Answered step by step

Verified Expert Solution

Question

1 Approved Answer

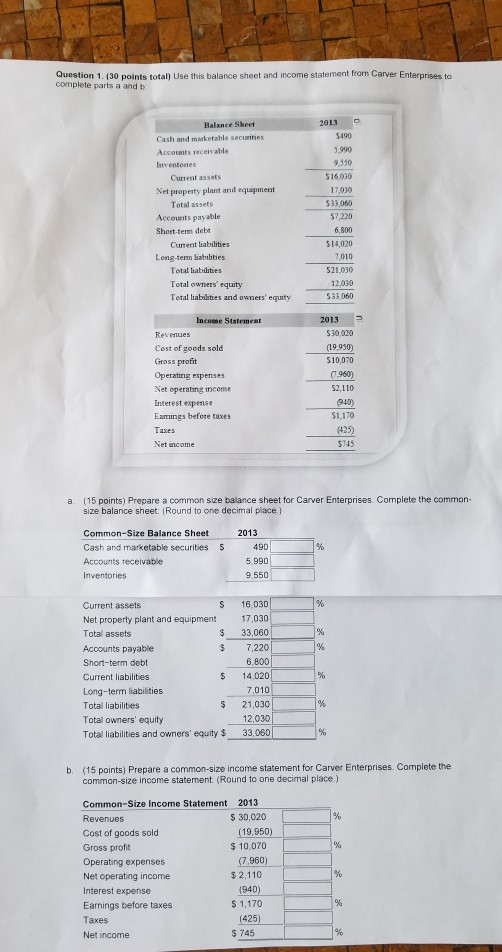

Question 1. (30 points total) Use this balance sheet and income statement fram Carver Enterprises to complete parts a and b 2013 Balance Sheet 5490

Question 1. (30 points total) Use this balance sheet and income statement fram Carver Enterprises to complete parts a and b 2013 Balance Sheet 5490 5,990 9,530 $16,030 17,030 33,060 $7,220 6,800 514,020 ,010 521,030 12,030 $33,060 Cash and marketable securities Accounts receivable Curnent assets Net property plant and equipment Total assets Accounts payable Short-tem debt Current liabilities Long-term liabilities Total liabilities Total owners' equity Total liabilities and owners' equity Income Statemeat 2013 Revenue:s Cost of goods sold Gross profft Operating expenses Net operating ncome interest expense Eammings before taxes 530.020 (19.950) 10,070 7960) 52,110 940) 1,170 Net income 5745 a. (15 points) Prepare a common size balance sheet for Carver Enterprises. Complete the common- size balance sheet: (Round to one decimal place) Common-Size Balance Sheet Cash and marketable securities Accounts receivable Inventories 490 5,990 9,550 S S 16.030D Current assets Net property plant and equipment 17,030 Total assets Accounts payable Short-term debt Current liabilities Long-term liabilities Total liabilities Total owners' equity Total liabilities and owners' equity $ 33,060 $ 33,060 $ 7,220 6,800 5 14,020 S 21,030 12,030 b (15 points) Prepare a common-size income statement for Carver Enterprises. Complete the common-size income statement (Round to one decimal place) 2013 5 30,020 Common-Size Income Statement 19,950 Cost of goods sold Gross profit Operating expenses Net operating income Interest expense Earnings before taxes Taxes Net income $10,070 960 $ 2,110 $1,170 425 745

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started