Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1 (30 marks: 45 minutes) Veggio (Pty) Ltd (Veggio) is a farming company that produces vegetables. There is only 150 hectares of land available

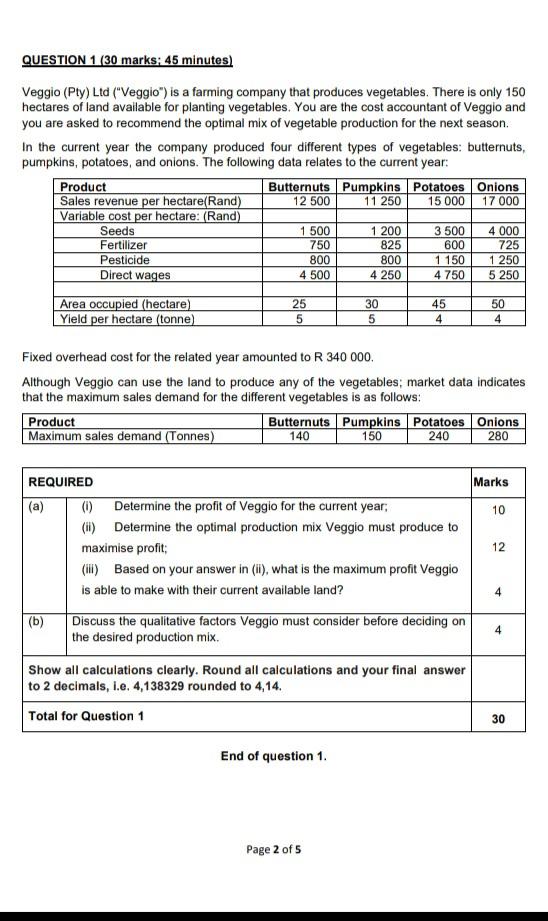

QUESTION 1 (30 marks: 45 minutes) Veggio (Pty) Ltd ("Veggio") is a farming company that produces vegetables. There is only 150 hectares of land available for planting vegetables. You are the cost accountant of Veggio and you are asked to recommend the optimal mix of vegetable production for the next season. In the current year the company produced four different types of vegetables: butternuts, pumpkins, potatoes, and onions. The following data relates to the current year: Product Butternuts Pumpkins Potatoes Onions Sales revenue per hectare(Rand) 12 500 11 250 15 000 17 000 Variable cost per hectare: (Rand) Seeds 1 500 1 200 3 500 4 000 Fertilizer 750 825 600 725 Pesticide 800 800 1 150 1 250 Direct wages 4 500 4 250 4750 5 250 Area occupied (hectare) Yield per hectare (tonne) 25 5 30 5 45 4 50 4 Fixed overhead cost for the related year amounted to R 340 000 Although Veggio can use the land to produce any of the vegetables, market data indicates that the maximum sales demand for the different vegetables is as follows: Product Butternuts Pumpkins Potatoes Onions Maximum sales demand (Tonnes) 140 150 240 280 Marks 10 REQUIRED (a) (0) Determine the profit of Veggio for the current year, (H) Determine the optimal production mix Veggio must produce to maximise profit (III) Based on your answer in (in), what is the maximum profit Veggio is able to make with their current available land? 12 4 (b) Discuss the qualitative factors Veggio must consider before deciding on the desired production mix. 4 Show all calculations clearly. Round all calculations and your final answer to 2 decimals, i.e. 4,138329 rounded to 4,14. Total for Question 1 30 End of question 1 Page 2 of 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started