Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 (30 marks) Eric is a US resident. He has been employed by Crypto One Inc (Crypto One), a company incorporated in the

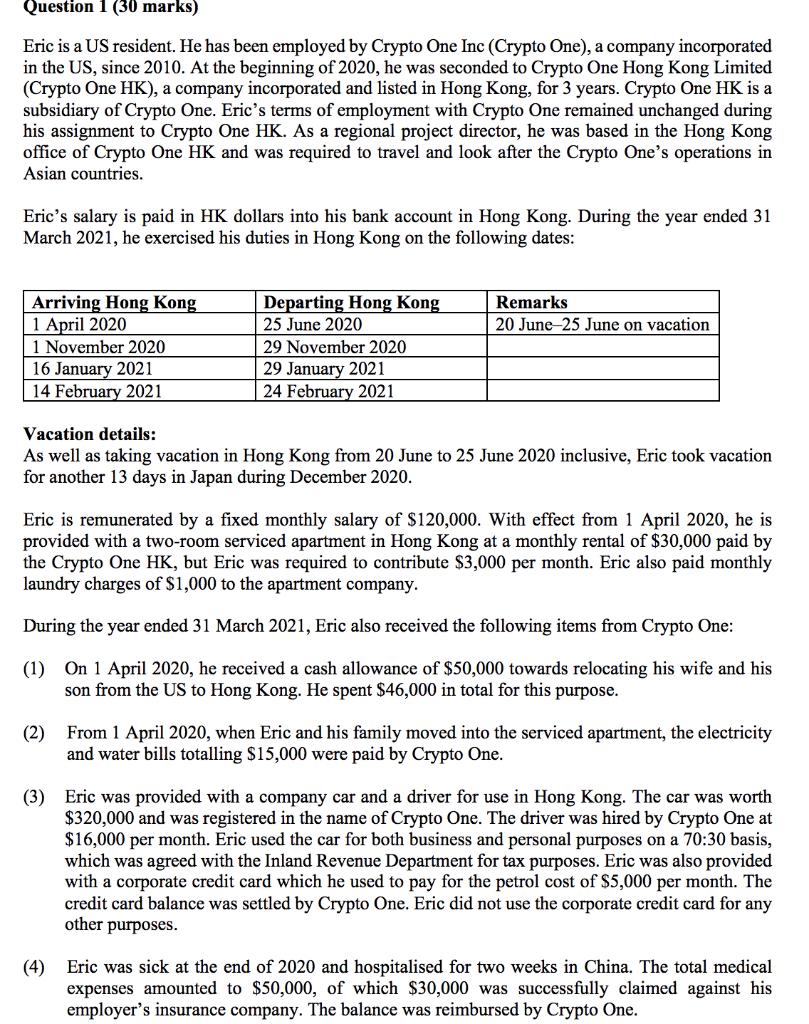

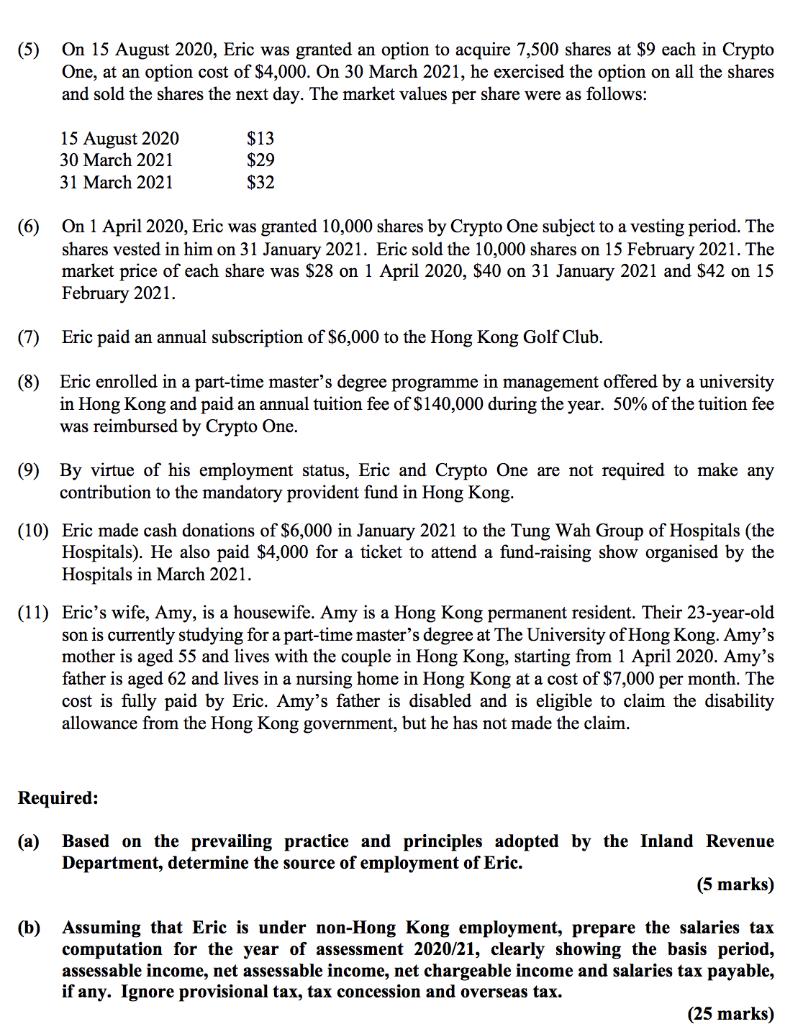

Question 1 (30 marks) Eric is a US resident. He has been employed by Crypto One Inc (Crypto One), a company incorporated in the US, since 2010. At the beginning of 2020, he was seconded to Crypto One Hong Kong Limited (Crypto One HK), a company incorporated and listed in Hong Kong, for 3 years. Crypto One HK is a subsidiary of Crypto One. Eric's terms of employment with Crypto One remained unchanged during his assignment to Crypto One HK. As a regional project director, he was based in the Hong Kong office of Crypto One HK and was required to travel and look after the Crypto One's operations in Asian countries. Eric's salary is paid in HK dollars into his bank account in Hong Kong. During the year ended 31 March 2021, he exercised his duties in Hong Kong on the following dates: Remarks Arriving Hong Kong 1 April 2020 Departing Hong Kong 25 June 2020 20 June 25 June on vacation 1 November 2020 16 January 2021 29 November 2020 29 January 2021 14 February 2021 24 February 2021 Vacation details: As well as taking vacation in Hong Kong from 20 June to 25 June 2020 inclusive, Eric took vacation for another 13 days in Japan during December 2020. Eric is remunerated by a fixed monthly salary of $120,000. With effect from 1 April 2020, he is provided with two-room serviced apartment in Hong Kong at a monthly rental of $30,000 paid by the Crypto One HK, but Eric was required to contribute $3,000 per month. Eric also paid monthly laundry charges of $1,000 to the apartment company. During the year ended 31 March 2021, Eric also received the following items from Crypto One: (1) On 1 April 2020, he received a cash allowance of $50,000 towards relocating his wife and his son from the US to Hong Kong. He spent $46,000 in total for this purpose. (2) From 1 April 2020, when Eric and his family moved into the serviced apartment, the electricity and water bills totalling $15,000 were paid by Crypto One. (3) Eric was provided with a company car and a driver for use in Hong Kong. The car was worth $320,000 and was registered in the name of Crypto One. The driver was hired by Crypto One at $16,000 per month. Eric used the car for both business and personal purposes on a 70:30 basis, which was agreed with the Inland Revenue Department for tax purposes. Eric was also provided with a corporate credit card which he used to pay for the petrol cost of $5,000 per month. The credit card balance was settled by Crypto One. Eric did not use the corporate credit card for any other purposes. (4) Eric was sick at the end of 2020 and hospitalised for two weeks in China. The total medical expenses amounted to $50,000, of which $30,000 was successfully claimed against his employer's insurance company. The balance was reimbursed by Crypto One. (5) On 15 August 2020, Eric was granted an option to acquire 7,500 shares at $9 each in Crypto One, at an option cost of $4,000. On 30 March 2021, he exercised the option on all the shares and sold the shares the next day. The market values per share were as follows: 15 August 2020 $13 30 March 2021 $29 31 March 2021 $32 (6) On 1 April 2020, Eric was granted 10,000 shares by Crypto One subject to a vesting period. The shares vested in him on 31 January 2021. Eric sold the 10,000 shares on 15 February 2021. The market price of each share was $28 on 1 April 2020, $40 on 31 January 2021 and $42 on 15 February 2021. (7) Eric paid an annual subscription of $6,000 to the Hong Kong Golf Club. (8) Eric enrolled in a part-time master's degree programme in management offered by a university in Hong Kong and paid an annual tuition fee of $140,000 during the year. 50% of the tuition fee was reimbursed by Crypto One. (9) By virtue of his employment status, Eric and Crypto One are not required to make any contribution to the mandatory provident fund in Hong Kong. (10) Eric made cash donations of $6,000 in January 2021 to the Tung Wah Group of Hospitals (the Hospitals). He also paid $4,000 for a ticket to attend a fund-raising show organised by the Hospitals in March 2021. (11) Eric's wife, Amy, is a housewife. Amy is a Hong Kong permanent resident. Their 23-year-old son is currently studying for a part-time master's degree at The University of Hong Kong. Amy's mother is aged 55 and lives with the couple in Hong Kong, starting from 1 April 2020. Amy's father is aged 62 and lives in a nursing home in Hong Kong at a cost of $7,000 per month. The cost is fully paid by Eric. Amy's father is disabled and is eligible to claim the disability allowance from the Hong Kong government, but he has not made the claim. Required: (a) Based on the prevailing practice and principles adopted by the Inland Revenue Department, determine the source of employment of Eric. (5 marks) (b) Assuming that Eric is under non-Hong Kong employment, prepare the salaries tax computation for the year of assessment 2020/21, clearly showing the basis period, assessable income, net assessable income, net chargeable income and salaries tax payable, if any. Ignore provisional tax, tax concession and overseas tax. (25 marks)

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

aThe source of employment of Eric is the United States Eric has been employed by Crypto One Inc Cryp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started