Answered step by step

Verified Expert Solution

Question

1 Approved Answer

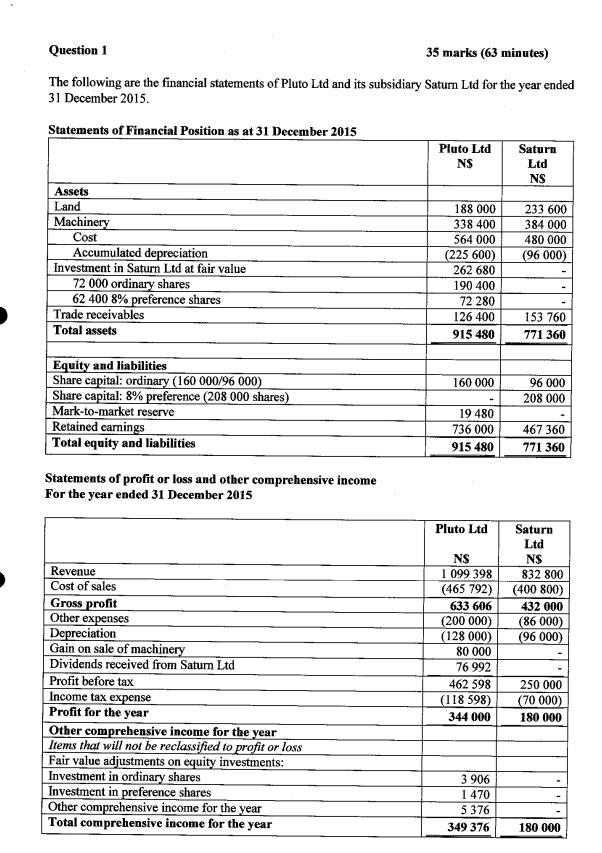

Question 1 35 marks (63 minutes) The following are the financial statements of Pluto Ltd and its subsidiary Saturn Ltd for the year ended

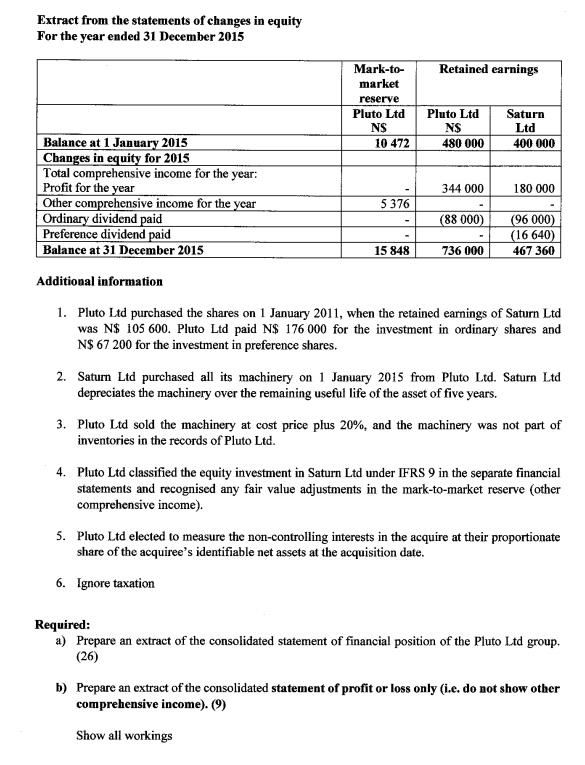

Question 1 35 marks (63 minutes) The following are the financial statements of Pluto Ltd and its subsidiary Saturn Ltd for the year ended 31 December 2015. Statements of Financial Position as at 31 December 2015 Assets Land Machinery Cost Accumulated depreciation Investment in Saturn Ltd at fair value 72 000 ordinary shares 62 400 8% preference shares Trade receivables Total assets Equity and liabilities Share capital: ordinary (160 000/96 000) Share capital: 8% preference (208 000 shares) Mark-to-market reserve Retained earnings Total equity and liabilities Statements of profit or loss and other comprehensive income For the year ended 31 December 2015 Revenue Cost of sales Gross profit Other expenses Depreciation Gain on sale of machinery Dividends received from Saturn Ltd Profit before tax Income tax expense Profit for the year Other comprehensive income for the year Items that will not be reclassified to profit or loss Fair value adjustments on equity investments: Investment in ordinary shares Investment in preference shares Other comprehensive income for the year Total comprehensive income for the year Pluto Ltd NS 188 000 338 400 564 000 (225 600) 262 680 190 400 72 280 126 400 915 480 160 000 19 480 736 000 915 480 Pluto Ltd NS 1 099 398 (465 792) 633 606 (200 000) (128 000) 80 000 76 992 462 598 (118 598) 344 000 3 906 1470 5 376 349 376 Saturn Ltd NS 233 600 384 000 480 000 (96 000) 153 760 771 360 96 000 208 000 467 360 771 360 Saturn Ltd N$ 832 800 (400 800) 432 000 (86 000) (96 000) 250 000 (70 000) 180 000 180 000 Extract from the statements of changes in equity For the year ended 31 December 2015 Balance at 1 January 2015 Changes in equity for 2015 Total comprehensive income for the year: Profit for the year Other comprehensive income for the year Ordinary dividend paid Preference dividend paid Balance at 31 December 2015 Additional information Mark-to- market reserve Pluto Ltd NS 10 472 - 5376 15 848 Retained earnings Pluto Ltd NS 480 000 344 000 (88 000) 736 000 Saturn Ltd 400 000 180 000 (96 000) (16 640) 467 360 1. Pluto Ltd purchased the shares on 1 January 2011, when the retained earnings of Saturn Ltd was N$ 105 600. Pluto Ltd paid N$ 176 000 for the investment in ordinary shares and N$ 67 200 for the investment in preference shares. 2. Saturn Ltd purchased all its machinery on 1 January 2015 from Pluto Ltd. Saturn Ltd depreciates the machinery over the remaining useful life of the asset of five years. 3. Pluto Ltd sold the machinery at cost price plus 20%, and the machinery was not part of inventories in the records of Pluto Ltd. 4. Pluto Ltd classified the equity investment in Saturn Ltd under IFRS 9 in the separate financial statements and recognised any fair value adjustments in the mark-to-market reserve (other comprehensive income). 5. Pluto Ltd elected to measure the non-controlling interests in the acquire at their proportionate share of the acquiree's identifiable net assets at the acquisition date. 6. Ignore taxation Required: a) Prepare an extract of the consolidated statement of financial position of the Pluto Ltd group. (26) b) Prepare an extract of the consolidated statement of profit or loss only (i.c. do not show other comprehensive income). (9) Show all workings

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Pluto Ltd Consolidated Statement of Financial Position As at December 31 2015 Assets Land Machinery ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started