Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ms Fong purchased a property in Yuen Long many years ago. The property was let to Mr Au for three years starting from 1

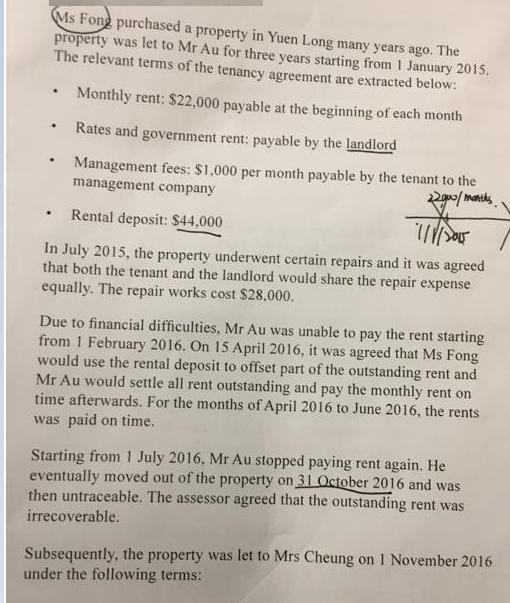

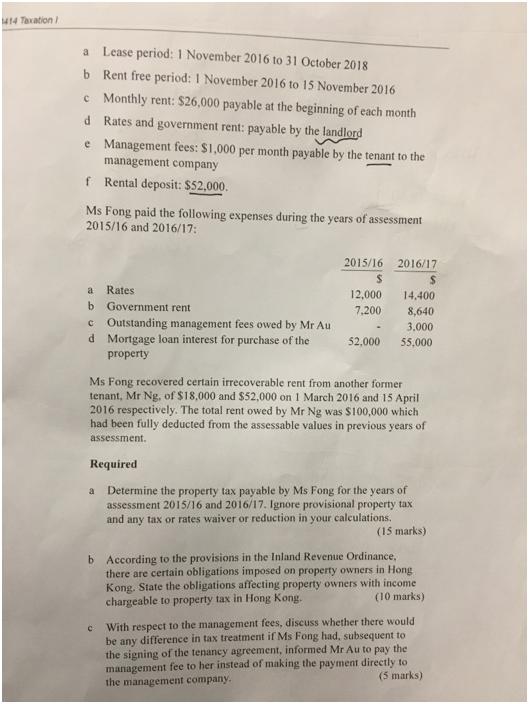

Ms Fong purchased a property in Yuen Long many years ago. The property was let to Mr Au for three years starting from 1 January 2015. The relevant terms of the tenancy agreement are extracted below: Monthly rent: $22,000 payable at the beginning of each month Rates and government rent: payable by the landlord Management fees: $1.000 per month payable by the tenant to the management company Rental deposit: $44,000 In July 2015, the property underwent certain repairs and it was agreed that both the tenant and the landlord would share the repair expense equally. The repair works cost $28,000. Due to financial difficulties, Mr Au was unable to pay the rent starting from 1 February 2016. On 15 April 2016, it was agreed that Ms Fong would use the rental deposit to offset part of the outstanding rent and Mr Au would settle all rent outstanding and pay the monthly rent on time afterwards. For the months of April 2016 to June 2016, the rents was paid on time. Starting from 1 July 2016, Mr Au stopped paying rent again. He eventually moved out of the property on 31 October 2016 and was then untraceable. The assessor agreed that the outstanding rent was irrecoverable. Subsequently, the property was let to Mrs Cheung on I November 2016 under the following terms: 414 Taxation a Lease period: 1 November 2016 to 31 October 2018 b Rent free period: I November 2016 to 15 November 2016 c Monthly rent: $26,000 payable at the beginning of each month d Rates and government rent: payable by the landlord e Management fees: $1,000 per month payable by the tenant to the management company f Rental deposit: $52,000. Ms Fong paid the following expenses during the years of assessment 2015/16 and 2016/17: 2015/16 2016/17 Rates b Government rent c Outstanding management fees owed by Mr Au d Mortgage loan interest for purchase of the a 12,000 14,400 7,200 8,640 3.000 52,000 55,000 property Ms Fong recovered certain irrecoverable rent from another former tenant, Mr Ng, of $18,000 and $52,000 on 1 March 2016 and 15 April 2016 respectively. The total rent owed by Mr Ng was $100,000 which had been fully deducted from the assessable values in previous years of assessment. Required Determine the property tax payable by Ms Fong for the years of assessment 2015/16 and 2016/17. Ignore provisional property tax and any tax or rates waiver or reduction in your calculations. a (15 marks) b According to the provisions in the Inland Revenue Ordinance, there are certain obligations imposed on property owners in Hong Kong. State the obligations affecting property owners with income chargeable to property tax in Hong Kong. (10 marks) With respect to the management fees, discuss whether there would be any difference in tax treatment if Ms Fong had, subsequent to the signing of the tenancy agreement, informed Mr Au to pay the management fee to her instead of making the payment directly to the management company. (5 marks)

Step by Step Solution

★★★★★

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a Property tax payable by Ms Fong 201516 201617 Rent receipts 2200011 months 220003260005 242000 196...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started