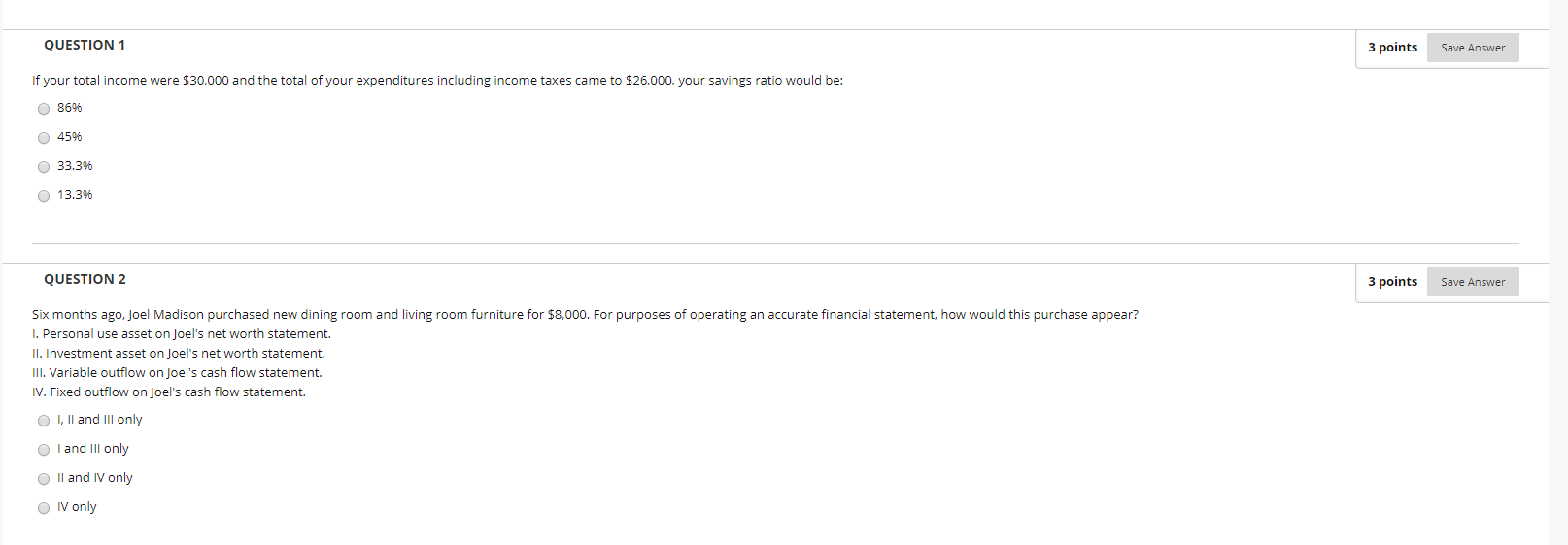

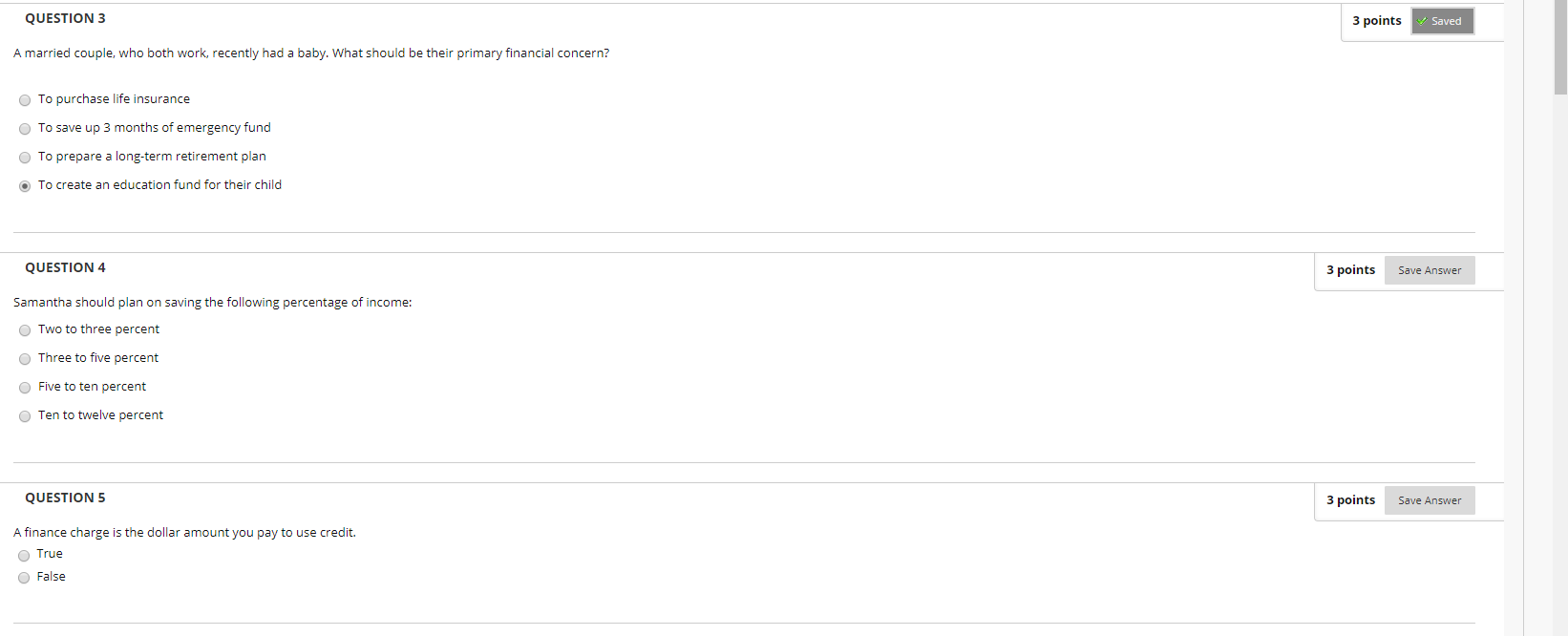

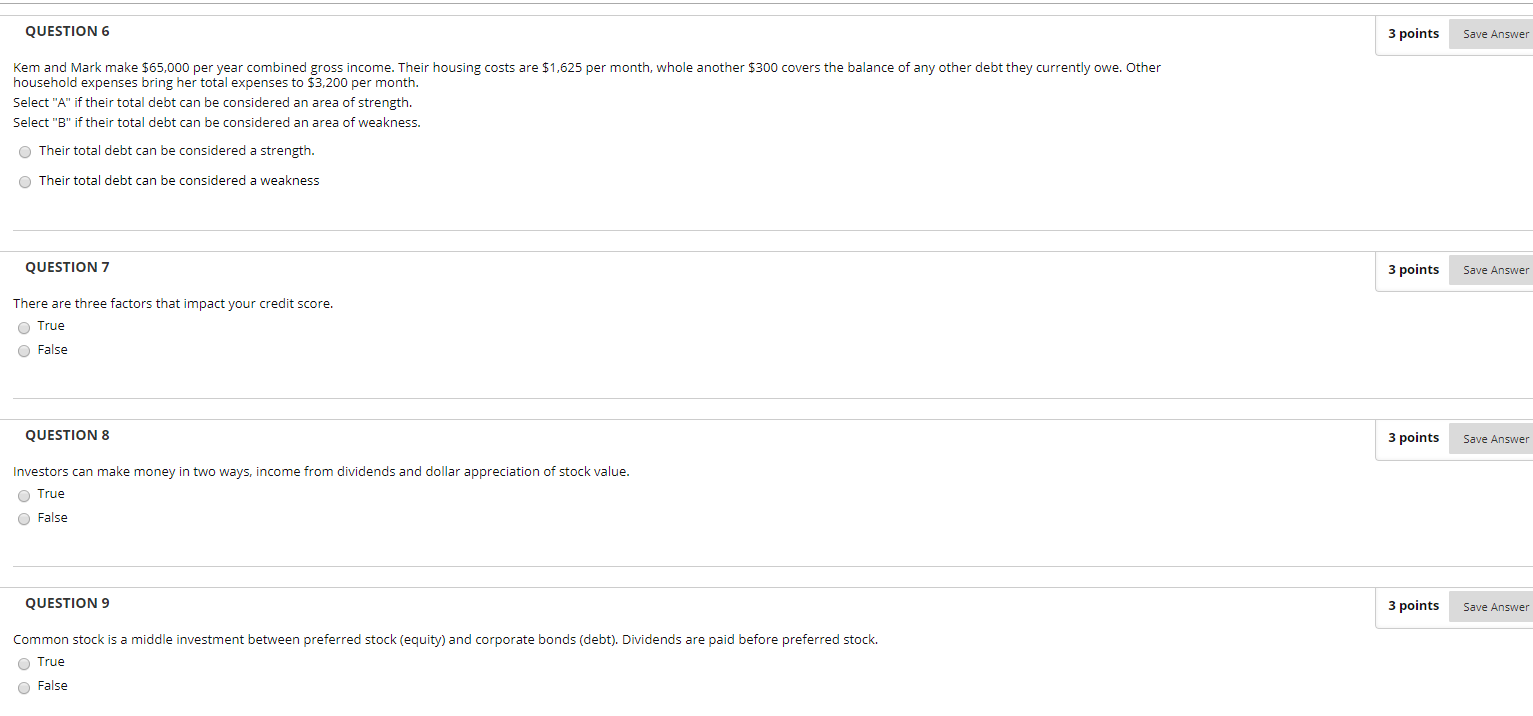

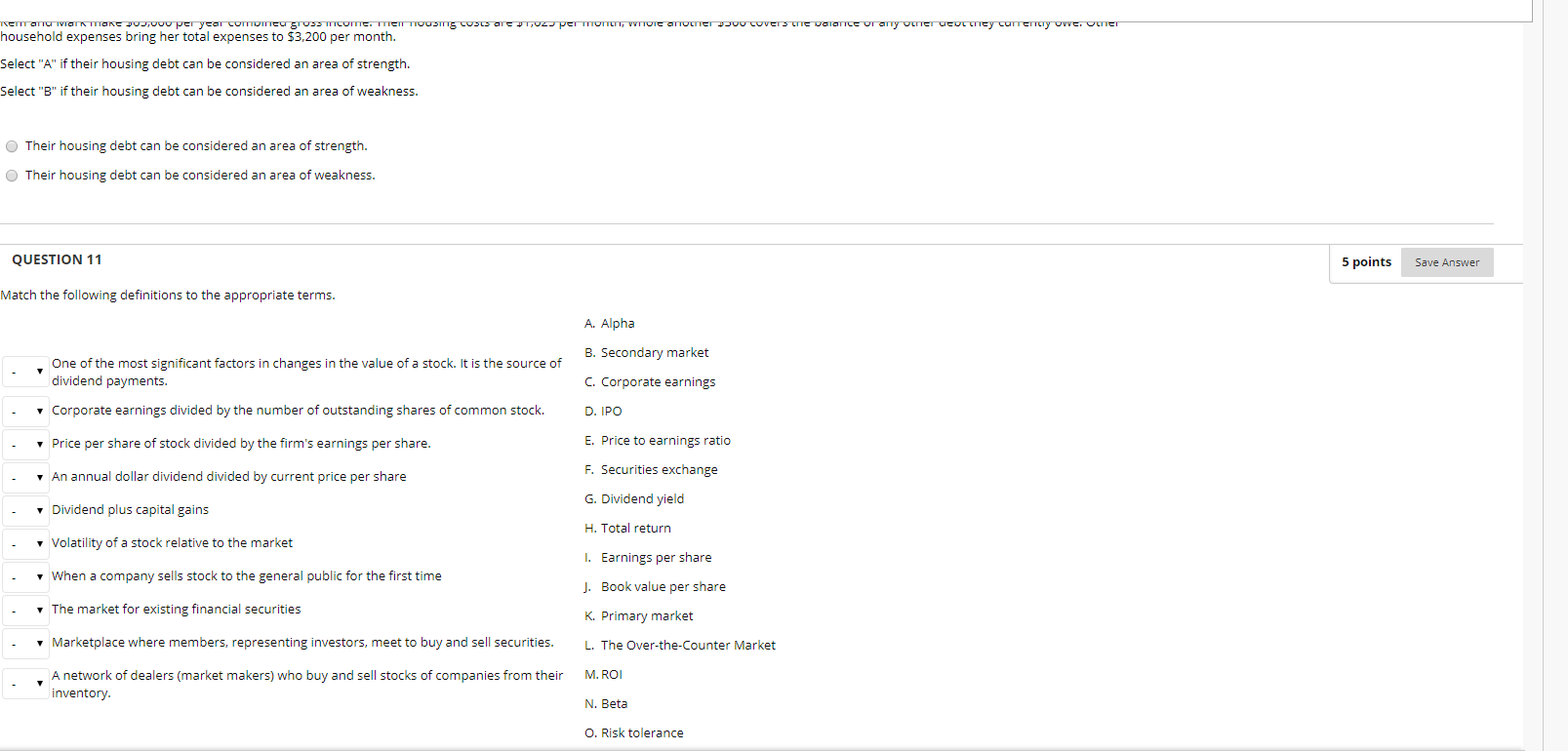

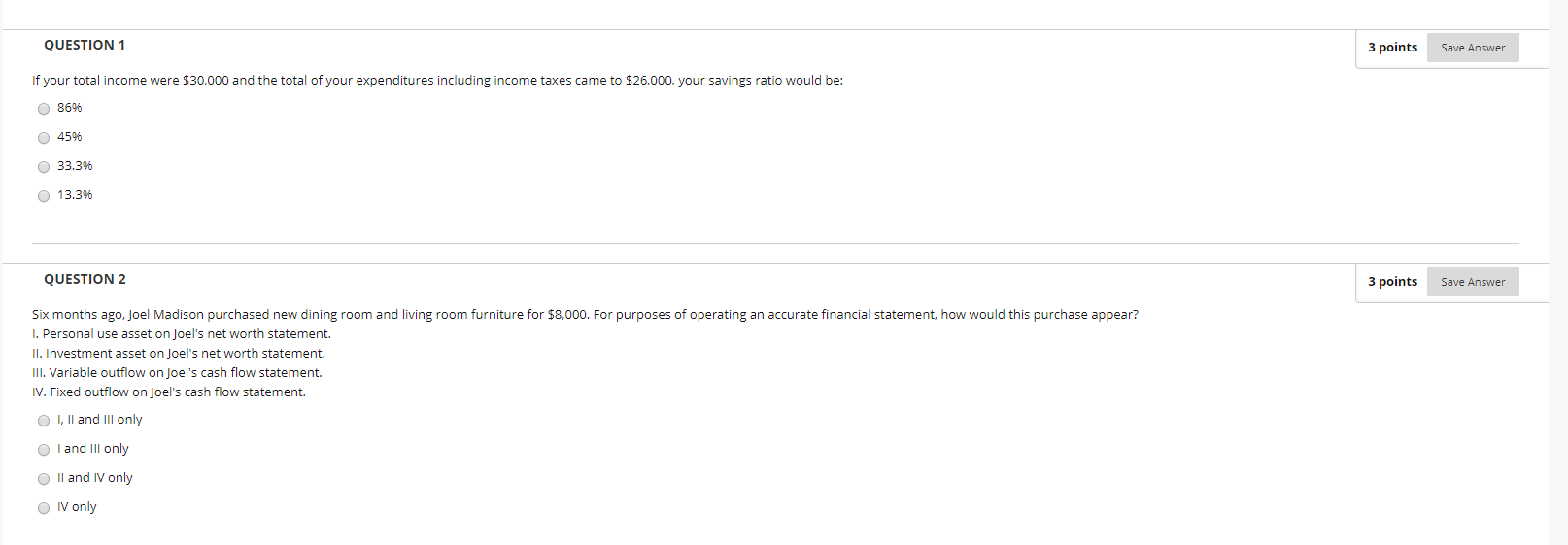

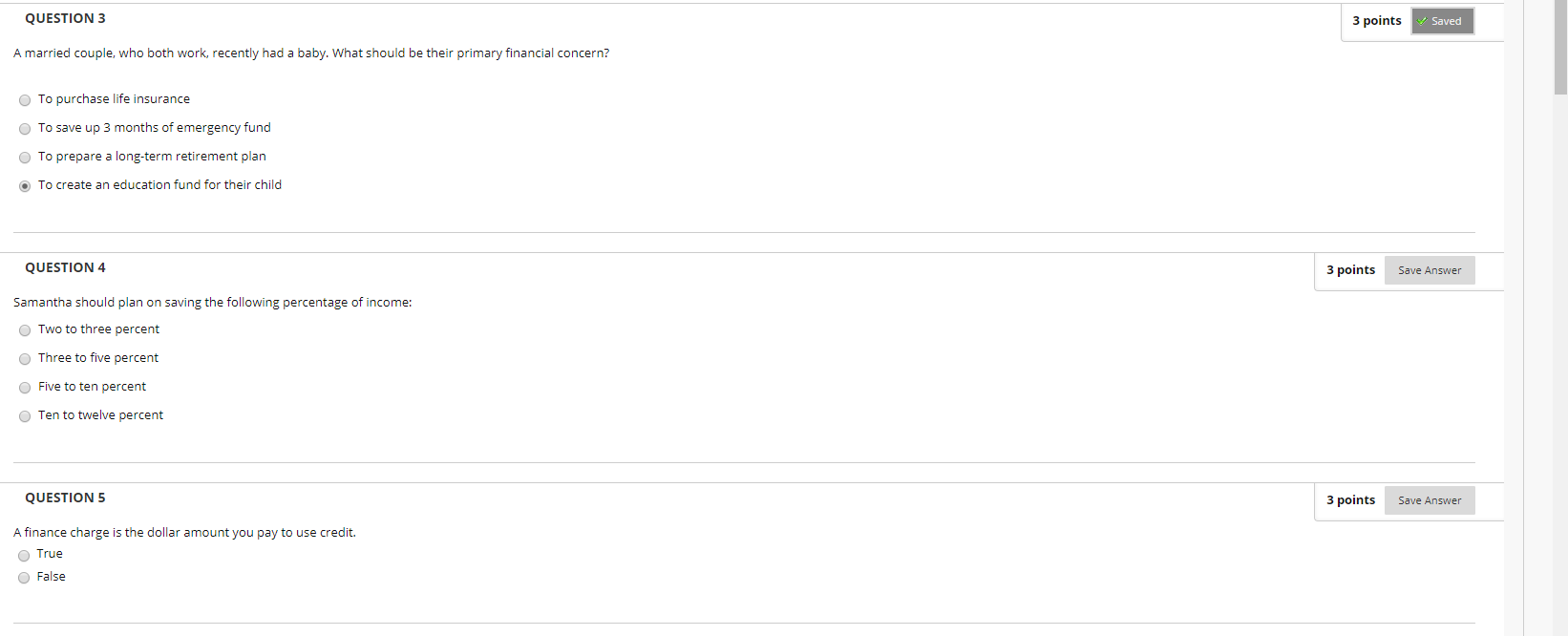

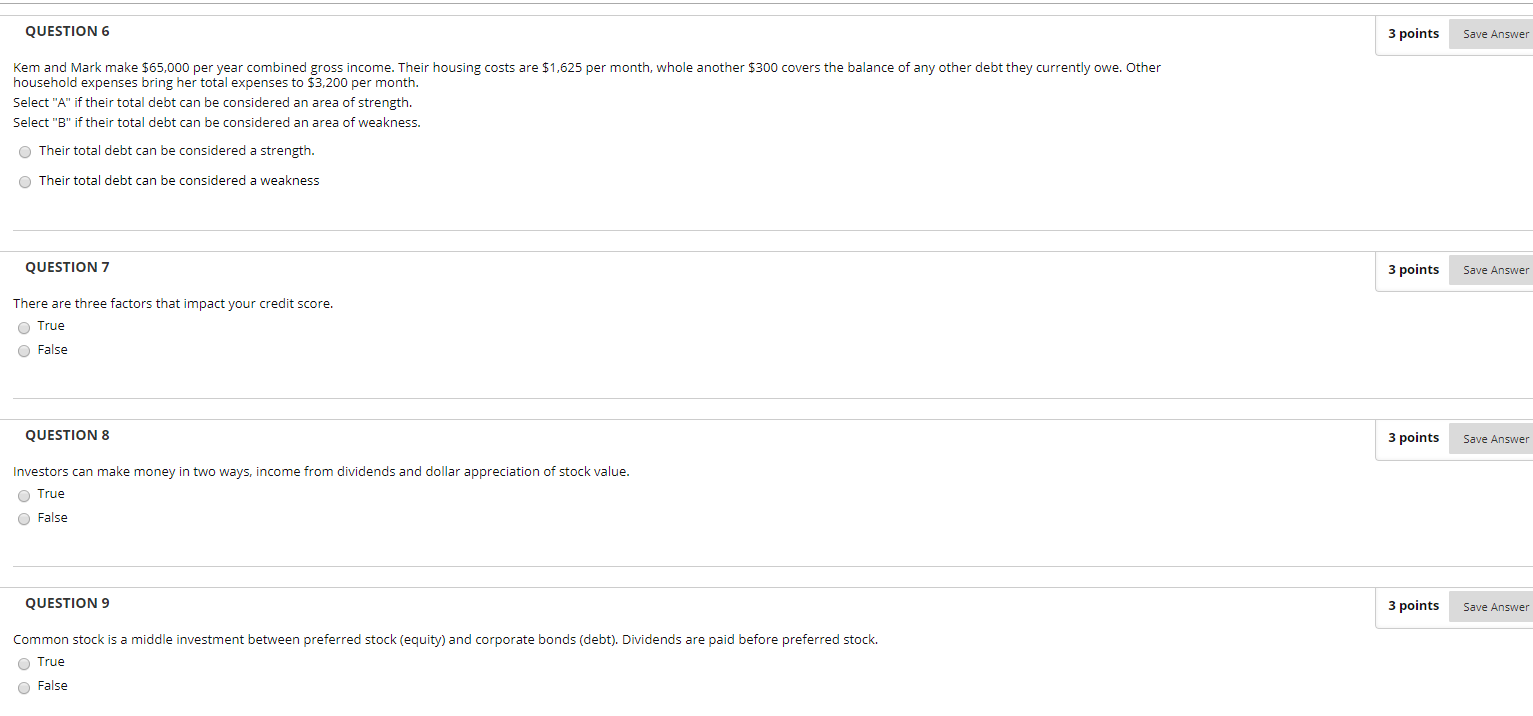

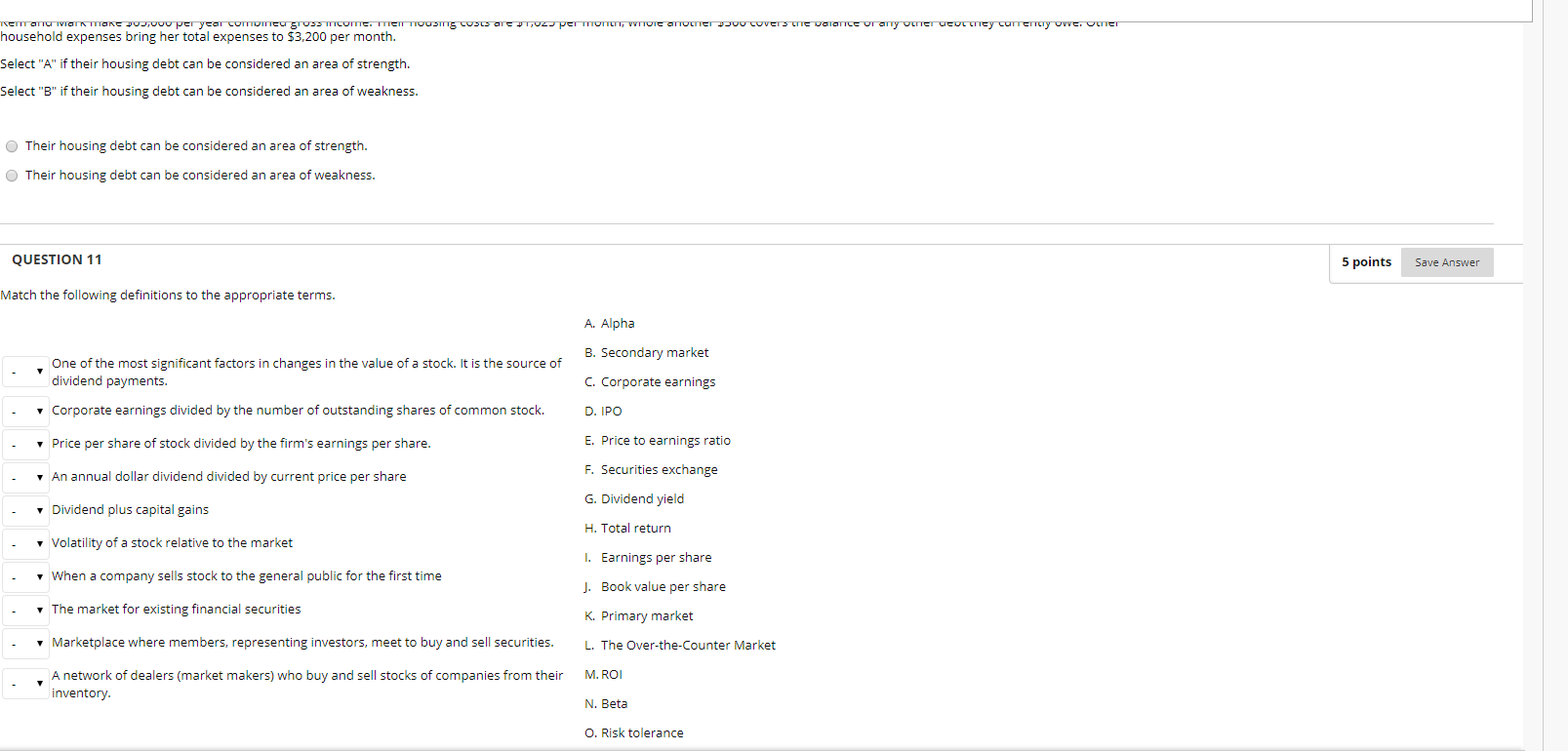

QUESTION 1 3 points Save Answer If your total income were $30,000 and the total of your expenditures including income taxes came to $26,000, your savings ratio would be: 08696 O 4596 33.396 13.396 QUESTION 2 3 points Save Answer Six months ago, Joel Madison purchased new dining room and living room furniture for $8,000. For purposes of operating an accurate financial statement, how would this purchase appear? 1. Personal use asset on Joel's net worth statement. II. Investment asset on Joel's net worth statement. III. Variable outflow on Joel's cash flow statement. IV. Fixed outflow on Joel's cash flow statement. I, II and III only I and Ill only O II and IV only OIV only QUESTION 3 3 points Saved A married couple, who both work, recently had a baby. What should be their primary financial concern? To purchase life insurance To save up 3 months of emergency fund To prepare a long-term retirement plan To create an education fund for their child QUESTION 4 3 points Save Answer Samantha should plan on saving the following percentage of income: Two to three percent Three to five percent Five to ten percent Ten to twelve percent QUESTION 5 3 points Save Answer A finance charge is the dollar amount you pay to use credit. True False QUESTION 6 3 points Save Answer Kem and Mark make $65,000 per year combined gross income. Their housing costs are $1,625 per month, whole another $300 covers the balance of any other debt they currently owe. Other household expenses bring her total expenses to $3,200 per month. Select "A" if their total debt can be considered an area of strength. Select "B" if their total debt can be considered an area of weakness. Their total debt can be considered a strength. Their total debt can be considered a weakness QUESTION 7 3 points Save Answer There are three factors that impact your credit score. True O False QUESTION 8 3 points Save Answer Investors can make money in two ways, income from dividends and dollar appreciation of stock value. True False QUESTION 9 3 points Save Answer Common stock is a middle investment between preferred stock (equity) and corporate bonds (debt). Dividends are paid before preferred stock. True False KEITT ATT VIGINTARS POJou per year comTUMICU grus TICOTTIS. THIEM TIOUSTIS CODIC PTO2- PER TUTTLIT, WITVIS ATTOLICI POU LOVETE UCIATICE UI any ULTET UCUL LIST COTTEITLY OWS. LIET household expenses bring her total expenses to $3,200 per month. Select "A" if their housing debt can be considered an area of strength. Select "B" if their housing debt can be considered an area of weakness. Their housing debt can be considered an area of strength. Their housing debt can be considered an area of weakness. QUESTION 11 5 points Save Answer Match the following definitions to the appropriate terms. A. Alpha B. Secondary market One of the most significant factors in changes in the value of a stock. It is the source of dividend payments. Corporate earnings divided by the number of outstanding shares of common stock. C. Corporate earnings D. IPO Price per share of stock divided by the firm's earnings per share. E. Price to earnings ratio An annual dollar dividend divided by current price per share F. Securities exchange G. Dividend yield Dividend plus capital gains H. Total return Volatility of a stock relative to the market 1. Earnings per share When a company sells stock to the general public for the first time J. Book value per share The market for existing financial securities K. Primary market Marketplace where members, representing investors, meet to buy and sell securities. L. The Over-the-counter Market M. ROI A network of dealers (market makers) who buy and sell stocks of companies from their inventory. N. Beta O. Risk tolerance