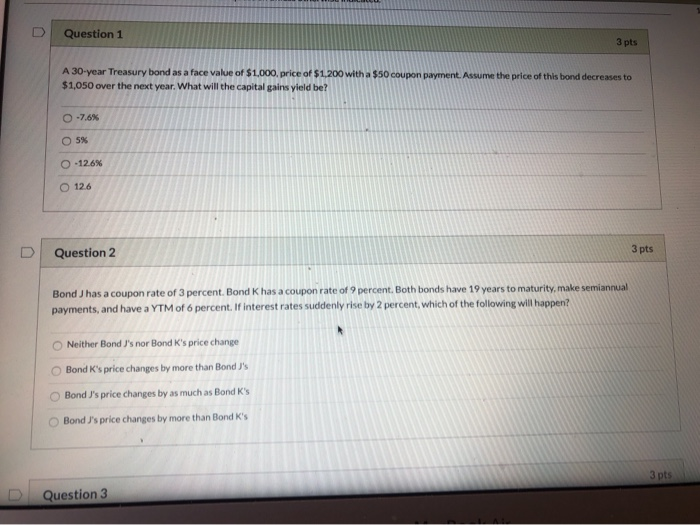

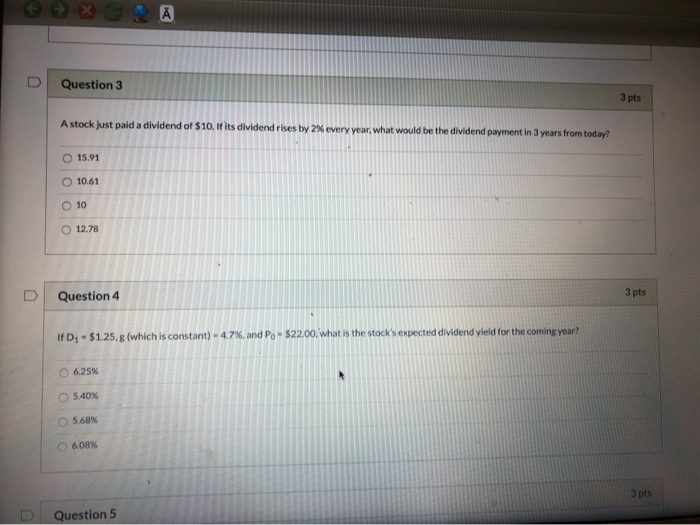

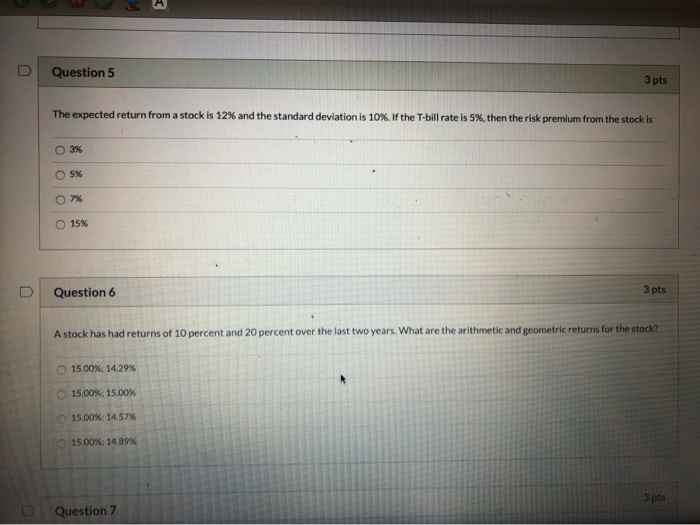

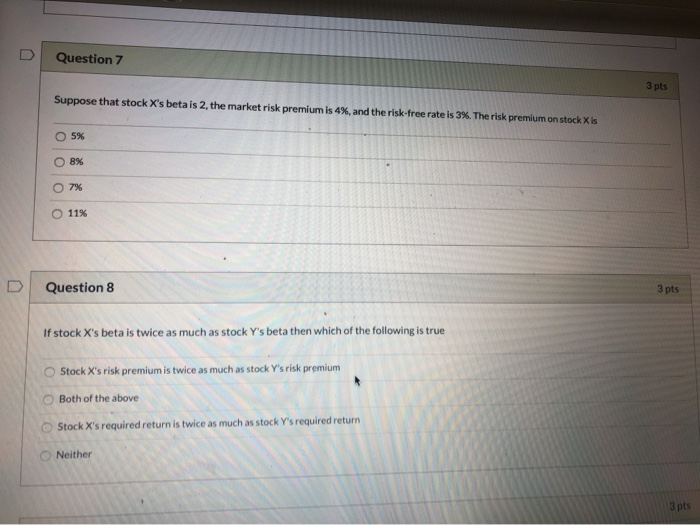

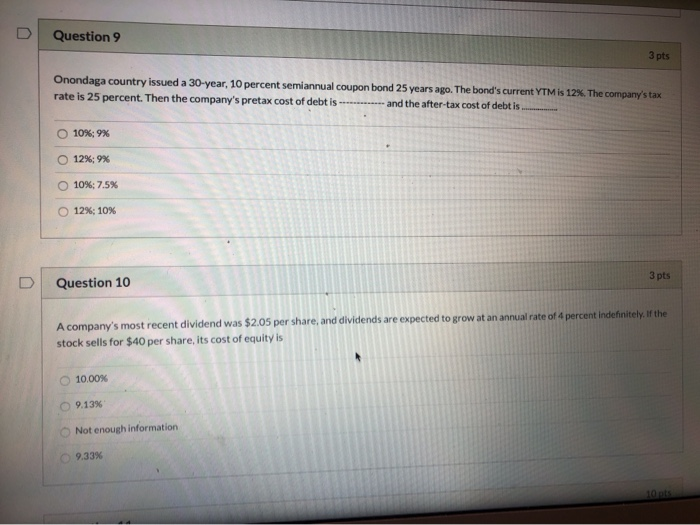

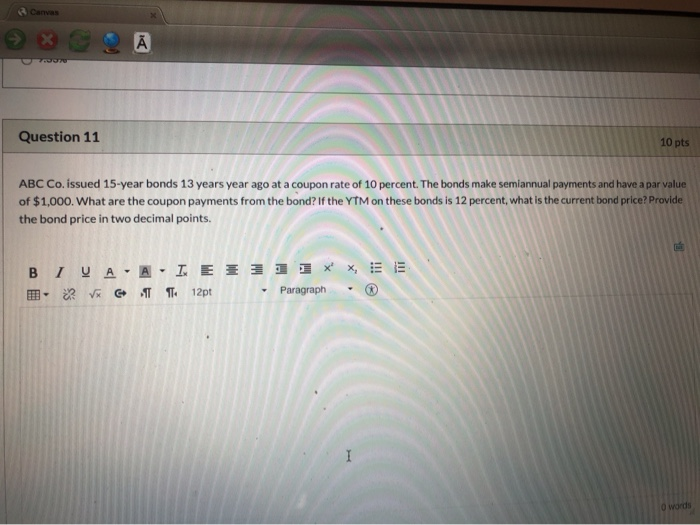

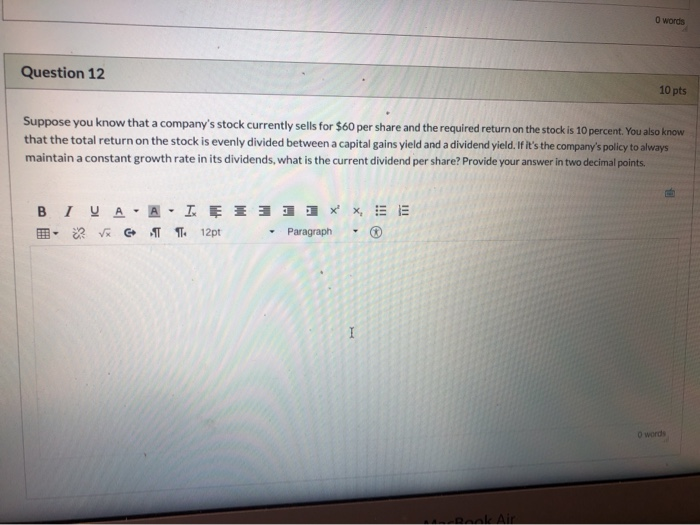

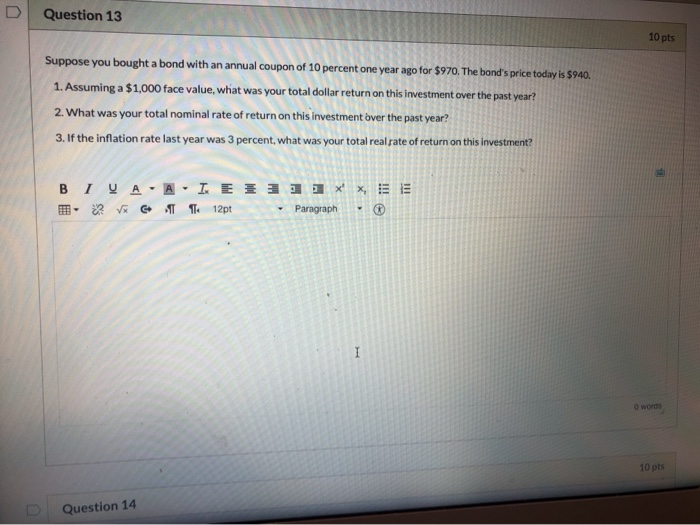

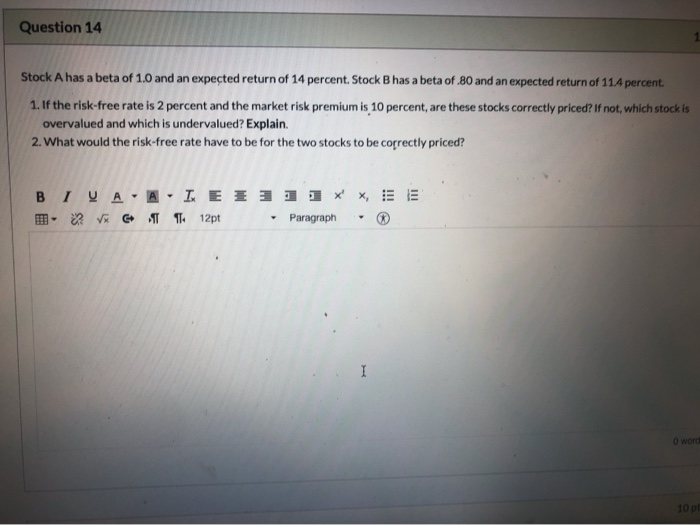

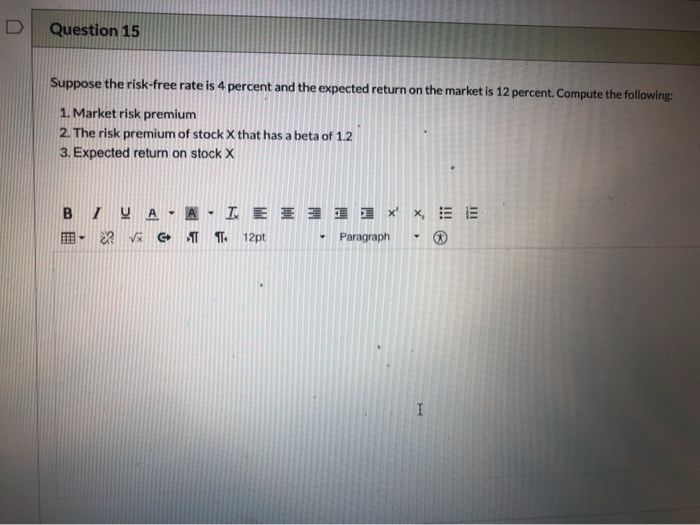

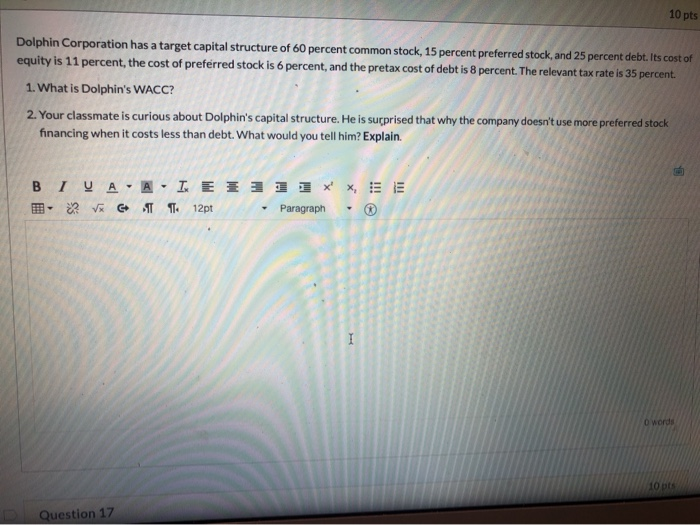

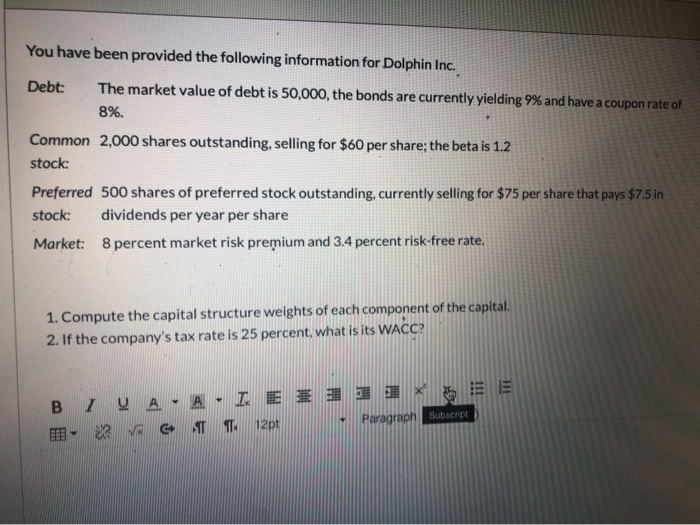

Question 1 3 pts A 30-year Treasury bond as a face value of $1.000 price of $1.200 with a $50 coupon payment. Assume the price of this bond decreases to $1,050 over the next year. What will the capital gains yield be? -7.6% 5% 126% 12.6 D Question 2 3 pts Bond J has a coupon rate of 3 percent. Bond Khas a coupon rate of 9 percent. Both bonds have 10 years to maturity, make semiannual payments, and have a YTM of 6 percent. If interest rates suddenly rise by 2 percent, which of the following will happen? Neither Bond J's nor Bond K's price change Bond K's price changes by more than Bond J's Bond J's price changes by as much as Bond K's Bond 's price changes by more than Bond K's Question 3 Question 3 3 pts A stock just paid a dividend of $10. If its dividend rises by 2% every year, what would be the dividend payment in 3 years from today! 15.91 O 10.61 ooo 12.78 3 pts Question 4 ID- $1.25.g (which is constant) - 4.7%, and Po.$22.00, what is the stock's expected dividend yield for the coming year? 6.25% 5.40% 5.68% 6.08% 3 pts Question 5 Question 5 3 pts The expected return from a stock is 12% and the standard deviation is 10%. If the T-bill rate is 5%, then the risk premium from the stock is 3% 5% 7% 15% D Question 6 3 pts A stock has had returns of 10 percent and 20 percent over the last two years. What are the arithmetic and geometric returns for the stock 15.00%: 14.29% 15.00%;15.00% 15.00%: 14.57% 15.00%: 14.89% 3 pts DI Question 7 Question 7 3 pts Suppose that stock X's beta is 2, the market risk premium is 4%, and the risk-free rate is 3%. The risk premium on stock is 5% 0 0 0 11% Question 8 3 pts If stock X's beta is twice as much as stock Y's beta then which of the following is true Stock X's risk premium is twice as much as stock Y's risk premium Both of the above Stock X's required return is twice as much as stock Y's required return Neither 3 pts Question 9 3 pts Onondaga country issued a 30-year, 10 percent semiannual coupon bond 25 years ago. The bond's current YTM is 12%. The company's tax rate is 25 percent. Then the company's pretax cost of debt is -- and the after-tax cost of debt is 10%; 9% 12%; 9% 10%: 7.5% 12%: 10% 3 pts Question 10 A company's most recent dividend was $2.05 per share, and dividends are expected to grow at an annual rate of 4 percent indefinitelyt stock sells for $40 per share, its cost of equity is 10.00% 9.13% Not enough information 9.33% Canvas Question 11 10 pts ABC Co. issued 15-year bonds 13 years year ago at a coupon rate of 10 percent. The bonds make semiannual payments and have a par value of $1,000. What are the coupon payments from the bond? If the YTM on these bonds is 12 percent, what is the current bond price? Provide the bond price in two decimal points. BIYA-A- IE * 3 1 1 x x, EE I- ? V T 1 12pt - Paragraph . O words O words Question 12 10 pts Suppose you know that a company's stock currently sells for $60 per share and the required return on the stock is 10 percent. You also know that the total return on the stock is evenly divided between a capital gains yield and a dividend yield. If it's the company's policy to always maintain a constant growth rate in its dividends, what is the current dividend per share? Provide your answer in two decimal points. BIVA -A- IEE3xx, EE ? V T 1 12pt - Paragraph . D Question 13 10 pts Suppose you bought a bond with an annual coupon of 10 percent one year ago for $970. The band's price today is $940. 1. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? 2. What was your total nominal rate of return on this investment over the past year? 3. If the inflation rate last year was 3 percent, what was your total real rate of return on this investment? x BIVA-A-I EI 3] x - V G T 12pt - Paragraph O words 10 pts D Question 14 Question 14 Stock A has a beta of 1.0 and an expected return of 14 percent. Stock Bhas a beta of 80 and an expected return of 114 percent 1. If the risk-free rate is 2 percent and the market risk premium is 10 percent, are these stocks correctly priced? If not, which stock is overvalued and which is undervalued? Explain. 2. What would the risk-free rate have to be for the two stocks to be correctly priced? BIYA-A- IE * 3 - V G T 12pt - * *, EE Paragraph . D Question 15 Suppose the risk-free rate is 4 percent and the expected return on the market is 12 percent. Compute the following 1. Market risk premium 2. The risk premium of stock X that has a beta of 1.2 3. Expected return on stock X BIVA - A- IE * 1 1 1 x x - V G T 12pt Paragraph 10 pts Dolphin Corporation has a target capital structure of 60 percent common stock, 15 percent preferred stock, and 25 percent debt. Its cost of equity is 11 percent, the cost of preferred stock is 6 percent, and the pretax cost of debt is 8 percent. The relevant tax rate is 35 percent. 1. What is Dolphin's WACC? 2. Your classmate is curious about Dolphin's capital structure. He is surprised that why the company doesn't use more preferred stock financing when it costs less than debt. What would you tell him? Explain. B IV AA- IE * 3 1 XX, E ? V G T 12pt - Paragraph Question 17 You have been provided the following information for Dolphin Inc. Debt: The market value of debt is 50,000, the bonds are currently yielding 9% and have a coupon rate of 8%. Common 2,000 shares outstanding, selling for $60 per share the beta is 1.2 stock: Preferred 500 shares of preferred stock outstanding, currently selling for $75 per share that pays $7.5 in stock: dividends per year per share Market: 8 percent market risk premium and 3.4 percent risk-free rate. 1. Compute the capital structure weights of each component of the capital. 2. If the company's tax rate is 25 percent, what is its WACC? 5 B IV A - A - IE3 2 1 2 x - v c 12p Paragraph