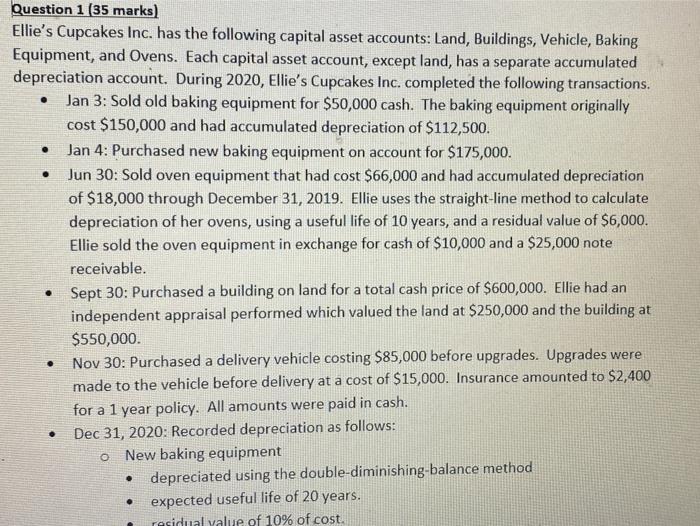

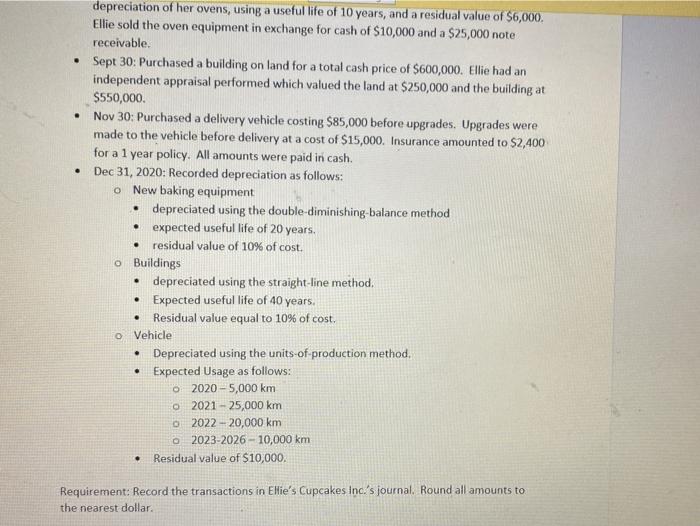

. . Question 1 (35 marks) Ellie's Cupcakes Inc. has the following capital asset accounts: Land, Buildings, Vehicle, Baking Equipment, and Ovens. Each capital asset account, except land, has a separate accumulated depreciation account. During 2020, Ellie's Cupcakes Inc. completed the following transactions. Jan 3: Sold old baking equipment for $50,000 cash. The baking equipment originally cost $150,000 and had accumulated depreciation of $112,500. Jan 4: Purchased new baking equipment on account for $175,000. Jun 30: Sold oven equipment that had cost $66,000 and had accumulated depreciation of $18,000 through December 31, 2019. Ellie uses the straight-line method to calculate depreciation of her ovens, using a useful life of 10 years, and a residual value of $6,000. Ellie sold the oven equipment in exchange for cash of $10,000 and a $25,000 note receivable. Sept 30: Purchased a building on land for a total cash price of $600,000. Ellie had an independent appraisal performed which valued the land at $250,000 and the building at $550,000. Nov 30: Purchased a delivery vehicle costing $85,000 before upgrades. Upgrades were made to the vehicle before delivery at a cost of $15,000. Insurance amounted to $2,400 for a 1 year policy. All amounts were paid in cash. Dec 31, 2020: Recorded depreciation as follows: New baking equipment depreciated using the double-diminishing-balance method expected useful life of 20 years. residual value of 10% of cost. . . o . . depreciation of her ovens, using a useful life of 10 years, and a residual value of $6,000. Ellie sold the oven equipment in exchange for cash of $10,000 and a $25,000 note receivable. Sept 30: Purchased a building on land for a total cash price of $600,000. Ellie had an independent appraisal performed which valued the land at $250,000 and the building at $550,000 Nov 30: Purchased a delivery vehicle costing $85,000 before upgrades. Upgrades were made to the vehicle before delivery at a cost of $15,000. Insurance amounted to $2,400 for a 1 year policy. All amounts were paid in cash. Dec 31, 2020: Recorded depreciation as follows: o New baking equipment depreciated using the double-diminishing balance method expected useful life of 20 years. residual value of 10% of cost. o Buildings depreciated using the straight-line method. Expected useful life of 40 years. Residual value equal to 10% of cost. Vehicle Depreciated using the units-of-production method. Expected Usage as follows: o 2020 -5,000 km 2021 - 25,000 km o 2022 - 20,000 km 2023-2026 - 10,000 km Residual value of $10,000. . . . 0 . O . Requirement: Record the transactions in Ellie's Cupcakes Inc.'s journal. Round all amounts to the nearest dollar