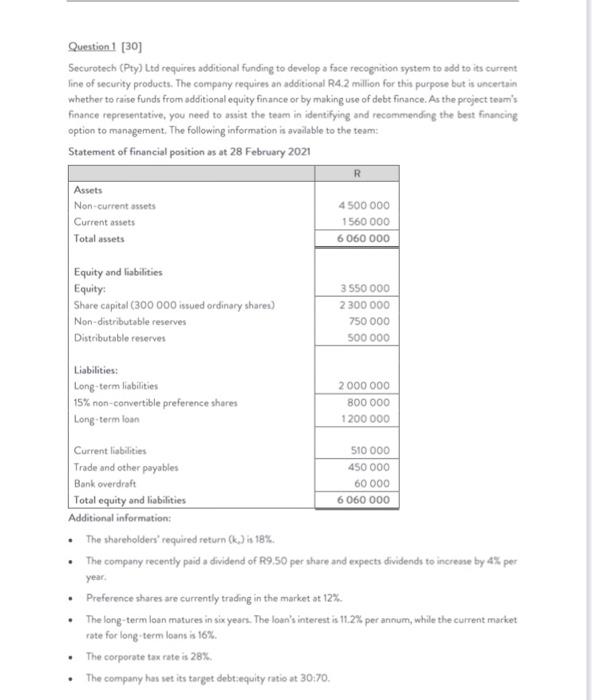

Question 1 [30] Securotech (Pty) Ltd requires additional funding to develop a face recognition system to add to its current line of security products. The company requires an additional R4.2 million for this purpose but is uncertain whether to raise funds from additional equity finance or by making use of debt finance. As the project team's finance representative, you need to assist the team in identifying and recommending the best financing option to management. The following information is available to the team: Statement of financial position as at 28 February 2021 R Assets Non-current assets Current assets Total assets 4500 000 1560 000 6060 000 Equity and liabilities Equity: Share capital (300 000 issued ordinary shares) Non-distributable reserves Distributable reserves 3 550 000 2300 000 750 000 500 000 Liabilities: Long-term liabilities 15% non-convertible preference shares Long term loan 2 000 000 800 000 1200 000 Current liabilities 510 000 Trade and other payables 450 000 Bank overdraft 60 000 Total equity and liabilities 6060 000 Additional information: The shareholders' required return (k.) is 18% The company recently paid a dividend of R9.50 per share and expects dividends to increase by 4% per year . Preference shares are currently trading in the market at 12% The long-term loan matures in six years. The loan's interest is 11.2% per annum, while the current market rate for long term loans is 16% The corporate tax rate is 28% The company has set its target debt:equity ratio at 30:70. . . Required: Show all calculations used to prepare the answer and round off all answers to the nearest rand. Use the information provided to determine and recommend the best financing option for the project to Securotech's management Question 1 [30] Securotech (Pty) Ltd requires additional funding to develop a face recognition system to add to its current line of security products. The company requires an additional R4.2 million for this purpose but is uncertain whether to raise funds from additional equity finance or by making use of debt finance. As the project team's finance representative, you need to assist the team in identifying and recommending the best financing option to management. The following information is available to the team: Statement of financial position as at 28 February 2021 R Assets Non-current assets Current assets Total assets 4500 000 1560 000 6060 000 Equity and liabilities Equity: Share capital (300 000 issued ordinary shares) Non-distributable reserves Distributable reserves 3 550 000 2300 000 750 000 500 000 Liabilities: Long-term liabilities 15% non-convertible preference shares Long term loan 2 000 000 800 000 1200 000 Current liabilities 510 000 Trade and other payables 450 000 Bank overdraft 60 000 Total equity and liabilities 6060 000 Additional information: The shareholders' required return (k.) is 18% The company recently paid a dividend of R9.50 per share and expects dividends to increase by 4% per year . Preference shares are currently trading in the market at 12% The long-term loan matures in six years. The loan's interest is 11.2% per annum, while the current market rate for long term loans is 16% The corporate tax rate is 28% The company has set its target debt:equity ratio at 30:70. . . Required: Show all calculations used to prepare the answer and round off all answers to the nearest rand. Use the information provided to determine and recommend the best financing option for the project to Securotech's management