Answered step by step

Verified Expert Solution

Question

1 Approved Answer

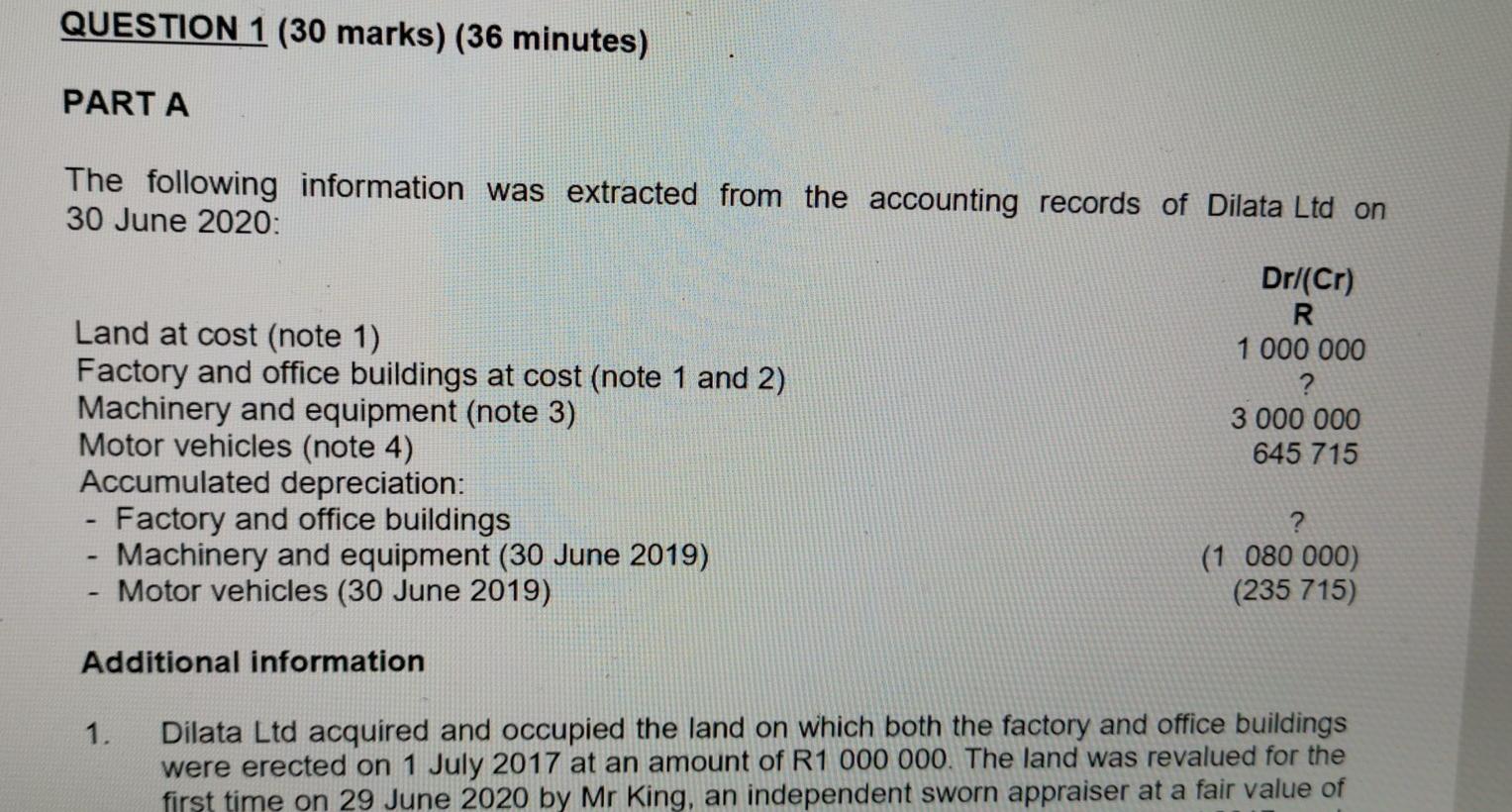

QUESTION 1 (30 marks) (36 minutes) PARTA The following information was extracted from the accounting records of Dilata Ltd on 30 June 2020: Drl(Cr) R

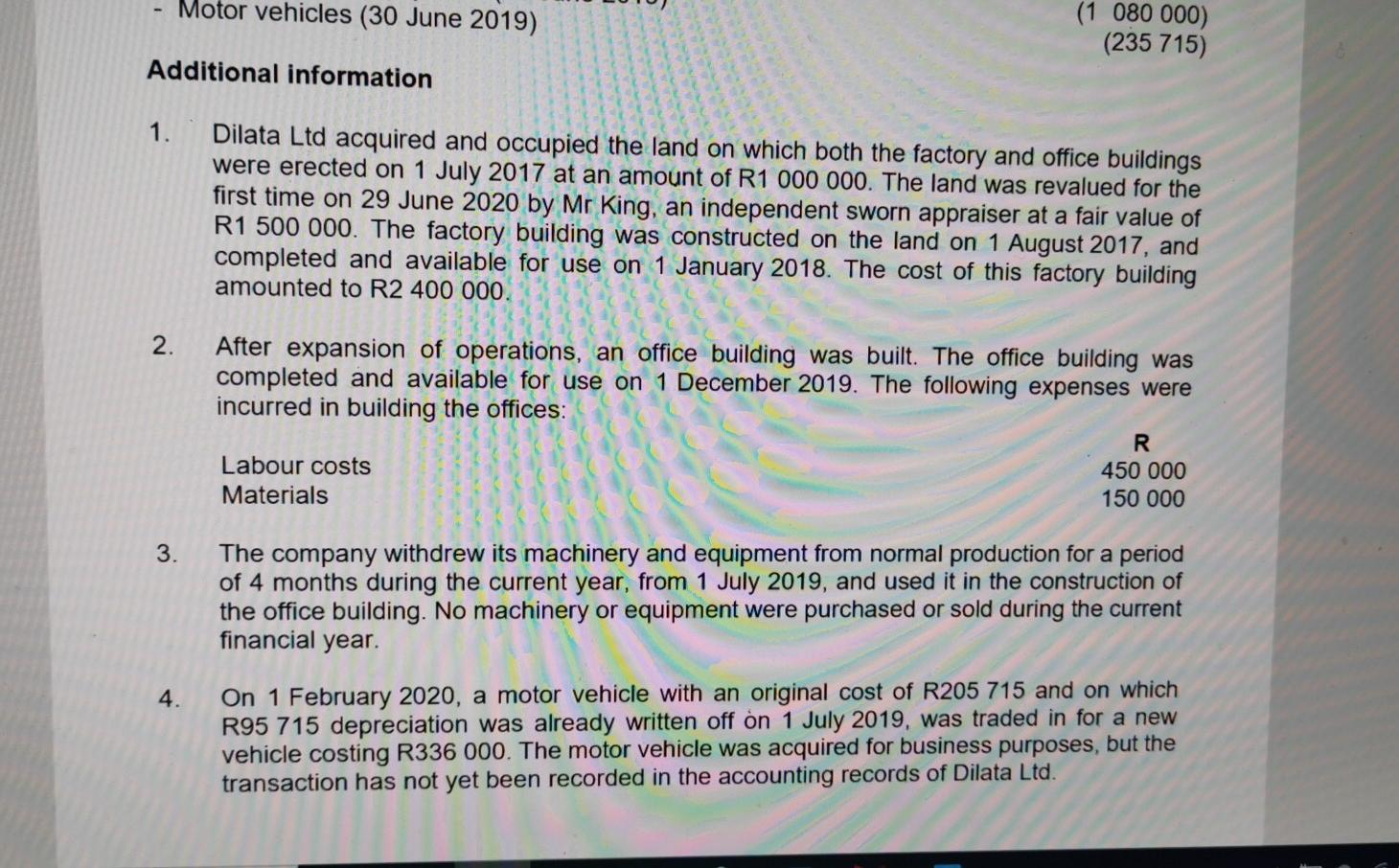

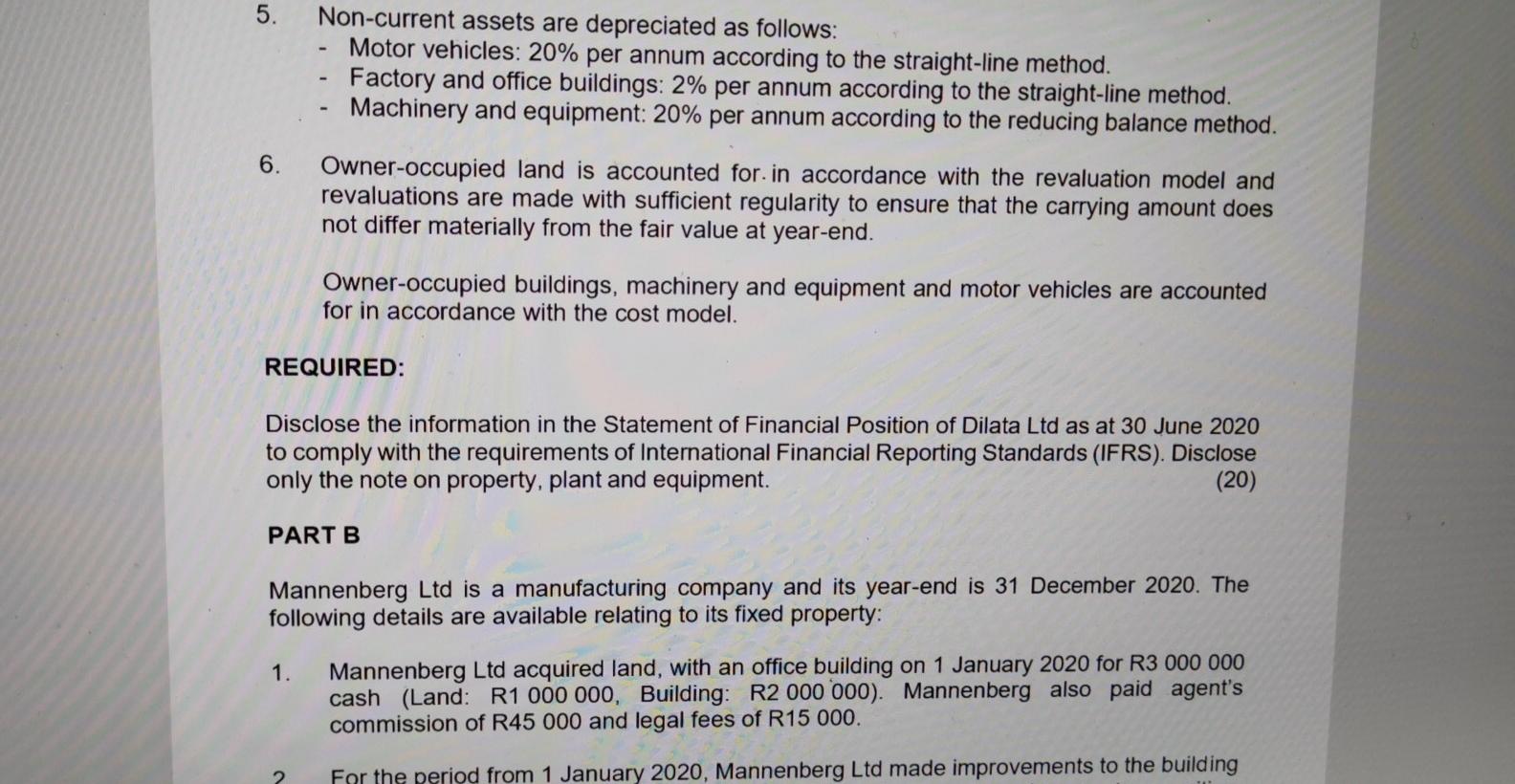

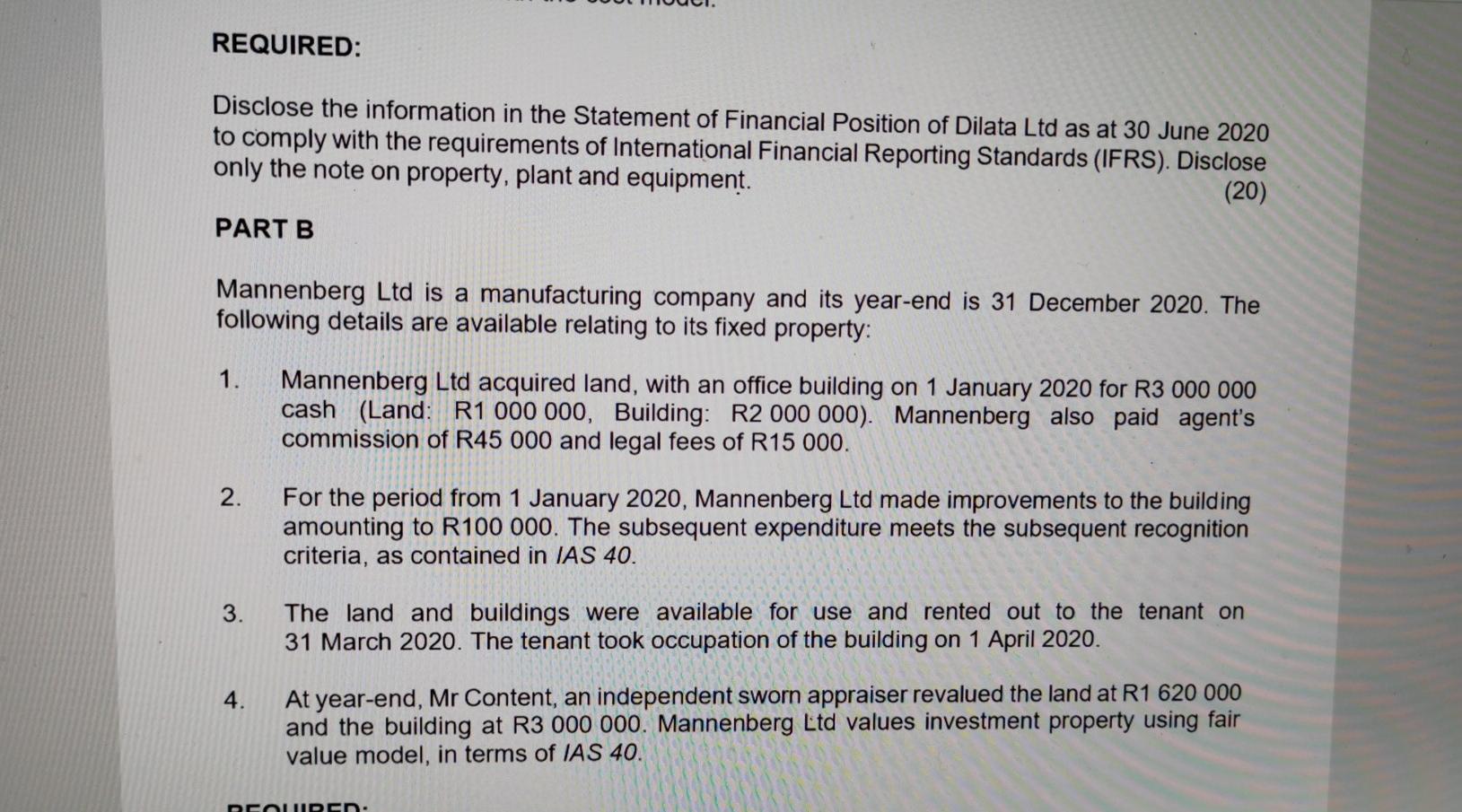

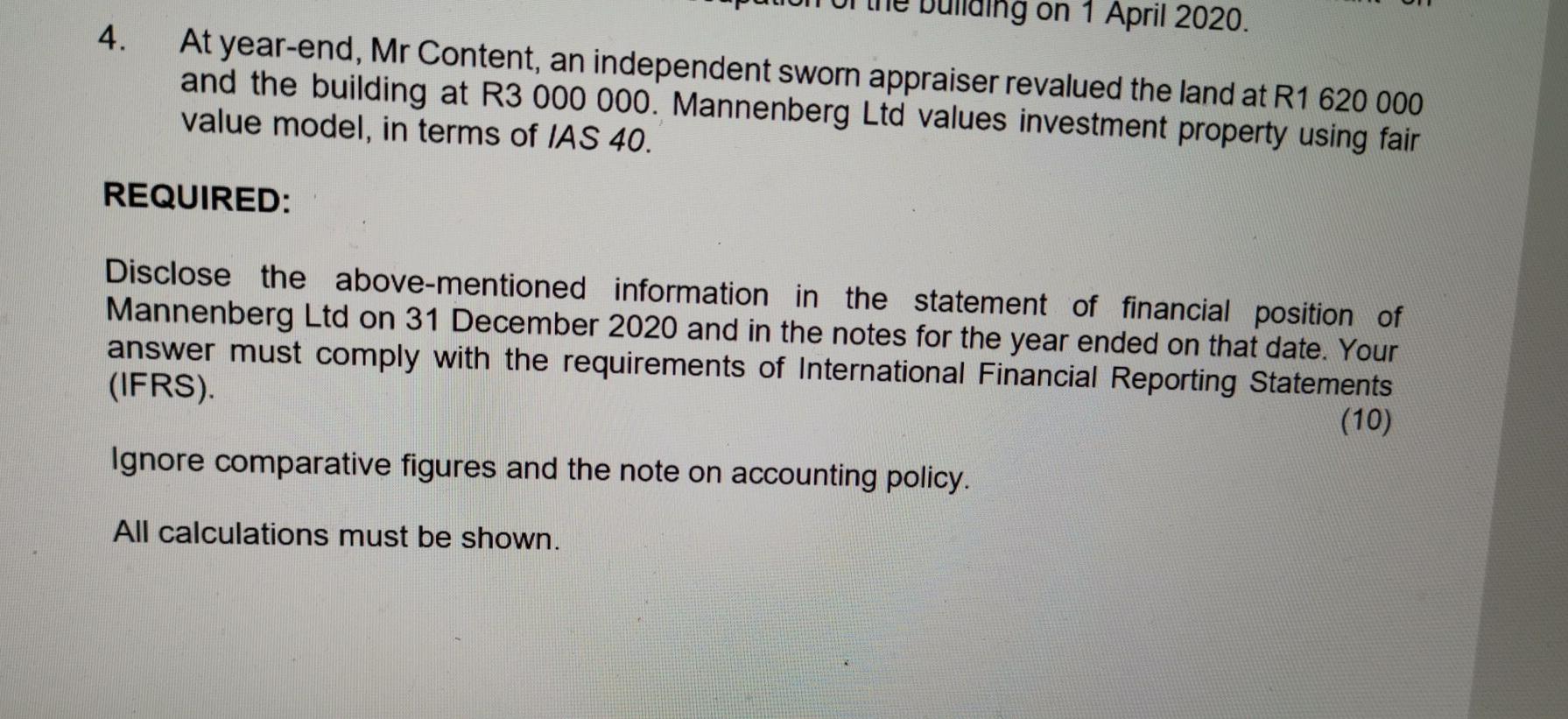

QUESTION 1 (30 marks) (36 minutes) PARTA The following information was extracted from the accounting records of Dilata Ltd on 30 June 2020: Drl(Cr) R Land at cost (note 1) 1 000 000 Factory and office buildings at cost (note 1 and 2) ? Machinery and equipment (note 3) 3 000 000 Motor vehicles (note 4) 645 715 Accumulated depreciation: Factory and office buildings Machinery and equipment (30 June 2019) (1 080 000) (235 715) Motor vehicles (30 June 2019) - Additional information 1. Dilata Ltd acquired and occupied the land on which both the factory and office buildings were erected on 1 July 2017 at an amount of R1 000 000. The land was revalued for the first time on 29 June 2020 by Mr King, an independent sworn appraiser at a fair value of - Motor vehicles (30 June 2019) (1 080 000) (235 715) Additional information 1. Dilata Ltd acquired and occupied the land on which both the factory and office buildings were erected on 1 July 2017 at an amount of R1 000 000. The land was revalued for the first time on 29 June 2020 by Mr King, an independent sworn appraiser at a fair value of R1 500 000. The factory building was constructed on the land on 1 August 2017, and completed and available for use on 1 January 2018. The cost of this factory building amounted to R2 400 000. 2. After expansion of operations, an office building was built. The office building was completed and available for use on 1 December 2019. The following expenses were incurred in building the offices: R Labour costs 450 000 Materials 150 000 3. The company withdrew its machinery and equipment from normal production for a period of 4 months during the current year, from 1 July 2019, and used it in the construction of the office building. No machinery or equipment were purchased or sold during the current financial year. 4. On 1 February 2020, a motor vehicle with an original cost of R205 715 and on which R95 715 depreciation was already written off on 1 July 2019, was traded in for a new vehicle costing R336 000. The motor vehicle was acquired for business purposes, but the transaction has not yet been recorded in the accounting records of Dilata Ltd. 5. Non-current assets are depreciated as follows: Motor vehicles: 20% per annum according to the straight-line method. Factory and office buildings: 2% per annum according to the straight-line method. Machinery and equipment: 20% per annum according to the reducing balance method. -- 6. Owner-occupied land is accounted for in accordance with the revaluation model and revaluations are made with sufficient regularity to ensure that the carrying amount does not differ materially from the fair value at year-end. Owner-occupied buildings, machinery and equipment and motor vehicles are accounted for in accordance with the cost model. REQUIRED: Disclose the information in the Statement of Financial Position of Dilata Ltd as at 30 June 2020 to comply with the requirements of International Financial Reporting Standards (IFRS). Disclose only the note on property, plant and equipment. (20) PART B Mannenberg Ltd is a manufacturing company and its year-end is 31 December 2020. The following details are available relating to its fixed property: 1. Mannenberg Ltd acquired land, with an office building on 1 January 2020 for R3 000 000 cash (Land: R1 000 000, Building: R2 000 000). Mannenberg also paid agent's commission of R45 000 and legal fees of R15 000. 2. For the period from 1 January 2020, Mannenberg Ltd made improvements to the building REQUIRED: Disclose the information in the Statement of Financial Position of Dilata Ltd as at 30 June 2020 to comply with the requirements of International Financial Reporting Standards (IFRS). Disclose only the note on property, plant and equipment. (20) PART B Mannenberg Ltd is a manufacturing company and its year-end is 31 December 2020. The following details are available relating to its fixed property: 1. Mannenberg Ltd acquired land, with an office building on 1 January 2020 for R3 000 000 cash (Land: R1 000 000, Building: R2 000 000). Mannenberg also paid agent's commission of R45 000 and legal fees of R15 000. 2. For the period from 1 January 2020, Mannenberg Ltd made improvements to the building amounting to R100 000. The subsequent expenditure meets the subsequent recognition criteria, as contained in IAS 40. 3. The land and buildings were available for use and rented out to the tenant on 31 March 2020. The tenant took occupation of the building on 1 April 2020. 4. At year-end, Mr Content, an independent sworn appraiser revalued the land at R1 620 000 and the building at R3 000 000. Mannenberg Ltd values investment property using fair value model, in terms of IAS 40. REOLRED. on 1 April 2020. 4. At year-end, Mr Content, an independent sworn appraiser revalued the land at R1 620 000 and the building at R3 000 000. Mannenberg Ltd values investment property using fair value model, in terms of IAS 40. REQUIRED: Disclose the above-mentioned information in the statement of financial position of Mannenberg Ltd on 31 December 2020 and in the notes for the year ended on that date. Your answer must comply with the requirements of International Financial Reporting Statements (IFRS). (10) Ignore comparative figures and the note on accounting policy. All calculations must be shown

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started