Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1 (35 MARKS, 42 MINUTES) Mavundla (Pty) Ltd ('Mavundla) is South African manufacturing company that manufactures toys. Mavundla to both the local market as

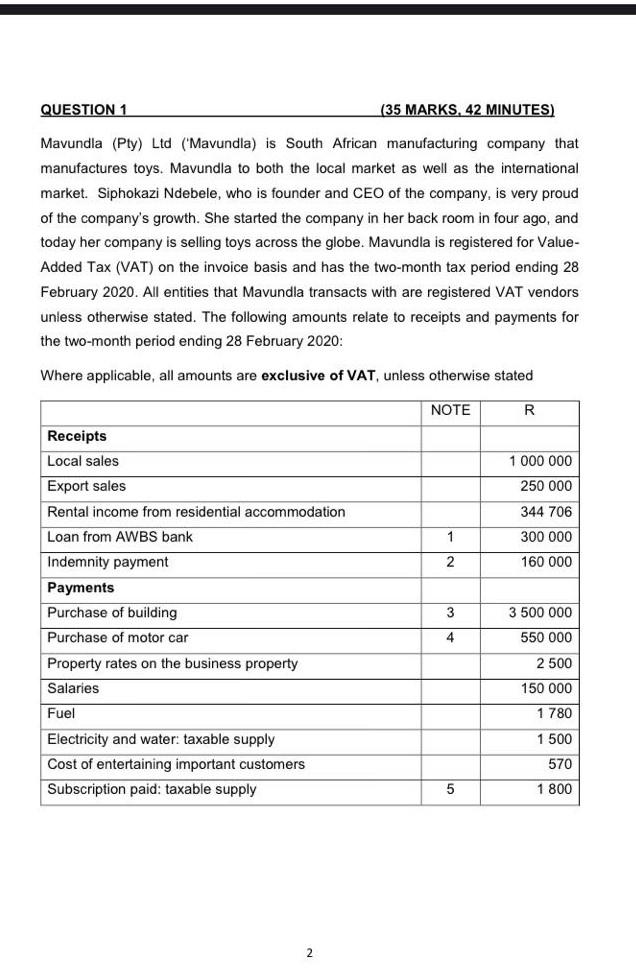

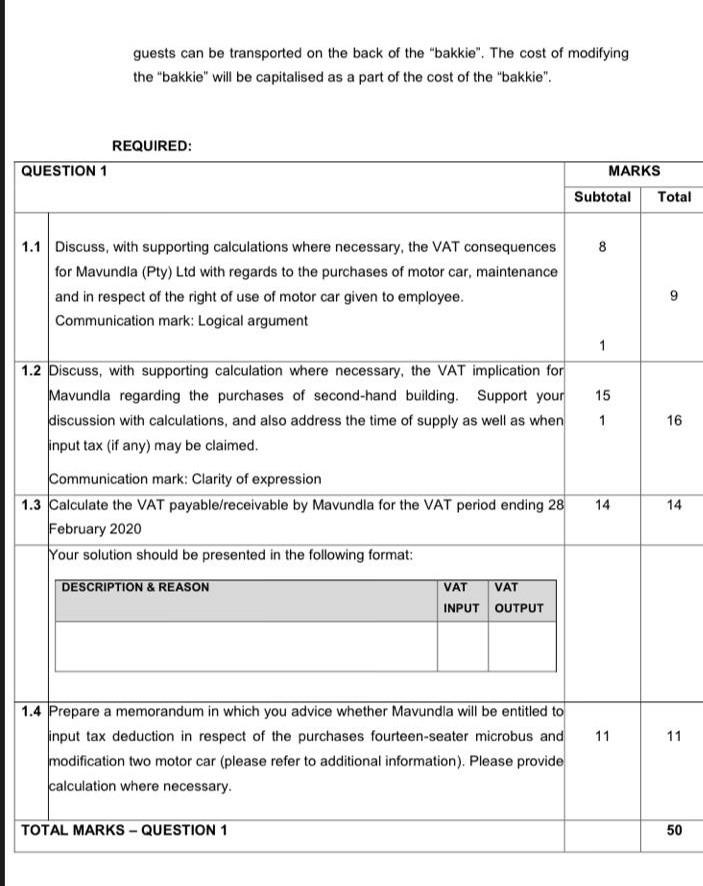

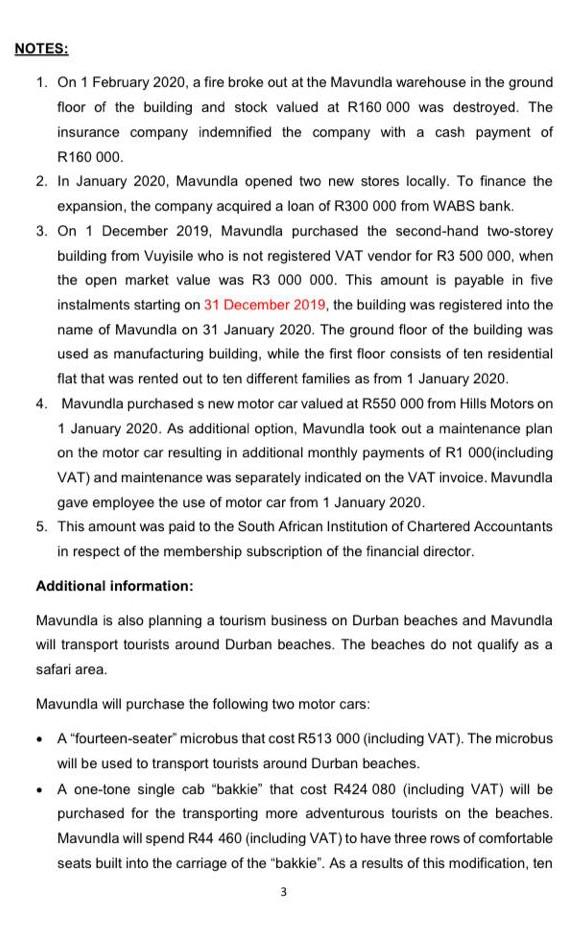

QUESTION 1 (35 MARKS, 42 MINUTES) Mavundla (Pty) Ltd ('Mavundla) is South African manufacturing company that manufactures toys. Mavundla to both the local market as well as the international market. Siphokazi Ndebele, who is founder and CEO of the company, is very proud of the company's growth. She started the company in her back room in four ago, and today her company is selling toys across the globe. Mavundla is registered for Value- Added Tax (VAT) on the invoice basis and has the two-month tax period ending 28 February 2020. All entities that Mavundla transacts with are registered VAT vendors unless otherwise stated. The following amounts relate to receipts and payments for the two-month period ending 28 February 2020: Where applicable, all amounts are exclusive of VAT, unless otherwise stated NOTE R Receipts Local sales Export sales Rental income from residential accommodation Loan from AWBS bank 1 000 000 250 000 344 706 1 300 000 2 160 000 3 3 500 000 Indemnity payment Payments Purchase of building Purchase of motor car Property rates on the business property Salaries 4 550 000 2 500 150 000 Fuel 1 780 1 500 Electricity and water: taxable supply Cost of entertaining important customers Subscription paid: taxable supply 570 5 1 800 guests can be transported on the back of the "bakkie". The cost of modifying the "bakkie" will be capitalised as a part of the cost of the "bakkie". REQUIRED: QUESTION 1 MARKS Subtotal Total 8 1.1 Discuss, with supporting calculations where necessary, the VAT consequences for Mavundla (Pty) Ltd with regards to the purchases of motor car, maintenance and in respect of the right of use of motor car given to employee. Communication mark: Logical argument 9 1 15 1 16 1.2 Discuss, with supporting calculation where necessary, the VAT implication for Mavundla regarding the purchases of second-hand building. Support your discussion with calculations, and also address the time of supply as well as when input tax (if any) may be claimed. Communication mark: Clarity of expression 1.3 Calculate the VAT payable/receivable by Mavundla for the VAT period ending 28 February 2020 Your solution should be presented in the following format: DESCRIPTION & REASON VAT INPUT OUTPUT 14 14 VAT 11 11 1.4 Prepare a memorandum in which you advice whether Mavundla will be entitled to input tax deduction in respect of the purchases fourteen-seater microbus and modification two motor car (please refer to additional information). Please provide calculation where necessary, TOTAL MARKS - QUESTION 1 50 NOTES: 1. On 1 February 2020, a fire broke out at the Mavundla warehouse in the ground floor of the building and stock valued at R160 000 was destroyed. The insurance company indemnified the company with a cash payment of R160 000. 2. In January 2020, Mavundla opened two new stores locally. To finance the expansion, the company acquired a loan of R300 000 from WABS bank. 3. On 1 December 2019, Mavundla purchased the second-hand two-storey building from Vuyisile who is not registered VAT vendor for R3 500 000, when the open market value was R3 000 000. This amount is payable in five instalments starting on 31 December 2019, the building was registered into the name of Mavundla on 31 January 2020. The ground floor of the building was used as manufacturing building, while the first floor consists of ten residential flat that was rented out to ten different families as from 1 January 2020. 4. Mavundia purchased a new motor car valued at R550 000 from Hills Motors on 1 January 2020. As additional option, Mavundla took out a maintenance plan on the motor car resulting in additional monthly payments of R1 000(including VAT) and maintenance was separately indicated on the VAT invoice. Mavundla gave employee the use of motor car from 1 January 2020. 5. This amount was paid to the South African Institution of Chartered Accountants in respect of the membership subscription of the financial director. Additional information: Mavundla is also planning a tourism business on Durban beaches and Mavundla will transport tourists around Durban beaches. The beaches do not qualify as a safari area. Mavundla will purchase the following two motor cars: A "fourteen-seater" microbus that cost R513 000 (including VAT). The microbus will be used to transport tourists around Durban beaches. A one-tone single cab "bakkie" that cost R424 080 (including VAT) will be purchased for the transporting more adventurous tourists on the beaches. Mavundla will spend R44 460 (including VAT) to have three rows of comfortable seats built into the carriage of the "bakkie". As a results of this modification, ten 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started