Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 3 Question 1 3 of 1 4 An employer can be assessed penalties for an employee's failure to meet due diligence requirements under

Question

Question of

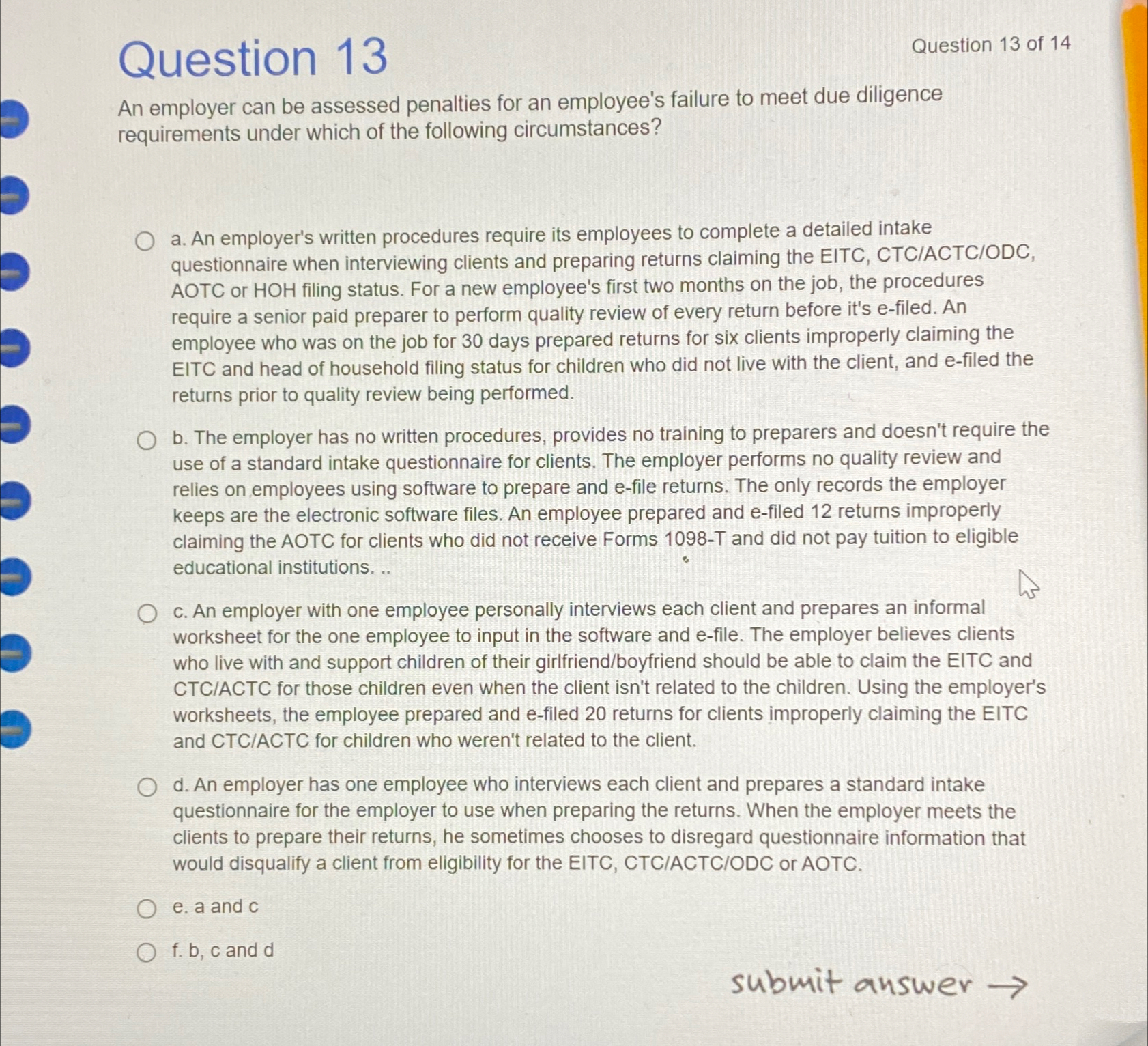

An employer can be assessed penalties for an employee's failure to meet due diligence requirements under which of the following circumstances?

a An employer's written procedures require its employees to complete a detailed intake questionnaire when interviewing clients and preparing returns claiming the EITC, CTCACTCODC AOTC or HOH filing status. For a new employee's first two months on the job, the procedures require a senior paid preparer to perform quality review of every return before it's efiled. An employee who was on the job for days prepared returns for six clients improperly claiming the EITC and head of household filing status for children who did not live with the client, and efiled the returns prior to quality review being performed.

b The employer has no written procedures, provides no training to preparers and doesn't require the use of a standard intake questionnaire for clients. The employer performs no quality review and relies on employees using software to prepare and efile returns. The only records the employer keeps are the electronic software files. An employee prepared and efiled returns improperly claiming the AOTC for clients who did not receive Forms T and did not pay tuition to eligible educational institutions.

c An employer with one employee personally interviews each client and prepares an informal worksheet for the one employee to input in the software and efile. The employer believes clients who live with and support children of their girlfriendboyfriend should be able to claim the EITC and CTCACTC for those children even when the client isn't related to the children. Using the employer's worksheets, the employee prepared and efiled returns for clients improperly claiming the EITC and CTCACTC for children who weren't related to the client.

d An employer has one employee who interviews each client and prepares a standard intake questionnaire for the employer to use when preparing the returns. When the employer meets the clients to prepare their returns, he sometimes chooses to disregard questionnaire information that would disqualify a client from eligibility for the EITC, CTCACTCODC or AOTC.

e a and c

f b c and d

submit answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started