Swiss franc call option with an exercise price of 90 had a

price of $5.10. The January 90 put was at $0.40. The spot rate was 94.18. All prices are in

cents per Swiss franc. The option expired on January 19 2019. The U.S. risk-free rate was

2.72 percent, and the Swiss risk-free rate was 3.15 percent. The options have European

expiries. Carry out the following:

a. Determine the intrinsic value of the call

b. Determine the lower bound of the call

c. Determine the time value of the call

d. Determine the intrinsic value of the put

e. Determine the lower bound of the put

f. Determine the time value of the put

g. Determine whether put-call parity holds

Question 2 (3 marks)

Consider a stock worth $100 that can go up or down by 40 percent per period. The risk-free

rate is 2.72 percent. Use one binomial period.

a. Determine the two possible stock prices for the next period.

b. Determine the intrinsic values at expiration of a European call option with an exercise

price of $100.

c. Find the value of the option today.

d. Construct a hedge by combing a position in stock with a position in the call. Show

that the return on the hedge is the risk-free rate regardless of the outcome, assuming

that the call sells for the value you obtained in part c.

e. Determine the rate of the return from a riskless hedge if the call is selling for $21.50

when the hedge is initiated.

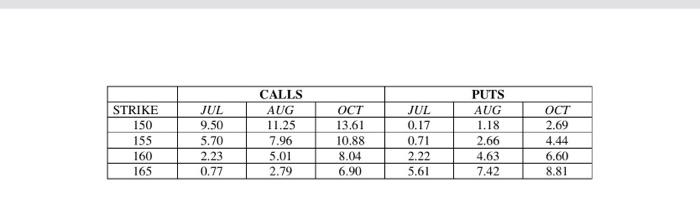

The following options prices were observed for calls and puts on Bull Ltd for the trading day

of July 6 2018. Use this information in Questions 3-8. The stock was priced at 163.37. The

expirations were July 17, August 21 and October 16. The continuously compounded risk-free

rates associated with the three expirations were 0.0517, 0.0542 and 0.0565, respectively. The

options have European expiries.

Question 3 (3 marks)

Let the standard deviation of the continuously compounded return on the stock be 20 percent.

Ignore dividends. Respond to the following:

a. What is the theoretical fair value of the October 165 call. Calculate this answer by

hand and then re-calculate it using BlackScholesMertonBinomial10e.xlsm.

b. Based on your answer in part a, recommend a riskless strategy.

c. If the stock price decreases by $1, how will the option position offset the loss on the

stock?

Question 4 (3 marks)

Use the Black-Scholes-Merton European put option pricing formula for the October 160 put

option. Repeat parts a, b and c of Question 3 with respect to the put.

Question 5 (4 marks)

Buy 100 shares of Bull Ltd and short one October 165 call. Hold the position until expiration.

Determine the profits and graph the results. Identify the strategy, breakeven stock price at

expiration, the maximum profit, and the maximum loss. Discuss any special considerations

associated with this strategy. Note: use the OptionStrategyAnalyzer10e.xlsm to obtain the

required payoff diagram.

Question 6 (4 marks)

Buy 100 shares of Bull Ltd and go long one October 160 put. Hold the position until

expiration. Determine the profits and graph the results. Identify the strategy, breakeven stock

price at expiration, the maximum profit, and the maximum loss. Discuss any special

considerations associated with this strategy. Note: use the OptionStrategyAnalyzer10e.xlsm to

obtain the required payoff diagram.

Question 7 (5 marks)

Construct an options strategy by going short one October 160 call and long one October 165

call. Hold the position until expiration. Determine the profits and graph the results. Identify

the strategy, breakeven stock price at expiration, the maximum profit, and the maximum loss.

Discuss any special considerations associated with this strategy. Note: use the

OptionStrategyAnalyzer10e.xlsm to obtain the required payoff diagram.

Question 8 (5 marks)

Construct an options strategy by going long one October 165 put and long one October 165

call. Hold the position until expiration. Determine the profits and graph the results. Identify

the strategy, breakeven stock price at expiration, the maximum profit, and the maximum loss.

Discuss any special considerations associated with this strategy. Note: use the

OptionStrategyAnalyzer10e.xlsm to obtain the required payoff diagram.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started