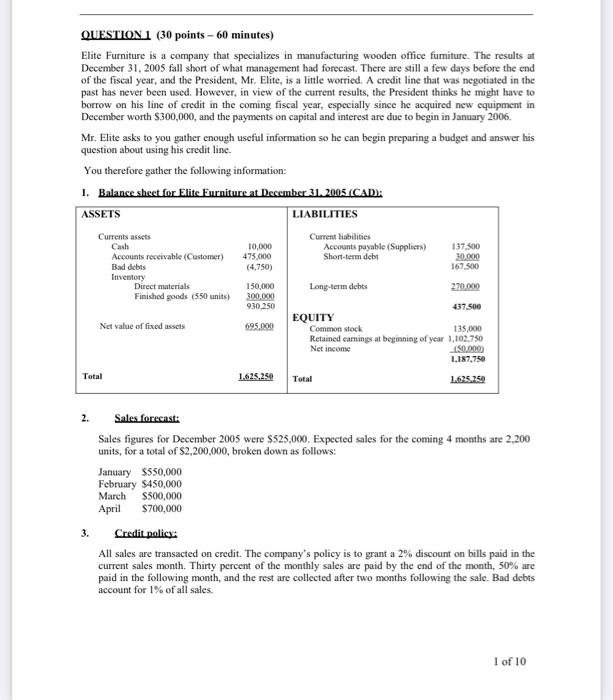

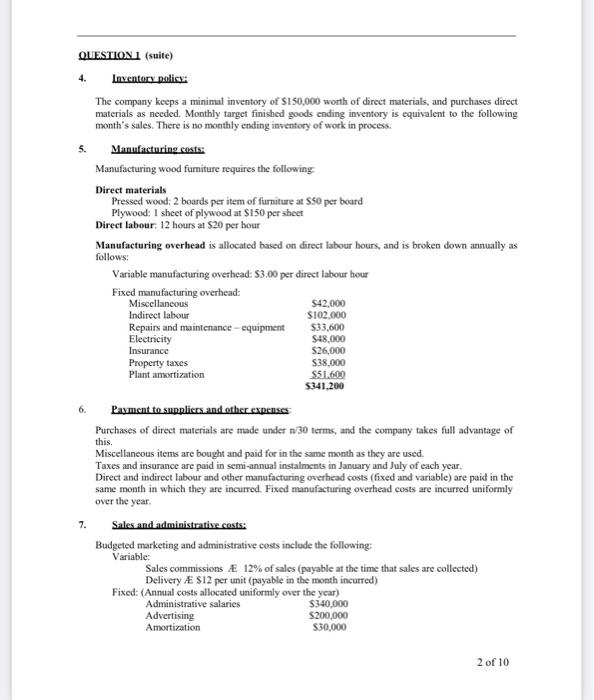

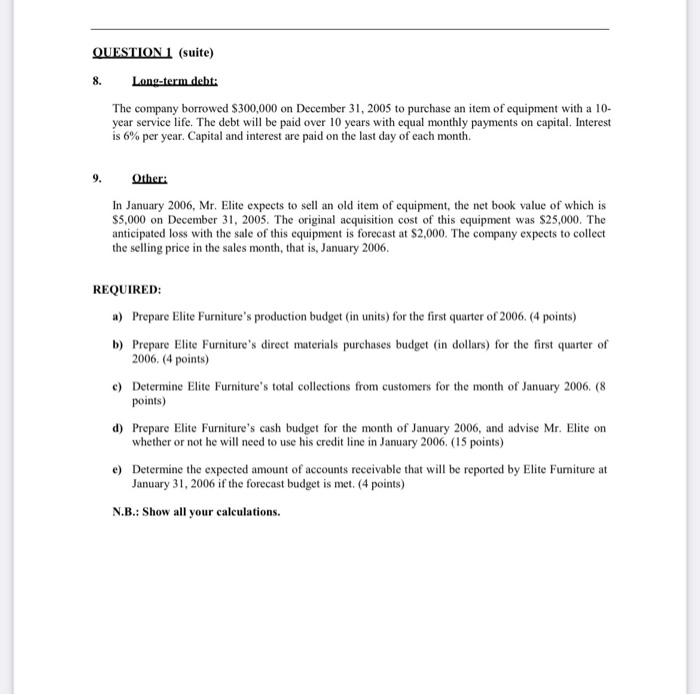

QUESTION 1 ( 30 points -60 minutes) Elite Furniture is a company that specializes in manufacturing wooden office fumiture. The results at December 31, 2005 fall short of what management had foreeast. There are still a few days before the end of the fiscal year, and the President, Mr. Elite, is a little worried. A credit line that was negotiated in the past has never been used. However, in view of the current results, the President thinks he might have to borrow on his line of credit in the coming fiscal year, especially since he acquired new equipment in December worth $300,000, and the payments on capital and interest are due to begin in January 2006. Mr. Elite asks to you gather enough useful information so he can begin preparing a budget and answer his question about using his credit line. You therefore gather the following information: 1. Balance sheet for Elite Furniture at December 31. 2005 (CAD): 2. Sales forecast: Sales figures for December 2005 were $525,000. Expected sales for the coming 4 months are 2,200 units, for a total of $2,200,000, broken down as follows: January $550,000 February $450,000 March $500,000 April $700,000 3. Credit policy: All sales are transacted on credit. The company's policy is to grant a 2% discount on bills paid in the current sales month. Thirty percent of the monthly sales are paid by the end of the month, 50% are paid in the following month, and the rest are collected after two months following the sale. Bad debts account for 1% of all sales. 4. Lnventory policy: The company keeps a minimal inventory of $150,000 worth of direet materials, and purchases direct materials as needed. Monthly target finished goods ending inventory is equivalent to the following month's sales. There is no monthly ending inventory of work in process. 5. Manufacturing costs: Manufacturing wood fumiture requires the following: Direct materials Pressed wood: 2 boards per item of furniture at 550 per board Plywood: I sheet of plywood at $150 per sheet Direct labour: 12 hours at $20 per bour Manufacturing overhead is allocated based on direct labour bours, and is broken down annually as follows: Variable manufacturing overhead 53.00 per direct labour hour 6. Payment to suppliers and other expense: Purchases of direct materials are made under n30 terms, and the company takes full advantage of this. Miscellancous items are bought and paid for in the same month as they are used. Taxes and insurance are paid in semi-annual instalments in January and July of each year. Direct and indirect labour and other manufacturing overhead costs (fixed and variable) are paid in the same month in which they are incurred. Fixed manufacturing overhead costs are incurred uniformly over the year. 7. Sales and administrative costs: Budgeted marketing and administrative costs include the following; Variable: Sales commissions E12% of sales (payable at the time that sales are collected) Delivery A$12 per unit (payable in the month incurred) Fixed: ( Annual enetc allorated nimifurmle awer the veari 8. Long-term-deht: The company borrowed $300,000 on December 31, 2005 to purchase an item of equipment with a 10 year service life. The debt will be paid over 10 years with equal monthly payments on capital. Interest is 6% per year. Capital and interest are paid on the last day of each month. 9. Other: In January 2006, Mr. Elite expects to sell an old item of equipment, the net book value of which is $5,000 on December 31,2005 . The original acquisition cost of this equipment was $25,000. The anticipated loss with the sale of this equipment is forecast at $2,000. The company expects to collect the selling price in the sales month, that is, January 2006. REQUIRED: a) Prepare Elite Furniture's production budget (in units) for the first quarter of 2006. (4 points) b) Prepare Elite Furniture's direct materials purchases budget (in dollars) for the first quarter of 2006. (4 points) c) Determine Elite Furniture's total collections from customers for the month of January 2006. (8 points) d) Prepare Elite Furniture's cash budget for the month of January 2006, and advise Mr. Elite on whether or not he will need to use his credit line in January 2006. (15 points) e) Determine the expected amount of accounts receivable that will be reported by Elite Fumiture at January 31,2006 if the forecast budget is met. (4 points) N.B.: Show all your calculations. QUESTION 1 ( 30 points -60 minutes) Elite Furniture is a company that specializes in manufacturing wooden office fumiture. The results at December 31, 2005 fall short of what management had foreeast. There are still a few days before the end of the fiscal year, and the President, Mr. Elite, is a little worried. A credit line that was negotiated in the past has never been used. However, in view of the current results, the President thinks he might have to borrow on his line of credit in the coming fiscal year, especially since he acquired new equipment in December worth $300,000, and the payments on capital and interest are due to begin in January 2006. Mr. Elite asks to you gather enough useful information so he can begin preparing a budget and answer his question about using his credit line. You therefore gather the following information: 1. Balance sheet for Elite Furniture at December 31. 2005 (CAD): 2. Sales forecast: Sales figures for December 2005 were $525,000. Expected sales for the coming 4 months are 2,200 units, for a total of $2,200,000, broken down as follows: January $550,000 February $450,000 March $500,000 April $700,000 3. Credit policy: All sales are transacted on credit. The company's policy is to grant a 2% discount on bills paid in the current sales month. Thirty percent of the monthly sales are paid by the end of the month, 50% are paid in the following month, and the rest are collected after two months following the sale. Bad debts account for 1% of all sales. 4. Lnventory policy: The company keeps a minimal inventory of $150,000 worth of direet materials, and purchases direct materials as needed. Monthly target finished goods ending inventory is equivalent to the following month's sales. There is no monthly ending inventory of work in process. 5. Manufacturing costs: Manufacturing wood fumiture requires the following: Direct materials Pressed wood: 2 boards per item of furniture at 550 per board Plywood: I sheet of plywood at $150 per sheet Direct labour: 12 hours at $20 per bour Manufacturing overhead is allocated based on direct labour bours, and is broken down annually as follows: Variable manufacturing overhead 53.00 per direct labour hour 6. Payment to suppliers and other expense: Purchases of direct materials are made under n30 terms, and the company takes full advantage of this. Miscellancous items are bought and paid for in the same month as they are used. Taxes and insurance are paid in semi-annual instalments in January and July of each year. Direct and indirect labour and other manufacturing overhead costs (fixed and variable) are paid in the same month in which they are incurred. Fixed manufacturing overhead costs are incurred uniformly over the year. 7. Sales and administrative costs: Budgeted marketing and administrative costs include the following; Variable: Sales commissions E12% of sales (payable at the time that sales are collected) Delivery A$12 per unit (payable in the month incurred) Fixed: ( Annual enetc allorated nimifurmle awer the veari 8. Long-term-deht: The company borrowed $300,000 on December 31, 2005 to purchase an item of equipment with a 10 year service life. The debt will be paid over 10 years with equal monthly payments on capital. Interest is 6% per year. Capital and interest are paid on the last day of each month. 9. Other: In January 2006, Mr. Elite expects to sell an old item of equipment, the net book value of which is $5,000 on December 31,2005 . The original acquisition cost of this equipment was $25,000. The anticipated loss with the sale of this equipment is forecast at $2,000. The company expects to collect the selling price in the sales month, that is, January 2006. REQUIRED: a) Prepare Elite Furniture's production budget (in units) for the first quarter of 2006. (4 points) b) Prepare Elite Furniture's direct materials purchases budget (in dollars) for the first quarter of 2006. (4 points) c) Determine Elite Furniture's total collections from customers for the month of January 2006. (8 points) d) Prepare Elite Furniture's cash budget for the month of January 2006, and advise Mr. Elite on whether or not he will need to use his credit line in January 2006. (15 points) e) Determine the expected amount of accounts receivable that will be reported by Elite Fumiture at January 31,2006 if the forecast budget is met. (4 points) N.B.: Show all your calculations