Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 [31] CASE STUDY Consider the case study here below and answer the questions that follow. You are encouraged to use ChatGPT in answering

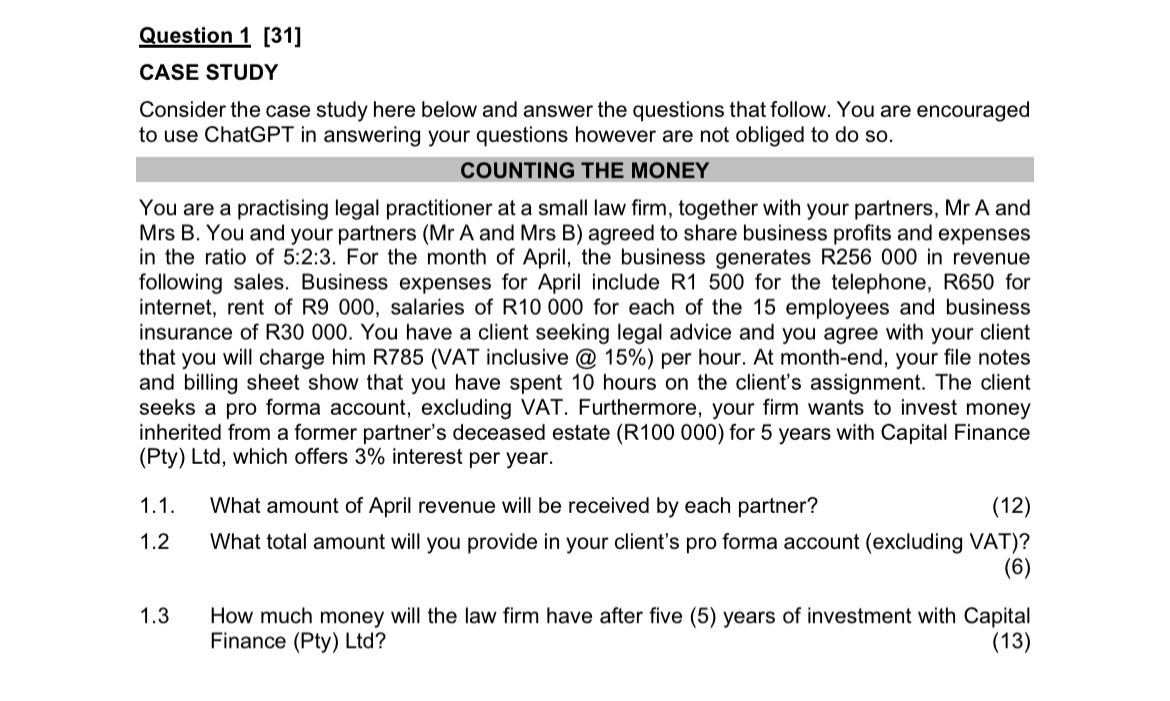

Question 1 [31] CASE STUDY Consider the case study here below and answer the questions that follow. You are encouraged to use ChatGPT in answering your questions however are not obliged to do so. COUNTING THE MONEY You are a practising legal practitioner at a small law firm, together with your partners, \\( \\mathrm{Mr} \\mathrm{A} \\) and Mrs B. You and your partners (Mr A and Mrs B) agreed to share business profits and expenses in the ratio of 5:2:3. For the month of April, the business generates R256000 in revenue following sales. Business expenses for April include R1 500 for the telephone, R650 for internet, rent of R9 000, salaries of R10 000 for each of the 15 employees and business insurance of R30 000. You have a client seeking legal advice and you agree with your client that you will charge him R785 (VAT inclusive @ 15\\%) per hour. At month-end, your file notes and billing sheet show that you have spent 10 hours on the client's assignment. The client seeks a pro forma account, excluding VAT. Furthermore, your firm wants to invest money inherited from a former partner's deceased estate (R100 000) for 5 years with Capital Finance (Pty) Ltd, which offers 3\\% interest per year. 1.1. What amount of April revenue will be received by each partner? 1.2 What total amount will you provide in your client's pro forma account (excluding VAT)? (6) 1.3 How much money will the law firm have after five (5) years of investment with Capital Finance (Pty) Ltd? (13)

Question 1 [31] CASE STUDY Consider the case study here below and answer the questions that follow. You are encouraged to use ChatGPT in answering your questions however are not obliged to do so. COUNTING THE MONEY You are a practising legal practitioner at a small law firm, together with your partners, \\( \\mathrm{Mr} \\mathrm{A} \\) and Mrs B. You and your partners (Mr A and Mrs B) agreed to share business profits and expenses in the ratio of 5:2:3. For the month of April, the business generates R256000 in revenue following sales. Business expenses for April include R1 500 for the telephone, R650 for internet, rent of R9 000, salaries of R10 000 for each of the 15 employees and business insurance of R30 000. You have a client seeking legal advice and you agree with your client that you will charge him R785 (VAT inclusive @ 15\\%) per hour. At month-end, your file notes and billing sheet show that you have spent 10 hours on the client's assignment. The client seeks a pro forma account, excluding VAT. Furthermore, your firm wants to invest money inherited from a former partner's deceased estate (R100 000) for 5 years with Capital Finance (Pty) Ltd, which offers 3\\% interest per year. 1.1. What amount of April revenue will be received by each partner? 1.2 What total amount will you provide in your client's pro forma account (excluding VAT)? (6) 1.3 How much money will the law firm have after five (5) years of investment with Capital Finance (Pty) Ltd? (13) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started