Question

QUESTION 1 (30 MARKS) Secure Inc. is looking for an alternative risk financing tool to manage their risk. The company is weighing the option to

QUESTION 1 (30 MARKS)

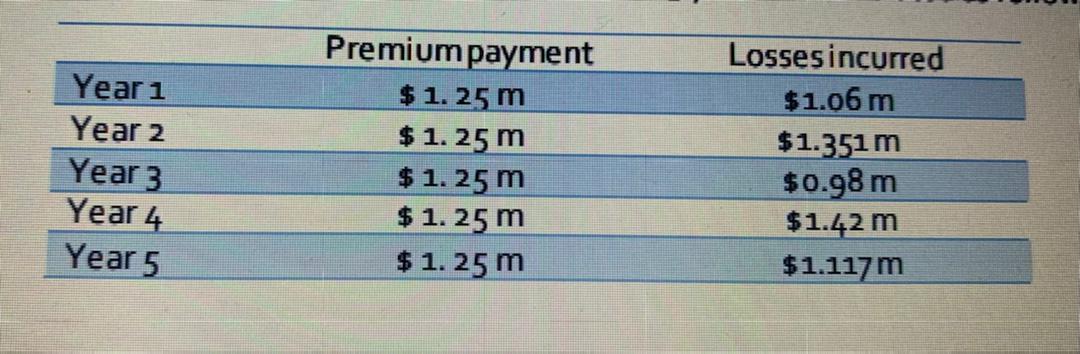

Secure Inc. is looking for an alternative risk financing tool to manage their risk. The company is weighing the option to conclude a finite risk reinsurance (FRR) arrangementwith Safeguard Re. As the risk consultant for the company, your job is to evaluate the feasibility of this option and advice the company if they should acceptthe option. The terms and conditions of this contract which have been discussed include the following: The FRR contract is designed to cover risk with an aggregate limit of $6m over a 5-year period. Premium will be paid at the beginning of each year and the amount of premium to be paid by Secure Inc. is specified in the table. As the reinsurer, Safeguard Re. is entitled to a 15.5% annual underwriting fee on the basis of annual premium payment. An interest of 7.25% will be credited into the beginning balance of the policyholder's account for each year, if applicable. In case of any deficit in the policyholder's account, the policyholder will be required to pay 93% out of the deficit in equal installments over the subsequent years.

Premium schedule payment and losses incurred for the 5 years are tabulated as follow:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started